By investing in the market we mean Investing in the Index which broadly in case of India is Nifty or Sensex. Nifty is the average of Top 50 capitalized companies of the Indian economy from different sectors. In other words, when we are talking about India, we are generally referring to these companies as they represents a significant and big portion of the Indian economy. These top 50 listed companies represents some Rs. 28,36,169 crores of market capitalization i.e. more than 66% of all the 1600 listed companies on the National Stock Exchange of India.

Similarly, investor can invest in the other index like Nifty Next50 Index which gives exposure to the Top 51-100 companies from the Indian Economy or Bank Nifty Index which gives exposure to the Top 12 banks of the Indian economy.

So, any investor who wishes to bet on the growth of the Indian economy and not any particular sector or any company can do so by investing in Nifty50 Index or Nifty Next50 Index.

While for any investor who wishes to bet on say banking sector can invest in the Bank Nifty Index which expose him to the top 12 banks and not betting on any individual bank. Like PSU banks were a large part of the Bank Nifty index but later replaced by the Private Banks due to bad performance and fall in market capitalization of these PSU banks. So, investor need not to bet on which stock will perform in the banks rather he is always invested in the top 12 capitalized banks of the Indian banking sector as these top 12 banks constitutes 92% of the free float market capitalization and 82.68% of the traded value of the stocks forming part of the Banking sector universe as on March 31, 2015.

Top 10 Companies in Nifty 50 Index

| Sr. No | Security Name | Industry | Free Float Market Cap (Rs. Crores) | Weightage (%) | Beta |

| 1 | Infosys Ltd. | Computers | 220694.6 | 7.78 | 0.74 |

| 2 | HDFC Bank Ltd. | Banks | 214129.4 | 7.55 | 0.89 |

| 3 | Housing Development Finance Corporation Ltd. | Finance | 199436.9 | 7.03 | 1.36 |

| 4 | I T C Ltd. | Cigrattes | 184144.3 | 6.49 | 0.75 |

| 5 | Reliance Industries Ltd. | Refineries | 167546.3 | 5.91 | 1.16 |

| 6 | ICICI Bank Ltd. | Banks | 151897.5 | 5.36 | 1.5 |

| 7 | Tata Consultancy Services Ltd. | Computers | 125505.2 | 4.43 | 0.57 |

| 8 | Larsen & Toubro Ltd. | Engineering | 104508.3 | 3.68 | 1.18 |

| 9 | Sun Pharmaceutical Industries Ltd. | Pharma | 89396.41 | 3.15 | 0.88 |

| 10 | Tata Motors Ltd. | Auto | 75679.98 | 2.67 | 1.31 |

Diversified Portfolio into Sectors

Investment in Nifty 50 index will give an investor exposure to the well-diversified sectors including financials, Information Technology, Energy, Consumer Good, Automobiles, and Pharma, etc and the index will always have the top performing and big companies like HDFC Bank, HDFC, Infosys, TCS, ITC, Reliance, Larsen & Turbo, Sun Pharma, Maruti, etc. from these different sectors. So, the investment of investor will always be in the top companies of Indian economy from the different sectors. The companies which majorly impacts their respective sectors by having a big segment of customer base and services and products. Similarly, by investing the Nifty Next50 Index, investor will be exposed to the Next top companies of Indian economy in their respective sectors after Nifty 50 companies.

[visualizer id=”2388″]

List of Companies in Nifty from Different Sectors

| Sr. No | Security Name | Industry | Free Float Market Cap (Rs. Crores) | Weightage (%) | Beta |

