On last Saturday (Feb 14th, 2015) when bank nifty on Friday was closed at 19459.1, we shared the article “Weekly WrapUp – Bank Nifty recovered sharply after 2 weeks bear fall” where we expected the market to find resistance at 19650-19750 and move in trading range of 19600 to 18800 for the coming days.

Refer Chart – I

For the next few trading days, market can find resistance at 19650-19750 and remain in trading range between 19600 and 18800.An excerpt - Weekly Wrap-Up - Bank Nifty recovered sharply after 2 weeks bear fall

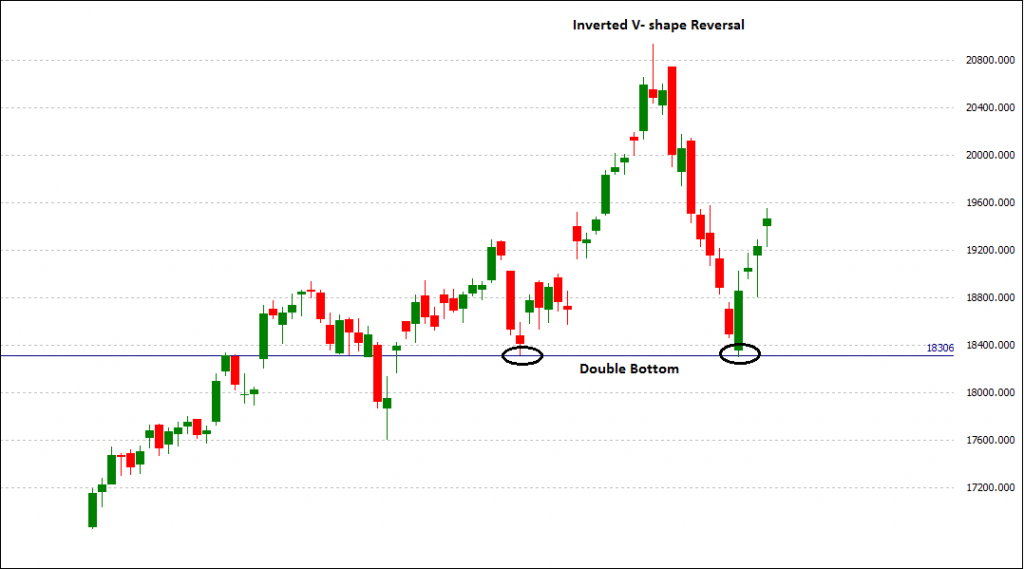

Chart – I, Bank Nifty Futures recovered after sharp fall

On Monday, the market actually turned out to find resistance at 19610 and closed 1% in red showing signs of stoppage of the up-trend started four trading days ago.

Refer Chart – II

Chart – II, Bank Nifty Futures EOD

We shared an article during the late evening on Tuesday as an update to “Weekly WrapUp – Bank Nifty recovered sharply after 2 weeks bear fall“, where we expected the market to move with the negative bias and consolidate in the big range 19600 to 18750 and to prepare for the Union Budget (due on Feb 28th, 2015).

Bank Nifty after topping out on Monday at 19610 falls for more than 350 points from the day’s high and moved choppy on Wednesday to close the day 0.6% in green. Sellers turned to be active the next day and bank nifty kept on drifting downwards after topping for the day at 19450 and falling 500 points led the sellers believe the expectancy for the down momentum to continue. We see a sudden drift in the sentiment of the market from sellers to buyers where market recovered more than 400 points “Just “within the last hour of the trade. This sudden fast rise forced the late short entrants to struggle with their trades and especially amateurs (those trading without stop loss) to book huge losses in jiffy.

The choppiness continued on the next day where market moved more than 350 points down early in the morning then rises more than 450 points and again fall more than 300 points in the later trading day.

Refer Chart – III

Chart – III, Bank Nifty Intraday Chart

Our analysis turned out to be with the market move, where bank nifty moved choppy with the negative bias (fall 700 points) within the trading band of 19610 and 18915 the whole week (with 4 trading days) to settle at 19104.9 (down approx 2%).

Refer Chart – III & Chart – IV

Chart – IV, Bank Nifty EOD

The week turned out to be red for the heavyweights Axis bank and ICICI bank which fall more than 3.5% and drags the bank nifty index down.

Markets on Budget Day

Markets had witnessed huge volatility and drop on the Budget days in the past three years where in last year 2014 Nifty was down 0.23% & BankNifty was down 1%, in 2013 Nifty ended in red 1.8% while bank nifty closed 3.7% down and in 2012 Nifty was down 1.2% while bank nifty was down 2%.

Markets to remain open for trading on the day of Union Budget on Saturday (Feb 28th, 2015)

The Securities and Exchange Board of India (SEBI) asked stock exchanges to remain open for trading as per normal trading hours (9 am to 3.30 pm) on the day when finance minister Arun Jaitley will present the Budget of the Modi-led government.

Disclaimer – Please note that the post series are our personal view and we advise you to consult your financial advisor before taking any trading decision.

For more, Visit http://justtrading.in/disclaimer/

Don’t forget to join our Email newsletter for getting more awesome updates. If you find this article informative, do share it on Facebook and Twitter.

KNOWLEDGE IS POWER!