Bank Nifty Weekly Options contract were introduced by National Stock Exchange of India (NSE) with effect from May 27th, 2016.

Bank Nifty Weekly Options contract were introduced by National Stock Exchange of India (NSE) with effect from May 27th, 2016.

Earlier, only monthly options contract were available for trading for all instruments including stocks and index whereas now you can trade in Bank Nifty Weekly Options contract where the expiry day for these weekly contract is Thursday of every week.

Wondering …..

how these weekly options on bank nifty index have benefits over the monthly option contracts?

why to trade bank nifty weekly options than trading bank nifty futures?

how we can trade these weekly bank nifty options to make money?

The benefits of trading options over futures as we outlined in the article Part VII – Getting Started With Trading – How to Trade Options? is that every investor are familiar with the old adage of “Buy Low and Sell High” but with options you can make profits when the markets are going up, down or even sideways.

Options give an edge to you as a trader to make money even when the markets are not trending and stuck in consolidation band.

Weekly options will give us at any time eight weekly contracts (Call / Put) on Bank Nifty Index for trading along with the third month monthly expiry contract. Therefore, as soon as the first month expires the weekly contracts for the third month will also be made available.

Why New Traders Feel that Options Trading is Like Gambling?

Most new traders who enters the market got excited and fascinated to know that they can buy a market or a stock with opportunities to make unlimited profit

and that too with very limited risk by buying the Out of the Money calls.

Wowww…

It seems to a good place to start and feels to be a magical wand which will lead them to new heights by simply buying the cheap OTM options and make big lofty profits.

This felt to be in-sync with the trader`s psychology (specially the new comers) of buying a stock low and selling it high where they fell into trap of buying low quality stocks at cheap price.

What happens then,

All the craziness went into a drain for most of the new comers when majority of their trading ideas of buying cheap options…… went into become nothing but Worthless and all becomes an Apocalypse.

This happens because of the fact that the trader need not to be right only with the direction of the price movement but also has to be right with the timing.

If we are wrong about any of the above, then it will result in the loss of the premium paid.

Generally, markets are in preparation phase for more than 70% of the time which leads to more than 70% of option contract expire worthless, in other words they become ZERO.

So, time works as an enemy for the buyer of the option as each day the underlying doesn’t move, the option premium will starts melting and evaporating.

Therefore, if you are an options buyer then there is 30% of the chances that you will be profitable while the seller has 70% chances the trade will be in his favor.

Ask yourself what you choose to trade when you entered the trading market for the very first time – Buying Options as the risk is limited or Selling Options which has more risk involved?

Do you know that the biggest mistake that most traders commit is that they think they should trade everyday.

They think that trading is all about being in front of your trading desk every single day, and buying and selling left and right.

And, they fall under the trap.

If you really want to avoid big trading losses, you need to have some facts and reasons to trade.

And believe me you will need to learn a lot of patience to understand the market, framing up and following your trading rules.

Avoid the trap, Read Why Trading Every Day is a Silly Plan (And What to Do Instead) to understand how day trading is different from the general thought of trading every day.

And, how professionals trade the markets to avoid committing the same mistakes again and again..

You might have read and heard million number of times that the risk with buying options is limited to the price of the premium paid. Right?

But Do You Know that we can even get trapped and lose more than the value of the premium even when you are buying options and what if I tell you that you can incur loss even after having a profitable trade.

Read Warning: 5 Traps To Avoid When Trading Bank Nifty Weekly Options on the Expiry Day to know how the theoretical adage of limited loss when buying options is not completely true in all of the cases and how to avoid one of the biggest trap of what we call as a “Contract Shock”.

Lets come back to options….

By this we do not mean that buyers of the options do not make money or we should not buy the options anyhow?

They do & We should do it toooo…

So whenever you are buy options, specially the ones which attracts a lot of interest from the new comers i.e. which are out of the money, you need a solid and a valid justification and a fact to prove that the markets are going to rise and that too before the expiry of the contract….

When you know that the market will rise or fall because of some pattern completion on charts or some other reasons, then it make sense to buy options and achieve some pretty good results.

WE may be right with the analysis that the market may rise say 200-300 points with few days and the OTM calls explode up 100-300% within a few days.

Similarly, there are ways when we can buy call option with a close stop loss for intraday when we are expecting bank nifty to complete a pattern and getting ready to rally and make decent money on our trade.

But this requires you to be very right with your analysis specially with the direction of the market.

We here would like to make it clear that it is not that we do not buy options.. We do…

But that strategy has different pre-requisites and should be implemented when we are expecting a clear directional move in bank nifty after clear bullish or bearish patterns.

Buying will be profitable only when we can analyse and predict the direction and a big price momentum in the underlying while selling can be profitable when you are right with the general thought that market may consolidate or not go above or below some major psychological marks.

Therefore, newcomers should not fall under the trap of trading options by buying the cheap calls or puts just because they are trading at low prices.

As buying always works like playing gambling in a casino where the sellers of the options are the owner of the casinos with higher probability of getting the trade in their favor.

I KNOW.. this may sound a bit disappointing right now but hopefully as we go through the article here you will start to feel the crux of the thought….

Just as like ….

There is no comparison when you buy a high quality stock at a reasonable price and when you are buying a low quality stocks just because it is trading at a cheap price.

You as a trader will always be at an advantage and have a higher chances of success of the trade when spotting and entering a high quality stock.

As even the risk will be very less and rewards will be very much pleasing.

Warren Buffet for Investing in Stocks said :-

“The big mistake which we made in the early years was to try and buy a bad business at a really cheap price…

It took me about 20-30 years to figure it out that it wasn’t a good idea.”

Similar thoughts could be applied while we are trading in stocks, futures or the options. So, it is not the price at which the option is trading rather it is more about evaluating the probability that we are expecting for the success of the trade.

The big consideration here is to first know and understand the opportunity and probability of the success of the trade specially when trading options rather than the cost of buying it.

But why the hell should I trade for small returns while taking big risks?

As just because 18000 Bank Nifty Weekly Call Option is trading at a cheap price of Rs. 10 does not make it a lucrative buy if the market has no way to go above that market within few days or till the expiry.

There is a reason why it is trading at Rs. 10 because there are less chances that the market will reach to that mark till the expiry.

So, it would be better to rather write the 18000 call option to receive the small premium value as there are higher probability that market may not reach that mark till the expiry.