| 1 | Hindalco Industries Ltd. | ALUMINIUM | 10904.33 | 0.38 | 1.36 |

| 2 | Bosch Ltd. | AUTO ANCILLARIES | 16875.42 | 0.6 | 1.14 |

| 3 | Bajaj Auto Ltd. | AUTOMOBILES | 34515.33 | 1.22 | 0.82 |

| 4 | Hero MotoCorp Ltd. | AUTOMOBILES | 32864.38 | 1.16 | 0.71 |

| 5 | Mahindra & Mahindra Ltd. | AUTOMOBILES | 58823.85 | 2.07 | 1 |

| 6 | Maruti Suzuki India Ltd. | AUTOMOBILES | 61144.58 | 2.16 | 0.78 |

| 7 | Tata Motors Ltd. | AUTOMOBILES | 75679.98 | 2.67 | 1.31 |

| 8 | Axis Bank Ltd. | BANKS | 75255 | 2.65 | 1.44 |

| 9 | Bank of Baroda | BANKS | 14712.87 | 0.52 | 1.37 |

| 10 | HDFC Bank Ltd. | BANKS | 214129.42 | 7.55 | 0.89 |

| 11 | ICICI Bank Ltd. | BANKS | 151897.49 | 5.36 | 1.5 |

| 12 | IndusInd Bank Ltd. | BANKS | 47203.5 | 1.66 | 1.1 |

| 13 | Kotak Mahindra Bank Ltd. | BANKS | 74129.02 | 2.61 | 1.06 |

| 14 | Punjab National Bank | BANKS | 8613.98 | 0.3 | 1.26 |

| 15 | State Bank of India | BANKS | 69380.76 | 2.45 | 1.37 |

| 16 | Yes Bank Ltd. | BANKS | 23732.01 | 0.84 | 1.5 |

| 17 | ACC Ltd. | CEMENT | 12727.25 | 0.45 | 0.82 |

| 18 | Ambuja Cements Ltd. | CEMENT | 15667.12 | 0.55 | 1.15 |

| 19 | Grasim Industries Ltd. | CEMENT | 23894.26 | 0.84 | 0.82 |

| 20 | UltraTech Cement Ltd. | CEMENT | 28470.38 | 1 | 1.12 |

| 21 | I T C Ltd. | CIGARETTES | 184144.33 | 6.49 | 0.75 |

| 22 | HCL Technologies Ltd. | COMPUTERS | 47506.47 | 1.68 | 0.73 |

| 23 | Infosys Ltd. | COMPUTERS | 220694.6 | 7.78 | 0.74 |

| 24 | Tata Consultancy Services Ltd. | COMPUTERS | 125505.2 | 4.43 | 0.57 |

| 25 | Tech Mahindra Ltd. | COMPUTERS | 31943 | 1.13 | 0.55 |

| 26 | Wipro Ltd. | COMPUTERS | 36008.06 | 1.27 | 0.64 |

| 27 | Hindustan Unilever Ltd. | DIVERSIFIED | 61208.45 | 2.16 | 0.53 |

| 28 | Bharat Heavy Electricals Ltd. | ELECTRICAL EQUIPMENT | 15293.67 | 0.54 | 1.13 |

| 29 | Larsen & Toubro Ltd. | ENGINEERING | 104508.26 | 3.68 | 1.18 |

| 30 | Housing Development Finance Corporation Ltd. | FINANCE – HOUSING | 199436.94 | 7.03 | 1.36 |

| 31 | GAIL (India) Ltd. | GAS | 17438.14 | 0.61 | 1.05 |

| 32 | Zee Entertainment Enterprises Ltd. | MEDIA | 23907.9 | 0.84 | 1.05 |

| 33 | Coal India Ltd. | MINING | 42392.25 | 1.49 | 0.74 |

| 34 | Vedanta Ltd. | MINING | 9950.19 | 0.35 | 1.68 |

| 35 | Cairn India Ltd. | OIL EXPLORATION/PRODUCTION | 7844.3 | 0.28 | 1.33 |

| 36 | Oil & Natural Gas Corporation Ltd. | OIL EXPLORATION/PRODUCTION | 43377 | 1.53 | 1.06 |

| 37 | Asian Paints Ltd. | PAINTS | 40008.32 | 1.41 | 0.97 |

| 38 | Cipla Ltd. | PHARMACEUTICALS | 32982.51 | 1.16 | 1.09 |

| 39 | Dr. Reddy’s Laboratories Ltd. | PHARMACEUTICALS | 39501.25 | 1.39 | 0.73 |

| 40 | Lupin Ltd. | PHARMACEUTICALS | 44221.04 | 1.56 | 0.75 |

| 41 | Sun Pharmaceutical Industries Ltd. | PHARMACEUTICALS | 89396.41 | 3.15 | 0.88 |

