What is futures trading?

Futures Trading is a form of investment which involves speculating on the price of a financial instrument or a commodity going up or down in the future. A futures contract has an expiration date but You don’t have to hold the contract until it expires. You can cancel it anytime you like. In fact, many short-term traders only hold their contracts for a few hours – or even minutes!

What is a Futures Contract?

A futures contract is a legally binding agreement to buy or sell a commodity or financial instrument at a later date. There are two types of futures contracts, those that provide for physical delivery (in case of commodities market) and those which call for a cash settlement. Even in case of delivery type futures contract very few actually result in delivery. Rather the vast majority of speculators choose to realize their gains or losses by offsetting the futures contract prior to delivery. Selling a contract that was

previously purchased liquidates a futures position in exactly the same way like selling 100 shares of Reliance Industries liquidates an earlier purchase of 100 shares.

Similarly, a futures contract that was initially sold can be liquidated by an offsetting purchase. In either case, the resulting gain or loss is the difference between the buying price and the selling price less transaction costs (commissions and fees).

Indian Equity Derivatives Market

India’s experience with the equity derivatives market has been extremely positive. The turnover of derivatives on the

NSE increased from Rs. 24 billion in 2000–2001 to Rs. 315,330 billion in 2012-13 and further to Rs. 382114.1 billion. in 2013-14.

The average daily turnover in the equity derivatives segment of NSE was Rs. 1,522.37 billion in 2013–14 as compared to Rs. 1,266.4 billion in 2012-13.

| Trading Volume in F&O Segment of NSE (2014-15) | ||||

| Products | Underlying | No. of Contracts | Turnover | |

| _____________________________ | ||||

| (Rs. Crores) | US $ bn | |||

| NIFTY | NIFTY | 137,64,22836 | 3,83,80182.07 | 6,131.92 |

| BANKNIFTY | BANKNIFTY | 13,11,51460 | 56,36150.91 | 900.48 |

| CNXIT | CNXIT | 185,010 | 5,163.51 | 0.82 |

| DJIA | DJIA | 114,844 | 4,902.02 | 0.78 |

| S&P500 | S&P500 | 66,633 | 3,298.40 | 0.53 |

| INDIAVIX | INDIAVIX | 11,274 | 2,256.45 | 0.36 |

| NFTYMCAP50 | NFTYMCAP50 | 3,341 | 122.55 | 0.02 |

| FTSE100 | FTSE100 | 1,646 | 55.40 | 0.01 |

| CNXINFRA | CNXINFRA | 69 | 2.10 | 0.00 |

| CNXPSE | CNXPSE | 68 | 1.71 | 0.00 |

| TOTAL | 1,507,957,181 | 44,032,135.12 | 7,034.92 | |

Key Concepts & Terms

Before getting into how actually a futures trade work, it is important to understand the key concepts and terms related to futures market.

Contract Size

Each futures contract has a standardized size that does not change. For example, If you are trading BankNifty or Nifty Futures, the contract size is always 25 units while every stock futures has a specific contract sizes.

At present in India, There are 6 Index futures, 135 Stock Futures and 3 Global Index Futures available for trading.

Download the complete list of Contract Size for Index & Stock Futures. Download

Contract Value

Contract value is calculated by multiplying the size of the contract by the current price. For example, if the Nifty futures contract is trading at 8000, the value of one Nifty contract would be Rs. 2,00,000 (Rs. 8000 x 25 units) & in case of BankNifty futures, the contract value is Rs. 4,00,000 (Rs. 16,000 x 25 units).

Contract Cycle

In India, there are atleast 3-month contract cycle available for trading at any point of time i.e.the near month, the next month and the far month. For Example, In Nov 2014 there are 3 contract cycle available for trading expiring Nov 27th 2014, Dec 25th 2014 & Jan 29th 2015. So even in the month of November, traders can buy or sell short January contract month but they have to square their position on or before Jan 29th, 2015.

Traders who have bought the November contract but want to hold on their long positions as the November expiration approaches can do so by roll over the position by simultaneously selling the Nov contract and buying the following Dec contract. In this way, he would offset his position in the Nov contract at the instant that he takes an equivalent long position in the Dec contract.

Tick Size

A tick is the minimum price change that the particular stock or futures contract can fluctuate. Tick size varies from contract to contract. A tick in the Nifty or BankNifty futures contract is equal to .05 points. Since one index point is valued at Rs. 25, so one tick is equivalent to Rs. 1.25.