So, whether the profits are small or large it should be sure which will help a trader to take big positions and make big sure profits.

To make a success in options trading, restrict yourself with first researching the price movement of the underlying (BankNifty) to predict where it will head towards within your stipulated time then go on find and enter the right option contract with justified reason of why you are buying or selling it.

Also, when you are trading Weekly bank nifty options, then the time value will evaporate very fast after the close of Tuesday.

So when buying options, you need to be quick, sharp and right with your analysis about the price movement you are expecting and knowing in what time frame….

This we have discussed at the end of the post outlining the benefits of writing an option than buying options.

Save your time and frustration. Time to read up on how to get started with trading options & bank nifty.

How to Make Money from Trading in Indian Stock Market? – We have made all the best possible to keep it detailed and crisp all you always wanted to know about Trading & Investing in Indian Stock Market. Here are eight steps to follow to start making money from trading.

Part VII – Getting Started With Trading – How to Trade Options? – Want to be a full-time options trader but scared of all the jargon’s or find it difficult to understand the dynamics of the options trading. Then you need to read this.

Part I – Getting Started With Trading Options – How does an Options Trade Work? – Getting into Real Trading is complicated. As a new trader, it is important to make your trading task more simple. Get deep into understanding how the options trade work in real market.

Why More Margin is Required to Short / Write Options than Buying Options? – Wondering why you are asked to put up more money when you are writing options than when you buy? It has something to deal with the risk of the trade. But that doesn`t reduces the probability of making smart money from shorting the options than buying. Time to Think……

What is BankNifty Index (CNX Bank Nifty Index) & How to trade BankNifty? – Its always important to understand what derives the movement of the underlying specially when you are dealing with options & that too when it is a highly volatile instrument Bank Nifty – then there is no escape to it. Ask yourself how can you make it big trading futures or options markets you know nothing about?

How to Trade Bank Nifty Futures? – Ever wonder how many traders have made their trading career just by trading bank nifty futures successfully? Here`s exactly how knowing a market deep and pre-planning will give you the sword to manage your risk wisely, be safe and remain profitable in the market forever. These elements will help transform you from a Aspiring Trader into a Legendary Trader.

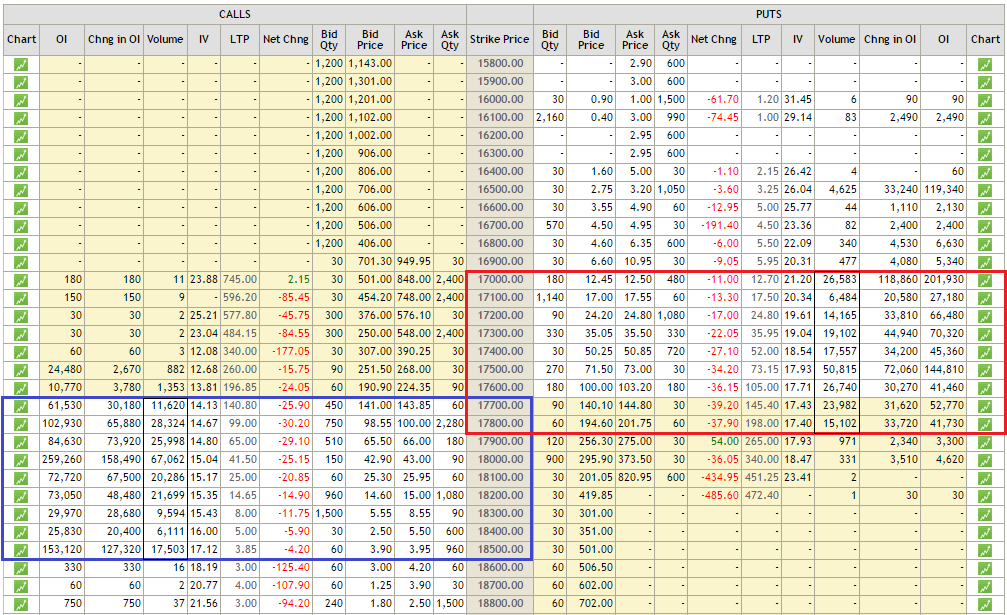

Bank Nifty Options Strike Price has a gap of 100 points within each contract. At present the Bank Nifty Index is @17700, so calls and puts of strike price for the weekly contracts from 16000 to 19500 are available for trading with successive contracts of 16100, 16200, 16300 and so on.

But liquidity is only available in the contracts which are near the underlying price with 5% plus and minus i.e. from 17700 till 18500 for call options and from 17700 till 17000 for put options and that too for the current week contract i.e. June 23rd, 2016.

Table 2 – Bank Nifty Weekly Options Chain

Check out the real time prices of the all the contracts available for trading BankNifty Options @ NseIndia.com – Bank Nifty Options Chain.

Why Out of the Money Options are the Most Active Contracts?

If you check the chart I, then we can outline that the call which are above the current market price (i.e. out of the money calls) are active with most traded volumes i.e. call options of the strike price 17800, 17900 and so on are traded big while the 18000 call has the highest volume traded for the day with highest open interest.

while the put options which are below the current market price (i.e. out of the money puts) are active with most traded volumes i.e. put options of the strike price 17600, 17500 and so on are traded big while put option of 17000 is the mostly traded with highest open interest.

Why would the call or put option which does not have any intrinsic value rather all the price of the premium is the time value are actively traded?

This is because a lot of writing is happening for the 18000 call option and 17000 put option i.e the market is expecting that bank nifty will not move anywhere above the 18000 and below 17000 mark before this expiry session.

& if that happens then both the sellers of the 18000 call option & 17000 put option will keep up the full premium of Rs. 42 & Rs. 17 in their pocket on the expiry as both of these options will become zero if market expires anywhere within the zone of 17000-18000.

Also, a trader should keep up a hawk eye on any rise on the open interest of the options contract which lets us know which levels markets are considering important as resistance and support.

To check the most active bank nifty options. Visit Top 20 Most Active Bank Nifty Options at NseIndia.com and choose Nifty Bank Options. This will help you to know the most important levels as support or resistance the market is betting on.

Ease of Trading for Buyers & Writers with Bank Nifty Weekly Options

Weekly options has surely widened the scope of trading opportunities available for a Bank Nifty trader.