| 42 | NTPC Ltd. | POWER | 30198.37 | 1.06 | 0.89 |

| 43 | Power Grid Corporation of India Ltd. | POWER | 31091.9 | 1.1 | 0.67 |

| 44 | Tata Power Co. Ltd. | POWER | 12299.6 | 0.43 | 1.1 |

| 45 | Bharat Petroleum Corporation Ltd. | REFINERIES | 23059.41 | 0.81 | 0.88 |

| 46 | Reliance Industries Ltd. | REFINERIES | 167546.28 | 5.91 | 1.16 |

| 47 | Adani Ports and Special Economic Zone Ltd. | SHIPPING | 23631.65 | 0.83 | 1.24 |

| 48 | Tata Steel Ltd. | STEEL | 17320.91 | 0.61 | 1.5 |

| 49 | Bharti Airtel Ltd. | TELECOMMUNICATION | 47013.11 | 1.66 | 0.72 |

| 50 | Idea Cellular Ltd. | TELECOMMUNICATION | 16118.36 | 0.57 | 0.66 |

| 2836168.81 |

For stocks in the Nifty Next 50 Index, please visit What is Junior Nifty?

For stocks in the Bank Nifty Index, please visit What is Bank Nifty?

Principle of Replacement

The constituents of the index are selected on the basis of the market capitalization. Therefore, the companies with the top 50 market capitalization from the different sectors of the Indian economy will only be the part of the Nifty 50 index and top 51-100 companies in the Nifty Next50 index. The index will always have the top companies from the wide sectors and those who do not perform will be replaced by those new companies performing.

Consider the Index as a Company & its stocks as the employees from the different departments where those employees who do not perform in the company from the specific department will be replaced by the new employees. So, companies will always strive to have the top performing employees.

Similarly, the index will always have the top performing & big companies from their specific sectors and those companies who don’t perform (market capitalization falls) will be performed by those other companies who perform (market capitalization rises).

Past Inclusions & Exclusions from Nifty 50 Index

As we outlined that the Nifty will always have the companies which are biggest in their respective sector. Any changes in the performance of the companies will surely impacts their market capitalization which in turn will decide the exclusions and inclusions from the Nifty 50 index.

| Index Name | Event Date | Scrip Name | Description |

| Nifty 50 | 28-03-2014 | Jaiprakash Associates Ltd. | Exclusion from Index |

| Nifty 50 | 28-03-2014 | Ranbaxy Laboratories Ltd. | Exclusion from Index |

| Nifty 50 | 28-03-2014 | Tech Mahindra Ltd. | Inclusion into Index |

| Nifty 50 | 28-03-2014 | United Spirits Ltd. | Inclusion into Index |

| Nifty 50 | 19-09-2014 | United Spirits Ltd. | Exclusion from Index |

| Nifty 50 | 19-09-2014 | Zee Entertainment Enterprises Ltd. | Inclusion into Index |

| Nifty 50 | 27-03-2015 | DLF Ltd. | Exclusion from Index |

| Nifty 50 | 27-03-2015 | Jindal Steel & Power Ltd. | Exclusion from Index |

| Nifty 50 | 27-03-2015 | Idea Cellular Ltd. | Inclusion into Index |

| Nifty 50 | 27-03-2015 | Yes Bank Ltd. | Inclusion into Index |

| Nifty 50 | 29-05-2015 | IDFC Ltd | Exclusion from Index |

| Nifty 50 | 29-05-2015 | Bosch Ltd. | Inclusion into Index |

| Nifty 50 | 28-09-2015 | NMDC Ltd. | Exclusion from Index |

| Nifty 50 | 28-09-2015 | Adani Ports and Special Economic Zone Ltd. | Inclusion into Index |