Price Limits

Futures contract as like stocks impose limits on daily price fluctuations. A price limit is the maximum amount the price of a contract can move in one day based on the previous day’s settlement price. These limits are set by the Exchange and help to regulate dramatic price swings.

Margin

Margin often referred to as span margin is the amount of money deposited by both the buyer and seller of a futures contract and the seller of an option contract with your broker to open and maintain a position in a futures contract which helps ensure that all market participants are able to meet their obligations. The margin represent only a fraction of the total value of the contract, often 10 to 30%.

The Nifty 50 Stock Index futures contract (Nifty Futures) could have a value of Rs. 2,00,000, but you would be able to buy or sell this contract say at 8000 by giving a margin of 10% of the contract value i.e. Rs. 20,000.

Mark-to-Market

At the end of each trading day, the Exchange sets a settlement price based on the day’s closing price for each futures contract. Each trading account is credited or debited based on that day’s profits or losses and checked to ensure that the trading account maintains the sufficient capital to meet the appropriate margin requirement on daily basis for all open positions. It helps maintain confidence in the financial integrity of the Exchange as a whole.

Suppose, you have a credit balance of Rs. 40,000 in your ledger and you bought a Nifty futures contract during the trading day at Rs. 8000 (Contract Value= Rs. 2,00,000 = 8000 x 25) by depositing a margin of 10%, i.e. 20,000 with your broker then the broker will debit your account with Rs. 20,000 and now your ledger balance shows a credit of Rs. 20,000.

At the end of the day, Nifty futures market close at a price of 8,200 then at the end of the day, your ledger will be credited with a profit of Rs.5,000 (Rs. 200 x 25) and will show a total credit of Rs 25,000.

But consider the other way, if the Nifty Futures closes at say 7,800 then your ledger will be debited with a loss of Rs. 5,000 (-200 x 25) and you ledger will show a net credit of Rs. 15,000.

Mark-to-market is an important safety measure that provides additional protection for you and your brokerage firm. Combined with other financial safeguards, mark-to-market is a major benefit of doing business on a regulated exchange.

Margin Call

If you had a loss on your open futures contract (in our case, of say Rs. 5,000) and your ledger account doesn’t have the any credit balance, then you will receive a margin call from your broker to you either add money (Rs. 5,000) to the account or reduce your positions to meet out the minimum margin requirements.

Nifty & BankNifty Futures Contract Specifications

| Parameter | Nifty Futures | BankNifty Futures |

| Ticker Symbol | Nifty | BankNifty |

| Contract Size | 25 Units (75 Units from Nov 2015 Contract) | 25 Units (30 units from Nov 2015 Contract) |

| Contract Value | Rs. 2,00,000 (25 X 8000) (Contract Size X Current Price) | Rs. 4.00,000 (25 X 16000) (Contract Size X Current Price) |

| Price Fluctuation | 1 index point = Rs. 25 | 1 index point = Rs. 25 |

| Trading Hours | Monday – Friday : 9:15AM – 3:30PM | Monday – Friday : 9:15AM – 3:30PM |

| Expiry Date | Expiration on last Thursday of the contract month | Expiration on last Thursday of the contract month |

| Trading Cycle | 3-month trading cycle – the near month , the next month and the far month. | 3-month trading cycle – the near month , the next month and the far month. |

| Daily Settlement Price | Last half hour’s weighted average price | Last half hour’s weighted average price |

| Final Settlement Price | Final settlement price shall be the closing price of the underlying index (CNX Nifty Index) in the Normal Market of the Capital Market segment of NSE on the last trading day of such futures contract. | Final settlement price shall be the closing price of the underlying index (CNX Bank Index) in the Normal Market of the Capital Market segment of NSE on the last trading day of such futures contract. |

| Settlement | All the Futures Contract are Cash settled in INR. | All the Futures Contract are Cash settled in INR. |

Read Articles: Introduction to BankNifty (CNX Bank Index) & Trading BankNifty Futures

Introduction to Nifty (CNX Nifty Index) & Trading Nifty Futures

Why Trade Futures?

Leverage

Leverage on futures contracts is created through the use of span margin. The margin represent only a fraction of the total value of the contract making futures a highly leveraged trading vehicle. Therefore, futures contracts represent a large contract value that can be controlled with a relatively small amount of capital. This provides the trader with greater flexibility and capital efficiency.