How?

As now the trader can take positions in weekly option contract by paying less premium than he had to pay when entering the monthly contracts.

Earlier the writer or buyer of the options faces a lot of trouble and need to keep in aligning their trading positions as there was big time gap between the expiry of the contracts. But introduction of the bank nifty weekly options hands opportunity to make money for predicting the market moves to be happened in the coming few days than waiting for the end of the month.

Similarly the seller of the options will have to predict the market for few days to take the benefit of the opportunity by writing the bank nifty weekly options.

There are generally two strategies that a trader can choose from :- Buying Options & Selling Options.

Buying option could involve buying calls (when expecting an upside in Bank Nifty Index) or buying puts (when expecting a fall in Bank Nifty Index). While on the other hand, Selling options involve selling calls or put options of the Bank Nifty Contract.

It is very important to understand what constitutes within the premium price of the options contract.

Premium = Intrinsic Value + Time Value.

Intrinsic value is what the options real or self worth is. In other words, what will be the value of the option if the contract is to be expired just right now.

Say, BankNifty is at 18000 and 17800 call is trading at Rs. 250 then the instrinsic value is Rs. 200 which is the value of the option if it will expire just right away. So the time value will become Zero.

Pricing of options are done on the factors like Value of underlying, time to expiry, etc.

So, pricing doesn’t take into consideration the position of the market, support or resistasnce levels that market can face, etc. So, the technical trader is at the advantage as they have this other key swords to understand where the markets will head towards within few days.

Buying Options

When buying an option you will be paying the premium price which includes some extra as the time value to decide whether you want to fulfill the contract or let your right expire.

A trader who buys a call / put option expect a up / down move in BankNifty Index more than the premium he paid and that too within a short time frame before or atleast till the expiry of the contact as the time value keeps on reducing with time.

For Example, when BankNifty Index is trading at 17700 the weekly call option of 17800 strike price is trading @ a premium price of Rs. 100. The 17800 call option has no intrinsic value while you are paying Rs. 100 extra to get the right to buy the BankNifty @ 17800.

So, the Rs. 100 extra is the time value you are paying to get the time to decide whether you want to fulfill your right to buy the bank nifty @ 17800 or let your right expires and suffer a max loss of the premium you paid.

Therefore you are expecting bank nifty to stay above 17900 i.e. 17800+100 till the expiry to profit from the trade.

Suppose on the expiry day, the bank nifty index rises to 18000 then this 17800 call option right will be worth Rs. 200 as the time value will now become zero and you will make a profit of Rs. 100 (200-100).

But what if the index rises to only 17800 then the call option will be worth Rs. zero and you will suffer a loss of total premium you paid when the bank nifty was trading @ 17700.

So, even after the bank nifty index has risen from 17700 to 17800 but you did not made any profit because you paid the extra value of Rs. 100 to the seller of the contract to extend you the time to decide whether you want to fulfill the contact or let your right expire.

Selling Options

While when you are selling an option you will be receiving the premium price for giving the buyer the right to buy the option which includes the time value which usually works in the favor of the sellers of the option contract.

A Trader who sells a call / put options expects not much significant down / up move in Bank Nifty Index more than the strike price level. So, sellers expect the market will not go up above the strike price of the call option he has sold and not go below the strike price of the put option he has sold.

Generally seller of the option contract enters the market during the third or last week of the monthly expiry but now its just the matter of the five trading sessions and higher probability trades can be entered by writing the options during the last 2-3 days of the contract as most of the time value evaporates fast during that period only.

In the Example above, on the expiry day if the bank nifty index rises to 18000 then the seller will have to suffer a loss of Rs. 100.

While if the index rises to only 17800 then the call option will be worth Rs. zero and the seller will take profit of the full premium. So, even after the bank nifty index has risen from 17700 to 17800 the seller is in the profit.

So, options trading involves not only predicting the expected price move of the underlying but also to access the time frame within which that price movement will happen as you will be paying the time value when buying a options contract.

Therefore, if you can predict that the market will move big in one direction, then you can buy call or put and make profit while if you are expecting that the market will not go above or below some level, then you can sell that option contract and take back all the premium as the time value will work in your favor if market did not move much with in the stipulated time period.

Now we are clear with the positive and negative of trading options, Let`s come back the context of the Bank Nifty Weekly Options Contract with which you can spot and catch more opportunities.

As now with the weekly options, we will have to access and predict what the market will be doing in the next couple of days to benefit of the opportunity…

Benefits of Trading Bank Nifty Weekly Options

There are various benefits for this:-

#1. Low Cost Trades

Now traders who would like to take positions in Bank Nifty can do so by buying calls or puts at a price lower than what was available with monthly options.

#2. Better Control on Trades

– It will help reduce a lot of ambiguity with the reduce time gap to expiry. As with monthly options, a lot of aligning of positions were required to be done within the month. As it is more convenient and possible to predict the moves for 5 trading days than 20+ trading days.

– As most of the big traders use options for writing and pocketing in the value of time decay. So, these weeklies will help them to have a better control on their trades as now they have to foresee the market for 5 trading days and not more than what will happen in the next 20 days.

#3. Opportunity to Trade as per market moves 4 times a month

Now time decay opportunities will be available 4 times in a month as compared to once every month. Traders get active during the last few days of the expiry to write OTM call and put options. So, now they can do so by trading every Week.

#4. Trade Major Events with Less Risk

Weeklies will help traders to take positions for big events like RBI policy, Brexit, Election Results and that too with very less risk.

– Trading on these days requires you to take positions on both directions of the market as we are expecting momentum but not sure of the direction. So, call and puts which will be available at very cheap cost can be bought to take the benefit of the volatility.

– Hedging for these events – weeklies can be specifically used to hedge your portfolio to any unbiased correction for short term. Like what happened on the day of brexit. Bank Nifty crashed from 18000 to 17000 and returned back to follow its current up trend. So, portfolio hedging can be done by buying weekly puts at low cost.

– Prior to the introduction of weekly options, if we wanted to hedge a position due to event risk, like a Brexit or RBI Policy or Inflation data, we were forced to use the monthly options and pay a premium for the days remaining to expiration for that option. Now it is much easier and cheaper to deal with hedging for event risk using weekly options.