Past Inclusions & Exclusions from Nifty Next50 Index

| Index Name | Event Date | Scrip Name | Description |

| Nifty Next 50 | 02-02-2015 | Eicher Motors Ltd. | Inclusion into Index |

| Nifty Next 50 | 02-02-2015 | ING Vysya Bank Ltd. | Exclusion from Index |

| Nifty Next 50 | 27-03-2015 | Idea Cellular Ltd. | Exclusion from Index |

| Nifty Next 50 | 27-03-2015 | Yes Bank Ltd. | Exclusion from Index |

| Nifty Next 50 | 27-03-2015 | Indiabulls Housing Finance Ltd. | Inclusion into Index |

| Nifty Next 50 | 27-03-2015 | United Spirits Ltd. | Inclusion into Index |

| Nifty Next 50 | 29-05-2015 | Adani Enterprises Ltd. | Exclusion from Index |

| Nifty Next 50 | 29-05-2015 | Bosch Ltd. | Exclusion from Index |

| Nifty Next 50 | 29-05-2015 | Britannia Industries Ltd. | Inclusion into Index |

| Nifty Next 50 | 29-05-2015 | MRF Ltd. | Inclusion into Index |

| Nifty Next 50 | 28-09-2015 | Adani Ports and Special Economic Zone Ltd. | Exclusion from Index |

| Nifty Next 50 | 28-09-2015 | Reliance Power Ltd. | Exclusion from Index |

| Nifty Next 50 | 28-09-2015 | Union Bank of India | Exclusion from Index |

| Nifty Next 50 | 28-09-2015 | Crompton Greaves Ltd. | Exclusion from Index |

| Nifty Next 50 | 28-09-2015 | Marico Ltd. | Inclusion into Index |

| Nifty Next 50 | 28-09-2015 | NMDC Ltd. | Inclusion into Index |

| Nifty Next 50 | 28-09-2015 | Sundaram Finance Ltd. | Inclusion into Index |

| Nifty Next 50 | 28-09-2015 | Ashok Leyland Ltd. | Inclusion into Index |

| Nifty Next 50 | 19-10-2015 | Aditya Birla Nuvo Ltd. | Exclusion from Index |

| Nifty Next 50 | 19-10-2015 | Indian Oil Corporation Ltd. | Inclusion into Index |

Therefore, companies can be excluded from the Index on many factors listed below:-

Non-performance – Companies which do not perform in term of their sales and profitability will lead to a fall in their market capitalization as well, so will force the stock to move out from the index and replaced by some other company performing well (from the same or different sector)

Good Performance – Companies with better performance can be taken out from the Index as well as in the case with Nifty Next 50 Index where companies will good performance and increasing market capitalization will force the company to be the part of the Nifty 50 Index and replaced by some other company in the index.

Example, Bosch Ltd, Yes Bank were taken out from the Next Nifty50 Index in 2015 and became a part of Nifty Index.

Why Investment in Index makes sense for every Investor?

Investing in the index put investor on the safe end as it is one of the best and simple way for investing in the market for any category of investor. A right mix of stocks in the portfolio gives the investor an edge which is best achieved by investing in the index as index helps investor to stay with top performing companies from a segment of the market or the broad economy. This in turn also put the investment on the safe side as the investor stay away from many unknown companies and he always remain invested even for the long term in just the top companies.

For more :- Visit Why Investment in Index makes sense for every Investor?