The Nifty 50 Stock Index futures contract (Nifty Futures) could have a value of Rs. 2,00,000, but you would be able to buy or sell this contract by giving a margin of say 10% of the contract value i.e. Rs. 20,000.

Maximizing Capital Efficiency

The leverage available in futures trading allows you to utilize your capital more efficiently.

For example, if you have Rs. 2,00,000 and you want to speculate on the direction of the Nifty-50 index, then you have two choices:

» Buy Rs. 2,00,000 of stock using all available capital. This can be done by purchasing an Exchange-Traded Fund (ETF), which for this example would be NiftyBees. NiftyBees seeks to replicate, net of expenses, the Nifty50 Index. It is regulated as, and trades in, equity (stock) like shares. Your exposure would be Rs. 2,00,000 worth of Nifty shares.

» Buy futures on margin, taking advantage of the approximately 10:1 leverage available with Nifty futures contract. This allows you to control the same portfolio of stocks by leveraging Rs. 20,000 of available capital. One Nifty futures contract represent approximately the same Rs. 2,00,000 of exposure of the Nifty-50 index stocks.

In each case, you have exposure to the same type of market risks and opportunities, but in the final example, you gain the same amount of market exposure while tying up significantly less of your available capital.

Multi-Directional Trades

Futures market help a trader to take position in any direction of the market. Remember, it is as easy to take a short position in futures market as it is like taking a long trade. This is the only reason why Hedge funds outperform most of the mutual funds during a falling market, as they can take short positions in the market to take the benefit of the bearish move.

For Example, If we are expecting that due to the inflationary reasons, RBI will increase the Repo rate to reduce the liquidity in the market, then we can take the short position in the bank nifty futures contract with an expectation that Banking stocks will tumble.

Read Article : Shorting the market

Who Trade Futures?

Hedgers and Speculators are the two categories of traders who participate in the futures market where hedgers use the futures market to manage their exposure to the price risk while on the other hand speculator accepts that risk to take the benefit of the favorable price movement. The market would not be possible without the participation of speculators as they provide immense liquidity in the markets and in turn help the hedgers to enter and exit the futures markets in an efficient manner.

So, the ultimate objective of hedging is to reduce or limit the risk of future price movement than to predict the price movement to make profits while speculators are the one who do not have any position in the underlying asset like hedgers rather they are trading in the market to take the benefit of the price movements.

Read Article : Getting Started with Trading – Who trades the market?

How does a Futures Trade Work?

An individual technical trader (Mr. Shrinivasan) manages his own capital by investing in stocks and trades in index futures market to take the benefit of leverage. Now, lets take a detailed look into how a futures trade actually work.

Entering the Trade

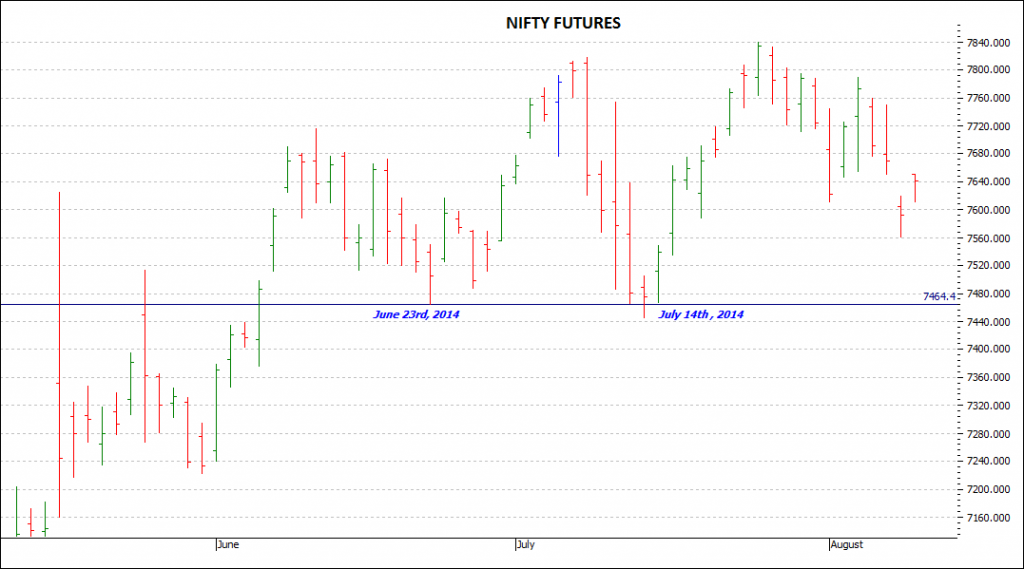

Mr. Shrinivasan has formulated a short term opinion on the direction of Nifty Futures market. He is of the thought technically that the current double bottom formed up at 7450 on July 14th, 2014 will sustain and Nifty can again touch the earlier top level of 7800.