#5. Opportunity for Small Traders

Just like trading an event, small traders can trade these weeklies to hedge their portfolios, write Out Of The Money (OTM) options to take the benefit of time decay which was difficult to do with high cost monthly options.

Weekly option puts are excellent and cheap hedges to cover other positions long term holdings while far weekly call options are great tool to work as Covered Call to write high probability bets.

#6. Reduced Spread between Bid & Ask Prices

This will help increase participation from all variety traders so there will be less gap between bid and ask prices. So a quick entry or exit can be done without worrying.

#7. Increased Commissions & Income to Exchange, Brokers

And yes, lastly increased participation will leads to more income to exchanges and brokers.

#8. Keep in Sync with developed Markets

In other developed nations, weekly options are available for trading on index as well as stocks to help traders hedge and take short positions on according to market conditions. Also, apart from weeklies, there are long term options on index and stocks are also available for trading to take big time positions by paying loss cost.

A Win-Win Situation for Every One.

Hopefully, we are going to see more weeklies on Stocks and other Indexes. Get get on with our shoes and get ready to design ideas, strategies to make money from these weeklies.

How to Trade Bank Nifty Weekly Options?

Pricing of the options are majorly driven by the price movement of the underlying which in this case is Bank Nifty Index. So, to judge out where the options will head towards it is important to give due consideration to where the Bank Nifty Index will move.

Therefore, first and foremost thing that we as bank nifty options trader is to do is analyse and predict what can happen in the bank nifty index for the next couple of days.

There is another way of seeing this – Expecting What the Bank Nifty Index will not do in the next few days?

Many traders do not feel confident in trading bank nifty futures even after they do a great work on research but they are good at evaluating after certain price action of the market what levels markets are not expecting to move above or below.

Options market help them deal with this problem and serve as a great tool to make consistent profits by using multi dimensional strategies in a sideways market movement.

If you are writing bank nifty weekly options right before the expiry day you need to judge out what the market is expected to do within the next day, which levels are important as support and resistance which market may not break even in case there is any high momentum price movement

This may not require much to predict the quantum and time of the move rather estimating what market may not do till Thursday.

As we outlined, the option premium has the intrinsic and time value at all the time. So, pricing doesn’t take into consideration how much market has already rallied? where are the major support and resistances which market may refer in the coming time?

A chartist has an advantage to get the benefit of this underlying opportunity.

Say if a trader can understand the position of the market and conclude that the market has rallied big and now sitting at a major resistance of 18000 which requires consolidation to happen in a big band to decide whether to go further up or starts correcting then they can sell the call option of strike price above 18000 mark as they will expire worthless if the market may not go above it.

This illustration seems to be so easy to trade. But many of you might be abusing that who the hell will tell us that the market will face the resistance @ 18000?

True.

So, it totally depends on what you are good at calling the market?

Can you make it up that the markets are going to spend time before going up or down or the markets are going to be blasting up or staging lower?

Each type of concluding evidence will help you decide what strategy to choose to take the utmost benefit.

But as now the options trading volumes are increasing multi folds since last few years and most of these option contract (atleast 70%) expire worthless.

So, who the hell is making money if we are buying options all the time to take less risk and ends up with worthless options?

Writing an option puts you at a great advantage as the decay of time value works in your favor. i.e. the premium starts to melt with the time decay.

Actually there are many many different ways we can trade these Bank Nifty Weekly Options but in this article we will discuss more about writing off the weekly options near or on the expiry day to have a regular and consistent flow of income and make this time decay as your sword in the war.

Writing / Shorting Bank Nifty Weekly Options

Writing options requires full margin to trade as in the case of the futures trading. Traders generally research the bank nifty index price movement and come up with the major levels which they expect market to not break till the expiry of the contract.

As pricing doesn’t consider the position of the market, rather it is dependent on the price of the underlying, volatility, and time to expiration.

Chart readers are always at advantage as they can see other important aspects that is not considered while evaluating the pricing of the premium.

How?

- Traders by analyzing the charts can make up that market within few days may not break the major resistance or support areas. So, they may know that the market find sellers coming in from the top again or buyers from the bottom.

- Traders can evaluate and understand the major trend of the market and can take positions accordingly. Say if the trend is up then there are higher probabilities that market after correcting will start moving again with the current trend and buying of calls can be done or selling of puts which are below the support levels.

- Market spends time for consolidation after big fast up or down moves which serve as an advantage of writing options to profit out from the time value decay.

- We may need not be right with the direction of the price move. Some traders are good at analyzing the big picture and can evaluate that the market may not break some support level, resistance level or will go lower before going up, etc.

As the time value evaporates very fast in the last two days for the weekly contract so a big line of trading positions are initiated in the weekly options market late Tuesday or during the trading hours on Wednesday with an expectations of where the market can most rise or fall till the expiry day i.e. Thursday.

So, our task starts by analyzing the big picture and price performance of Bank Nifty Index till Tuesday to predict what can happen on Wednesday and Thursday (the expiry day).

If we can make up that market will not rise or fall below some major levels then we can start writing the options to take the benefit of the time value decay.

Chart 1 – Bank Nifty Weekly Expiry Chart (5 Minutes)

In the chart 1 above (for the month of May & June 2016), all the blue lines represent the Weekly expiry days while the dotted pink line represents the place where market closed on Tuesday of every week i.e. 2 days before the expiry.

For example, the very last blue line represents the weekly expiry of June 16th, 2016 while the pink line before it represents the closing position of the market on Tuesday i.e. June 14th, 2016.

Choosing a right option contract is very important specially when writing the options.

Always go with the charts and try to write the call or put option which is far away from the current market price but has strike price close to some important top or bottom. This will generate a very small profit but will put the probability of working right in your favor.

So, the task here is to analyse the big picture of the market till Tuesday or early Wednesday to forecast where the market can go maximum up or down till it expires on Thursday. Therefore, we need to anchor the major support and resistance levels of the bank nifty index which will serve as an anchor for us to trade in the coming two days till expiry.

Say on 14th June, 2016 (Wednesday) we can see that the market has a strong resistance at or above 18000 which again serve as a sellers place.

So, we can plan to short the 18000 call on Wednesday but as the market kept on going positive since opening and also closed bullish to reach to 17900 levels.

This requires us to trade with conservative thought and will give us another anchor point to consider as support which now is 17500.