Comparing Nifty with Dow Jones

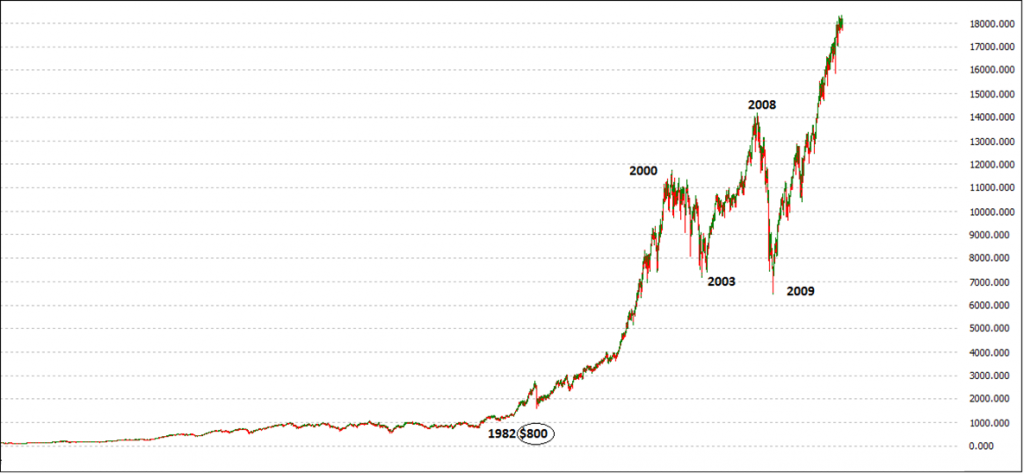

Our markets have a history of some decades but we have got a market which has a long history of record to learn and understand the dynamics and importance of investing in the index i.e. Dow Jones. Dow Jones is the average of the top 30 stocks from the different sectors of the US economy.

History of Dow Jones

US markets have seen one of the worst depression in the history in 1929 where the Dow Jones Index fall from $400 in 1929 to $40 in 1932, a fall of 90% in just 3-4 years. Many big companies which were the part of the Dow Jones Index before or during the depression gone bankrupt in the coming years and were out of the business and were replaced other companies which helped US economy to come back on its feet again and helped the Dow Jones to rise back from $40 in 1932 to $1000 in 1966, an appreciation of 2400% in just 32 years.

A big line of companies were replaced during this great depression from the Dow Jones Index.

In July 18, 1930

| Old Companies | New Companies |

| American Sugar | Borden |

| American Tobacco B | Eastman Kodak Company |

| Atlantic Refining | Goodyear |

| Curtiss-Wright | Liggett & Myers |

| General Railway Signal | Standard Oil of California |

| Goodrich | United Air Transport |

| Nash Motors | Hudson Motor |

In May 26, 1932

| Old Companies | New Companies |

| Liggett & Myers | American Tobacco B |

| Mack Trucks | Drug Incorporated |

| United Air Transport | Procter & Gamble Company |

| Paramount Publix | Loew’s |

| Radio Corporation | Nash Motors |

| Texas Gulf Sulphur | International Shoe |

| National Cash Register | International Business Machines |

| Hudson Motor | Coca-Cola Company |

So, even after the markets US Economy underwent all the financial crises, world wars, etc the market kept on still growing as there were some sectors or companies which helped US Economy to grow and prosper. Therefore, perpetual nature of the markets or index gives and advantage to the long term investor as the stocks which were there in 1930s are not there, but economy is still there the markets are still there and growing from more than 100 years.

So, the philosophy of “Believe & Invest” is well suited for any investor in case of investing in the Index.

Investors from India can learn and understand the dynamics and importance of investing in the Index from the US markets. So, any investor from India can invest in Indian markets by investing in Index ETFs available for trading.

How to Invest in Index?

Any investor who wishes to get exposure to the index can do so by buying the Index ETF which is available from trading on the equity stock exchange. In India, at present there are three major Index ETFs available for investing:-

Nifty50 ETF – Helps to invest in the Top 50 companies of the Indian Economy via NiftyBees.

Nifty Next50 ETF – Help to invest the Top 51-100 companies. The companies which may become large caps in the future and be part of Nifty 50 Index via JuniorBees.

Bank Nifty ETF – Helps to invest in Top 12 banks of the Indian Economy via BankBees.

There are two ways investors can use these ETFs for investing.

Lump sum that is buying directly real time from the markets. Lump sum buying is generally preferably when the markets have corrected cyclically.

SIP that is buying in monthly installments just like SIP of Mutual Funds. Investment at every level of the market.

Warren Buffett on Investing in USA via Index Fund

“Just making monthly investments in a low-cost index fund makes a lot of sense, Owning a piece of America, a diversified piece, bought over time, held for 30 or 40 years, it’s bound to do well. The income will go up over the years, and there’s really nothing to worry about.”

“A low-cost index fund is the most sensible equity investment for the great majority of investors.”

“My advice to the trustee couldn’t be more simple: Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund. I believe the trust’s long-term results from this policy will be superior to those attained by most investors – whether pension funds, institutions or individuals – who employ high-fee managers.”

KNOWLEDGE IS POWER!