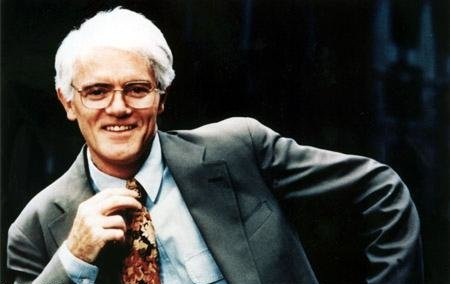

Peter Lynch a stock investor and author of many stock investment books and one of the most followed money manager in America. He was the head of the Magellan Fund till 1990 managing some $14 billion in assets.

Lynch believes that everyday investors have an advantage of making money from stocks over wall street professionals because they are able to spot good investments in their day-to-day lives and their familiarity with the market place. In his books, ‘One Upon Wall Street’ & ‘Beating The Street’ he outlined the approaches and his specific examples of his investment decisions in various companies which he spotted from his day to day personal life routine.

For more about Peter Lynch, Visit our Trading Legends Page – Peter Lynch

Invest In What You Know Best!

He outlined how an everyday investor can have an edge on his investment by spotting a company with better future prospects within their own day to day routines – The one whose products they are consuming, interacting with their employees regularly. This will generally help them understand the company much better and much before these information are available to the investment professionals. He stresses on that an investor should first spot the company which they feel have an edge over the others and then categorize the company under different heads he outlined.

Categorization of Companies

Slow Growers

Companies which are growing at a slow pace but slightly better than the economic growth.

Stalwarts

Companies which are growing at a nominal growth rate of 10+% which offer downside protection during the time of recessions and can offer good returns of more than 20% a year on the investments if purchased at a right time and right price. Like Coca-Cola, Procter & Gamble, etc.

Fast Growers

Companies which are small and aggressive growing at a rapid pace of 20-30% every year offer a great opportunity for the investor to invest in and earn amazing returns but are riskier than the stable and slow growing companies.

Cyclical

Industries like Steel, Auto, Airlines, hotels fall under the category of Cyclical whose sales and income tend to rise and fall in predictable patters and move in cyclical time patterns. Investing in these industries or company at the right time becomes a lot important for the investors as they fall dramatically during the bad times.

Turnarounds

Companies which are currently going through bad phase but is on some verge for a turnaround by investing in new technology or new opportunities in their industries, a comeback after a bad management play, etc fits under this category. These companies generally have a trend of their own and offer big time opportunity to investors to earn exponential returns.

Asset Opportunity

Companies with specific or hidden assets which are overlooked by various investment professionals. Companies under oil, gas, metal, media, real estate, patents fits best under this category.

How to Find Prospecting Companies?

He has outlined various factors which require investors to give utmost stress to while finding a prospect for investment. Some of them are listed below:-

- Company with high growth in a no growth industry.

- Company with a niche control on a market segment.

- Companies with the all time going product which people are going to consume during bad or good times.

- Overlooked company with unfamiliar or uncool names

- Companies with Year on Year Earnings

- Dividend Payout

- Sales and Profit Growth

- Debt to Equity Ratio

- Inventories

Investment Philosophies According to Peter Lynch

#1. There’s no shame in losing money on a stock. Everybody does it. What is shameful is to hold on to a stock, or worse, to buy more of it when the fundamentals are deteriorating.

#2. Your investor’s edge is not something you get from Wall Street experts. It’s something you already have. You can outperform the experts if you use your edge by investing in companies or industries you already understand.

#3. Behind every stock is a company. Find out what it’s doing.

#4. If you don’t study any companies, you have the same success buying stocks as you do in a poker game if you bet without looking at your cards.

#5. “If you’re prepared to invest in a company, then you ought to be able to explain why in simple language that a fifth grader could understand, and quickly enough so the fifth grader won’t get bored.”

#6. “During the Gold Rush, most would-be miners lost money, but people who sold them picks, shovels, tents and blue-jeans (Levi Strauss) made a nice profit.”

#7. “Go for a business that any idiot can run – because sooner or later any idiot probably is going to be running it.”

#8. “Actually Wall Street thinks just as the Greeks did. The early Greeks used to sit around for days and debate how many teeth a horse has. They thought they could figure it out by just sitting there, instead of checking the horse.

#9. “Look for small companies that are already profitable and have proven that their concept can be replicated. Be suspicious of companies with growth rates of 50 to 100 percent a year.”

#10. “Consider the size of a company if you expect it to profit from a specific product.”

#11. “Time is on your side when you own shares of superior companies.”

#12. All you need for a lifetime of successful investing is a few big winners, and the pluses from those will overwhelm the minuses from the stocks that don’t work out.

#13. The natural-born investor is a myth.

#14. Never invest in any idea you can’t illustrate with a crayon.

#15. “I’ve found that when the market’s going down and you buy funds wisely, at some point in the future you will be happy.

KNOWLEDGE IS POWER!