Chart 2 – Bank Nifty June Weekly Chart ( 5 Minutes)

Now, we can analyse the market position early on the day of the expiry to conclude maximum it can move up and down with in the day.

As on day of expiry, the market had a big fall within the first few hours of the trading day. But as we analysed that the market was coming to a major support level of 17500 where it had a big consolidation and went up earlier.

So, here we can write the 17500 put options as this level will act as a major support for the market to consolidate or reverse for the upside.

Also, This fall make the conclusion very clear here that the that now the market will not break the today`s high of 17800 or the ultimate top level of 17900. But we cannot write the call options after this crash.

So we have to wait for the market to rise up so that we can start writing the call options of 17800 or 17900 and digests in all the premiums with the time decay.

If market did not reached the levels till the closing time then these call options will expire worthless or in other words will become Zero.

If you see the chart 2, the market started to consolidate in a band after the rise which benefits the option writer.

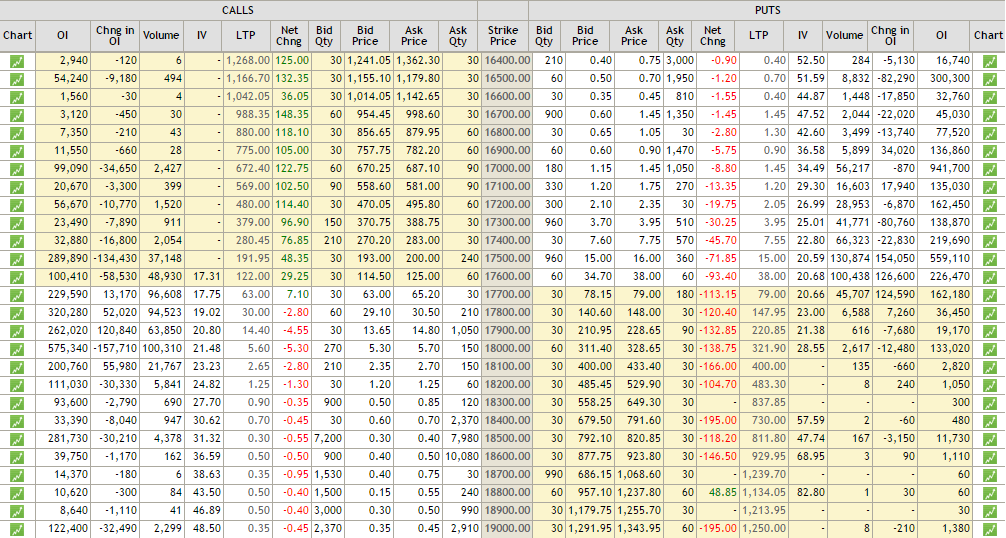

To check this further in another situation, Lets take the market position as on 29th June, 2016 i.e. Wednesday as now only one day is left for the expiry of the June Contract.

Chart 3 – Bank Nifty Weekly Chart June 2016 (15 Minutes)

There is no clear pattern forming up to conclude which levels can be act as anchored place to take stop losses as market in current phase is in strong intermediate up trend with no corrections.

From the chart above, we can see that the bank nifty has closed near 17700 mark on Wednesday and there are major resistance marks of 17900 & 18000 and support of 17400.

At 17900 mark, market has formed a double top which may again create a lot of problem for the market. Also, there is a major gap down from that level so even if market will reach that level it will just close the gap. This becomes our anchored top to write the call option of 17900 mark tomorrow i.e. on the day of expiry.

Table 3 – Bank Nifty Weekly June Contract Options Chain

From the table above, the 17900 call option is trading at Rs. 14 which was trading for more than Rs. 20 today. So, tomorrow watching the market opening and few early trading time, we can analyse if market had less chances to go above it then one can write this call option to make small profit but which has higher chances and probability of success.

Also, if you see it is the only call option which has the highest positive change of open interest of 1,20,840 contracts which signifies that this is the option which has most of the interest of the market participant today and surely they are not buying it rather writing off to make Small But Higher Probability Profit.

17900 seems to be a better call option to write which we expect can become worthless with higher probabilities of success..

But as the markets current trend is up and momentum and volatility is huge so we may skip writing the call this expiry as the market can still continue the up trend and even opens gap up tomorrow.

As the volatility is huge so writing of options or carry any over night position specially when writing options in not suggestive as market map open with gaps the following days. So, under such cases, always wait till the day of expiry and trade as per the market move which happens in the early hours.

If we talk about the support of 17400 we cannot call it to be a major but still we can anchor it as a support for the market which can help us to write the put options below that level by checking the movement of the bank nifty tomorrow by the afternoon.

Also, the open interest is increasing in 17500,17600 put options by 1,54,050 and 1,26,600 contracts with highest open interest of more than 5.5 lac contracts in 17500 put option which depicts interest of market at these levels. This shows market is seeing them to also work as a major support so tomorrow market is also expecting that it may gap up and stay above 17500 or 17600 levels so they may also seem good to trade. if this happens, and market gap up and get moving up then the interest in 17700 put option will also increase.

Therefore, as there is big increase in open interest of 17500 & 17600 puts which shows market is seeing them to work as a major support tomorrow so there are chances that market may continue its current up trend further to go near 17900 pr 18000.

So, writing of calls seems a bit less attractive where if we go with the current trend of the market and high increasing open interest in puts of 17500 and 17600, the writing of puts or buying call seems to be a better choice on the expiry day tomorrow.

The Idea Here Is……..

#1. Whenever markets are not forming any clear bullish or bearish pattern and we are unable to find places to enter the market and place our stop losses so cannot buy options, then writing of options of strike price above or below the major anchored top or bottom is the only way for the trader to take the benefit of time decay on or before every weekly expiry.

#2. Wait for the market move till Tuesday Close

#3. Anchor Major Resistance & Support Levels

#4. Analyse how far the market may go (in any direction) today even when there is high price momentum. If volatility is high and a trend is underway, wait to see the market movement in early hours on the day of expiry to take any positions.

#5. Check which options has higher open interest and changes in the open interest to understand which market is seeing as major support or resistance near your anchored top or bottom. If even after reaching resistance market starts to show increase in open interest in puts expect market to keep going with current up trend. So skipping writing calls is what makes sense with buying calls or writing puts will put us under great chances of success.

#6. Write the option above or below the major levels as and when market moves towards it but when it is still far off from major levels.