Lets suppose, Shrinivasan has a ledger balance of 50,000 in his trading account. He decides to buy One lot of Nifty futures Contract on July 15th, 2014 during the closing of the day @ 7539 with a stop loss of 7467 (July 15th, 2014 Low Level) and expecting a target of 7800.

Chart 1 shows the Nifty Daily futures chart

Exiting the Trade

There are three options available to Mr. Shrinivasan to exit his position.

- Squaring the Position – One of the easy way available to Mr. Shrinivasan is by squaring his position by selling one lot of nifty futures contract. If he has shorted the market, then he can square his position by buying one lot.

- Roll Over Position – All futures contracts have a specified date on which they expire. Traders who want to hold on their futures positions for long can roll the position to the new contract month before or during the expiry of current contract. In our case study, if Mr. Shrinivasan wanted to stay long in the Nifty contract as the July expiration approached, he could simultaneously sell the July contract and buy the following august contract. In this way, he would offset his position in the July contract at the instant that he takes an equivalent long position in the August contract.

- Final Settlement on Expiry day – As all futures contracts have an expiration date. Mr. Shrinivasan can hold on his long position till the July month contract expires and his position can automatically be squared at the spot market closing price and his position will be cash settled.

Trade Details

Total Contract Value :- 3,76,950 (50 x 7539) (Nifty had a contract size of 50 units before Oct 31st, 2014)

Margin :- 10% i.e., 37,695 (Assumptions :- Margin of 10% remains same, but exchanges recalculates & changes margin requirements every day)

Brokerage & other charges :- .040% = Rs. 150. (Assumed to be similar on buying & selling)

Net Ledger Balance :- 50,000 – 37,695 – 150 = Rs. 12,155

Buying Price :- 7539

Stop Loss :- 7,467 or 72 Points (Risk = [7539-7467] x 50 = 72 x 50 = Rs. 3,600)

Estimated Target :- 7,800 or 261 points (Return Expected = [7,800-7,539] x 50 = 261 x 50 = Rs. 13,050)

Estimated Reward:Risk :- 3.6:1 (261:72)

| Day | Closing Price | Day`s Profit/Loss | Day`s Profit/Loss to Ledger | Ledger Balance |

| Day1 | 7539 | 0 | 0 | 12155 |

| Day2 | 7643.05 | 104.05 | 5202.5 | 17,357.5 (5205.5+12155) |

| Day3 | 7658.75 | 15.7 | 785 | 18142.5 (785+17357.5) |

| Day4 | 7669.35 | 10.6 | 530 | 18672.5 (530+18142.5) |

| Day5 | 7686.2 | 16.85 | 842.5 | 19515 (842.5+18672.5) |

| Day6 | 7767.95 | 81.75 | 4087.5 | 23602.5 (4087.5+19515) |

| Day7* | 7791.55 | 23.6 | 1180 | 62327.5 (23602.5+1602.5+37695-150)** |

* Position Closed @ 7791.55

** Margin of Rs. 37695 credit to account after closure of trade & Brokerage of Rs. 150 charged on selling.

Calculating Profit or Loss

As Mr. Shrinivasan has bought the one lot of Nifty futures contract at 7539 and sold his position at 7791.55 (target of 7800 acheived), so he made a profit of 252.55 points. As Nifty futures has a lot size of 50 units, so his total profit (excluding costs) is 12,627.50 (252.55 x 50) i.e. a return of 32.7% on his utilized capital.

So, his net ledger balance after squaring his position should be 50000 (Initial Margin) + 12627.50 (Total Profit) – 300(Brokerage & Taxes) = Rs. 62327.50.

KNOWLEDGE IS POWER!

Hi, That’s a nice post!

great artical for nifty future. thank you so much for giving detail knowledge aboyt futures.

Thank you Dear Azmat. Also visit our detailed article on How to Trade BankNifty Futures?

Also, do subscribe to our newsletter to get regular updates on your email or Whatsapp.

absolutely wonderful and most fundamental article and very well explained for a novice into Futures like me.

Very articulate –and very informative.

Very articulate. You have made me welcome –I shall join this journey !