#7. As options pricing do not consider these technical aspects of markets, so the right analysis becomes a sword for the trader to make great trades with higher chances of success.

The major drawback of this strategy is that it did not give us place to put up stop losses as even after shorting the option, the premium can rise with the movement against but still not move above or below the strike price and later become Zero.

Thatswhy it makes sense to trade near the expiry days (i.e. on later Wednesday or Thursday) which can give you be clear with the moves and in-turn have higher chances of successful trades.

Trading Bank Nifty Weekly Options in the Last Hours on the Expiry Day

There are another set of traders who just get active on the last 2 hours of the expiry day. Seeing the trading for the complete day they come to conclusion for the new levels which market will now anchor as resistances or supports. So during the last 120 minutes, levels which are 100-200 points away from the current market needs to be anchored on.

So, the idea again is here to conclude What the Bank Nifty Index will not do in the next 90-120 minutes?

i.e., knowing Which levels market will not break now.

Also, some times during the expiry day which will happen once or twice every month, market will be near the major resistance or support levels. Traders have a tendency to book the profits during the last hours of the trading day when the market has moved in one direction during the day. Also this reluctancy to carry position is strong when the markets have reached some major sellers or buyers level.

So, those levels becomes our anchor levels to write the call or put options above or below it to take the benefit of time decay. The premiums must be trading at very low levels of Rs. 10-25 but the success rate will be huge as time decay is very fast during the last few hours of expiry…

The Idea Here Is……..

#1. Wait for the market movement till 1-2 PM on the expiry day i.e., every Thursday

#2. Anchor Resistance & Support Levels 100-200 points away from the current market price

#3. Also, check if the market is near some major resistance top or support bottom. Market may not go above or below it just because traders are reluctant to enter new buy or sell positions at the end of the day to avoid carrying any overnight positions whenever the markets are near these major levels which may give surprises by tomorrow morning gap up or gap down.

#4. Also, if the market has been swiftly moving in a single direction though out the day and reaching the major sellers or buyers area then traders who bought during the day starts to book profits before the close. So, this may push the market lower or higher and not breaking these major resistance or supports.

#6. Write the option above or below these important levels as and when market moves towards it but when it is still far off from major levels.

#7. Again, as options pricing do not consider these technical aspects of markets, so the right analysis becomes a sword for the trader to make great trades with higher chances of success.

An important point to remember here is that the options will expire as per the settlement price of the underlying which in our case is Bank Nifty Spot Index. Settlement price is calculated as the weighted average of the last 30 minutes i.e. from 3-3:30 PM. Do not confuse it with the last traded price. So if on any day the bank nifty index rises in the last half hour then surely settlement price will comes out somewhere in between the last half hour range.

The objective to detail out about options and writing strategy is to show you how big traders create a lot of positions by writing options according to the market conditions. This can also be justified with increasing open interest in calls and puts which shows big writing off these options. This is not the only way to trade options but there are other strategies that we may follow which with time will keep on sharing.

But Remember, Whenever markets are trending strong in one direction and volatility is there then you should surely avoid writing the options as this may increase the risk and go all against you.. Whenever the volatility is huge it is always better to buy options (Calls or Puts) then writing or selling options first.

So, be sure of why you are buying or writing the options. Don`t be in a hurry to trade similar on every expiry day and even as we say that Trading Everyday is a Silly Plan similarly Trading on Every Expiry is a Silly Plan too and more silly with similar plan every time.

Therefore, it is always important first to understand how volatile the market is and how higher the chances are that it will stuck in range and will not break the important supports or resistance levels. Because if the trend is strong and markets are drifting in one direction from last few days and you still follows the similar strategy of writing options to get few profit points you might get into trouble.

You should know that the when the markets are not trending, stuck in band during the expiry days and no trending pattern is getting completed to let the market run in fast momentum in very short time frame then you can make out the important support or resistance levels which market may not break with higher probability and write options.

But when the trend is strong or patterns for bullish or bearish moves are there then writing will surely not be fruitful or sometimes may out the trader into trouble when the market reverses and corrects fast.

Therefore, always first analyse and give complete importance to the understanding the what the bank nifty is expected to do in the next few hours to day to decide what is best strategy to adopt to trade bank nifty weekly otpions on or near expiry.

Just like buying options is always not the right strategy similarly writing options is always not the right strategy too.

Weekly bank nifty options contract has widened the scope of trading options as now options sellers can repeat the process to sell options 4 times in a month which will reduce the ambiguity of being restricted to trade monthly options which had big time frame of 20+ trading days to expiration.

But only when you trade right ..

and when you do not fall under the trap of trading options by buying the cheap far away options.

Ask yourself why some has so much of interest in these far away option which has high open interest?

Are they really buying it all because they are trading at cheap price?

And if they are buying with such great interest, then who the hell is selling to them and ends up pocketing all premium value of the worthless options on expiry?

To make money it is not always important to know what the markets will do

.. rather by knowing what the market will not do can make decent money for you and that too with higher probabilities of success.

It`s like the living up with the angel and devil… The angel on one shoulder says you’r trading it the right way, one that will result in a great trade and change the way you see it. Meanwhile, the devil on the other shoulder calls you a moron, born fool for taking risk and avoiding the way to make unlimited profits.

These are not the only way to trade it…

There are many many other ways to trade in the market.. Do find one which is within your comfortable zone and keep stretching…

So..

Make big profits and achieve Sensational RESULTS.

& we will keep sharing with you some more awesome ways to do it during our journey together..

We have before us a great deal of opportunity to make monstrous and sensational fortune and feel the jaw dropping miracle. And the way is … to Trade Options. And more consistent when trading bank nifty weekly options. But Responsibility to use it wisely is what makes the miracle to continue.

So, next time you think you’re ready to click Enter, go back and weed out these important killers.

Your trading will be more powerful and your profits will surely soar … Big

Go Ahead and Tell The World… The Way of Making it Big… Your Way?

It’s our responsibility. Because those of us who are successful have to speak up and share what we’ve learned.

Leave your answer in the comments, share this with others.

After all, isn’t that what we’re here to do? Help people? Change somebody’s life for Good?

Shall We start?

KNOWLEDGE IS POWER!

Disclaimer: Please note that all the information shared is solely for the general information purpose only. No information, views, opinions or examples constitute a solicitation or offer by JustTrading.in to buy or sell any securities or to furnish any investment & trading strategy / advice or taxation advice or service. Every attempt has been made to assure accuracy & completeness, we assume no responsibility for errors or emissions.

JustTrading.in advises you to consult with your certified professional finance advisers, chartered accountant & tax advisors before making any investment, trading or taxation decisions. For more, Please Visit & Read: Disclaimer

Related Posts

Nice post….Thank you.

@Amuthan.. Happy to hear that… Thanks for taking time to share your words.

Enjoy…

Thank you, a very informative article on Banknifty, it covers all aspects of nifty option trading.

Many many thanks for inspiring the New Comers

Dear Mr. Das

Heartful thanks to you for sharing such words. Its really motivating for us to keep up the pace for sharing more great content. This really gives us a feeling of satisfaction for our effortful work. Thanks a lot and we are delighted that you liked our work.

Let`s work together and help the traders make a success.

Cheers..

I like what you write. Can you point me to any articles you have written on Technical Analysis/Derivatives Analysis/Chart Reading. In case you haven’t can you please point me to some really good resources?

Dear Devesh

Really good to hear that you like our post.

There are a lot of content available online but unsure of any crisp and clear on chart reading. As most of the content talk only about candlesticks and technical indicators.

We are working on writing content on chart reading and how traders can use chart reading to refine their trading further and get an edge just like professional traders.

Once we are done, we will send you an update on your email or whats-app.

Till then you can read a short one on Charting. Getting Started with Technical Trading – What is a Chart?

Also, refer to the Recommended Trading Books that helped us in our trading.

REALLY NICE POST AND ENJOYED READING IT.

Could you please let us know if any such tool available which takes all required data from internet FOR A GIVEN (selected) UNDERLYING and can advise us to buy/sell any particular option for the selected underlying?

PLEASE HELP.

Dear Satosh

The automated software’s are generally used by big traders or institutions to take benefit of mis-pricing due to market volatility. That is the reason why markets reverses very fast after big up or down moves…

Any mis-pricing generates trading opportunities for arbitrage or less risk trades..

I don`t think there is any such free tool available online which can generate buy/sell triggers. But if you got any trading strategy for options then you can find ones by exporting the real-time price into excel and using formula`s to determine the right entry time…

I am also in process to write about some option trading strategies we keep a track of. The one we shared in this same article is the one we generally use to trade during or near the expiry.

There are some option software vendors in the market but we have not reviewed them till yet. Let me try contracting some and find which are worth buying. Once we do it we will review it here on the website.. You can also share the ones here, if u find some good one. we can review it here…

By the way, thanks for complimenting and we are also happy that you loved reading it..

Sir, please excuse me. I have a request. Above post has very confusing language. Some sentences are absolutely beyond comprehension. I do not wish to criticize. But simple, short, precise structure will help novices like me to appreciate your work.

Concrete problem. In many places above you have covered call and put actions together. In some places you have talked about call, put, buying and writing in a single breath. Even an experienced option trader cannot make a head or tail out of it.

Hope you do not take me wrongly.

Madhav Joshi

Dear shri Madhav Ji.

I have tried keeping things in great details as possible.. To help all get the core of the thought.. Writing in short will ease my work but feels that won’t suffice (as you adviced as per the need of the newcomers)

Actually, we have shared all the links in between to other article which relates to basics of options, bank nifty futures, etc to help new comers to get the grip on options and bank nifty..

But yes, I understand you concern and whatever questions, or confusion you have related to this article you can post it here ..and I am here to reply and solve it. Any number of queries.

Feel free to share… Will be more than happy to discuss and learn new things from traders like you..

And that what we believe in – An open environment where our readers can ask us anything they wish to.

Waiting for your all questions… Even our other readers will be happy to know new sides and problems they can face while trading bank nifty weekly options..

I agree with mr. Madhav Joshi. While trying to go into more detailed explanation, some points are repetetive, some points are overlapped, some points are not clear, because of which, the clear intention of author’s , to help us , is half done.

Point Taken. Generally written for all sort of traders (specially the new ones as most find options complicated). So to simply and help them understand – done whatever best i can do.

BTW thanks for the feedback.

very helpful article

Dear Sir,

Thanks a lot for explaining options in an easily comprehensible manner. your posts have triggered my passion for options.

Looking forward to read more similar stuff.

S.Karthikeyan

OH My God! I am amazed reading your thoughts.. Didn`t expected such great response…. Thanks a lot Karthikeyan for such inspiring words.. Your comment has also triggered my passion to right more great stuff.

Sir, Great series of articles. Specially this one (Turn bank nifty …).

Do you have a write up on entry price ? As an example at one place I decide that 17900 call should be shorted @14 Rs. I would decide this on Tuesday evening. But when I fire my order on Wed, the volatility brings price down to 4 Rs within first 20 minutes of trading and then not sure if there is any juice left in it. As traders we never launch market orders. How to deal with this situation ?

Hey Kunal

I am really glad that you like the work.

At present, I havn`t written much on trading and entry system but i am planning to do so asap. In your example, yes the prices generally fall much faster within the last 1-2 days of the expiry due to time value decay but such fall from 14 to 4 might be of the case that the market has opened way lower than Tuesday close.

Always it better to place in limit orders when trading the options for such small price gap as many of them have big bid and ask price between them.

The only way to deal is by either enter on Tuesday evening or trade on Wednesday the option which is more close to the index value by evaluating well what the market is going to do till the expiry… What levels it will not break.. What tops or bottoms are important… and what the market is due for.. etc

Can anybody can tell margin required for selling call or put bank nifty ?

Dear asparisk

Margin for shorting options is more or less similar to what is required to trade in bank nifty futures. At present it is approximately Rs. 60,000.

Dear Sir,

I want to know about options selling. Here i am putting some question so plz help me by solving these questions.

1. Suppose i short sell Bank Nifty 21000 call at 20 and that time spot price is 20850. If expiry day spot price is 20950 and premium is 0.05. So i am in loss or profit ?

2. Can i buy back my short position at 0.05.

3. What will happen if i forget to square off my short selling position in the expiry day.

4. Suppose i short sell 21000 call and i am in loss and i want to hold my position till the expiry. So is it possible and if yes so how ?

5. I short sell Bank Nifty 20800 call at 30 spot – 20720 and the expiry day Bank nifty close at 20900 and premium became 55. So am i in loss ? if yes so how much loss i have to bear.

I want to answer just five question and i hope you will give proper response.

Dear Rajat

Good to see you are finding answers to your queries. I have tried to share my thoughts on the questions in detail.. Hope it helps answer your queries rightly.

#1. When you have shorted Bank Nifty 21000 call that means you are expecting market to expire below 21000 to pocket in the full premium amount of Rs. 20. And, the bank nifty index expired @ 20950 so the 21000 call will become worthless i.e. becomes zero.

So, as you have shorted it at Rs. 20 and it got expired at zero, you made a profit of Rs. 20 x 40 = 800.

#2. Yes, you can buy your short position @ 0.05.

#3. Even if you forget to buy back the shorted call option – You will still pocket in the full value of premium i.e. Rs. 20 as the call option has expired out of the money.

#4. If you have sold short 21000 call and you wish to carry the option then you need to take care of M to M loss everyday as future and options are settled everyday.

Suppose, you shorted 21000 call option at premium of rs. 20 and at the end of the day the premium rises to Rs. 30 and there are few more days left to expiry and you are still in the position then the broker will debit your trading ledger with the M – M loss of Rs 400 (40 x 10). Also, if next day the premium went down and close to Rs. 25 from the last day close of Rs. 30 then the broker will credit the ledger with the profit of Rs. 200 (40 x 5).

Also, you will have to maintain the total margin requirement which these days will be approx. Rs. 60000.

#5. If you have shorted the bank nifty 20800 call at Rs. 30 and on the expiry bank nifty index expires @ 20900 then the premium will become Rs. 100 and not Rs. 55.

So, you will have to bear a total loss of Rs. 70 x 40 = Rs. 2800.

I hope the answers have solved your queries. You can further read the below article to get equipped with the basics & advanced of the options market.

Warning: 5 Traps To Avoid When Trading Bank Nifty Weekly Options on the Expiry Day

Part VII – Getting Started With Trading – How to Trade Options?

Why More Margin is Required to Short / Write Options than Buying Options?

Part I – Getting Started With Trading Options – How does an Options Trade Work?

Further, if you have any more questions. do share here.. I will be more than happy to answer.

Thank you very much Sir. You are doing great job to help the begainer trader

Thanks Rajat For your kind words…. We started this with the same thought of helping new traders to not commit mistakes that we even fall into during our early days.

Hope to continue the same in the future.

Its very great explanation on Bank Nifty Writing strategies , which i ever found in WWW. I have small query on margin required for writing options . Do we need that 60k fixed irrespective of call/put premium we are writing at ( for wg., 20,30,50/- ) ? or margin varies depends on premium value of underlying strike price , which we are selling ?

Dear Ramanujam

There is a slight margin difference between the different strike prices where the 60K might become 65K or 70K. So, atleast you will require 60000 these days to carry overnight position in options selling.

But if you are trading for intraday say writting on the day of the expiry, then you might be able to do one lot of short selling at 20k by getting intraday MIS exposure. which requires you to square your position 10-15 minutes before the market close.

Hope this help. If you have any other query, do post it here. I will be more than happy to help.

Hi

I have been reading your insanely lengthy posts which are so detailed that i cannot but appreciate the efforts you have been putting in, in every article. Great effort

I was reading this post and was wondering if it is possible to do weekly spreads on the nifty options ??

Do you have any articles on spreads..

Thanks

Rupma

Hi..

Correction. I meant on The weekly Bank NIfty Options

Thanks

Dear Rupma

Till now I didn`t get into that concept… I generally trade options as an alternative to futures. Will try to pace up to learn further about options strategies…

Dear Rupma

Thanks a lot for your words… really good to hear that it helped you in some bits… You are reminding of the nights i took out to write those… Sleepless nights 🙂 hahaha…

Dear Sir,

Thanks a lot for your value able suggestion. I have some confusion as below, hoping for suggestion :-

1. Suppose I buy Banknifty 25500 call at Rs.20/- . If expiry day spot price is 25620 and closing bank nifty is 25715 and premium price is Rs.45/- what will be my profit or loss.

Profit will be 25620-25500.. and i feel the premium will not be 45, it must be somewhere around rs. 100 before the expiry.

I have never come across a better article on the internet about options selling.Hats off to you for the antention to detail

Thanks Vidyanand….

Dear Admin,

I have read all most each of your specifically explained posts on each topics. It’s amazing how you have spend time to educate newbies like me. Really appreciate your efforts in spreading the knowledge gained, may be, after many years of experience or paying learning fees which market always demands for.

I do have one query though – It is obvious that writers of the options are the one who have the most probability of making profits, statistically around 70% times. But can intra-day trading (mostly buying calls or puts as per trend) in options be fruitful with the help of charts; indicators; volumes; and other governing factors. I mean if a person can decide entry point with strict stop loss and target % profit on intraday profit with BANK NIFTY, is it viable to end in green in longer term ?

Have you explored this aspect of 30% when buyers are making profits ? Also, if you can please guide on one point that increase in open interest is mostly due to hedge funds who buy options at particular strikes to protect their position, which in turn means that the big sharks may be on the other side in futures on monthly expiry ? If you can enlighten us on how to the hedging plays important role in +/- of Open Interest then it would be more than helpful.

Btw thank you once again for the efforts you have put in to pen down all the minute details and the traps new traders fall for.

Thanking you.

Regards,

Mehul

Dear Mehul

Yes you are too the point that one can profit from buying options which generally work as an alternative to taking position in bank nifty futures. So, if one is inline with the right time and price then surely buying options is more fruitful.

Regarding your question, I buy options mostly when I am unable to take positions in Futures contract due to big stops or overnight positions.

And for increase in open interest, mostly it is due to short selling in those specific options contract (same has been illustrated in the article).. Yes. hedge funds do hedge by taking multiple positions in futures or options. Its a wide deep subject to talk on as there are thousands of strategies that these big traders take in options or futures contracts.

Thanks for writing and sharing your thoughts in length.. happy to connect with you.

Hi Sir,

Is there some one who can teach me banknifty options trading. Please let me know. I need a real good tutors please.

Dear Murthy

Very soon coming up with a realtime trading room where we will share our realtime trades and knowledge with all the new aspiring traders.