We all love trading options on the expiry day. Don`t we?

The excitement and love must have increased 400% now with the introduction of bank nifty weekly options

which earlier was restricted to once every month by trading only monthly expiry contracts

Bank Nifty weekly options has surely opened a gate to the options trader to make consistent profits, hedge their portfolio positions and take benefit of the major market driven events like results, RBI policies, economic events, etc at real low cost…

Some traders are addicted to buy options which are trading at lower prices on the expiry day with a thought of making big with less risk while others make up their trading plan to write the out of the money options and pocket in the full premium value.

This addiction has also increased multi folds when now traders can trade or write options to make money from trading bank nifty weekly options.

We have shared deep information in the article How to Turn Bank Nifty Weekly Options into a Regular Income-Driving Machine? on how traders specially those who are professionals use Bank Nifty weekly options to make sure money consistently on their capital by writing the options and putting the benefit of the time value decay in their favor. Also, how they use weekly bank nifty options to buy the markets instead of taking positions in the bank nifty futures..

We have shared deep information in the article How to Turn Bank Nifty Weekly Options into a Regular Income-Driving Machine? on how traders specially those who are professionals use Bank Nifty weekly options to make sure money consistently on their capital by writing the options and putting the benefit of the time value decay in their favor. Also, how they use weekly bank nifty options to buy the markets instead of taking positions in the bank nifty futures..

Trading options gives a sword to the trader as you can not only make money when the markets are trending up or down but also when the market are moving sideways and stuck in consolidation band

But most traders fell into the trap by engaging in options market in similar old fashioned thoughts and trading ideas

by buying out of the money options with a thought that the loss is limited and opportunity to make big or unlimited profits are in their favor

many who trades it on the expiry day, usually buys the cheap low prices options in big quantities by dreaming that the market will zoom up or fall big to turn their small risk trade into big turnaround profitable day

and there are some who doubles up their position in the losing option by buying more at the lower price to average out and compromise on their risk management

These mistakes are mostly incurred by new comers who enter the options market with the fascination of making big money by buying cheap low prices options and with lack of planning, and research

But there are some mistakes or trap that most traders generally fall into due to lack of understanding of the mechanism and settlement of the options market and suffer big losses..

and one of the biggest trap is when they have what we call as a “Contract Shock”.

You might have read and heard million number of times that the risk with buying options is limited to the price of the premium paid. Right?

Is that the case?

No

not always

If you fail to understand the technicalities behind the mechanism of options market then the rule of limited loss surely do not apply there.

Feeling Puzzled, Right?

Ok, so lets take a very simple case here

Say if you have bought hundred lots or 4000 units (100 x 40) of bank nifty weekly 19000 call option on the day of expiry for Rs. 3 when bank nifty index is trading @ say 19000, And you knew that market will surely close above 19000 today anyhow…

then what will be the maximum loss you can have?

The answer must be a maximum loss of Rs. 12000 Right?

Ehmmmm …. No.

Puzzled

Recalculating… Oh yes we miss the brokerage and taxes, etc..

So, the new answer must be max approx Rs. 13,000. Right?

Still not correct

Sorry.. But I need to ask this too…

Tell me what happen if the bank nifty index rises and you are sure that the market will settle at a higher price and you know that difference between the close price of Bank Nifty Index and your call option strike price of 19000 will be your profit.

and as you expected … it did settled above 19000 say @ 19010.

You must be calculating the profit on the trade as 4000 x 7 (10-3) = Rs. 28000 .. Right?

But let me tell you when you will receive your contract note in the evening, you are going to get a “Contract Shock” by seeing what happened…

Rs. 67,000 Net Loss on a Profitable Trade of Rs. 28000.

How you can incur such big loss even when you had a profitable trade and that too when you know that the loss is limited to the premium we pay when we buy options i.e. Rs. 4000 x 3 = Rs. 12000

Curious to know how that can happen?

or must be feeling that it is all bullsh*t & rubbish….

But actually it is not…

Read the TRAP 1 & TRAP 2 to understand how we can get trapped by even letting our profitable trade in big losing one that too when we have read and convinced all through over that

WHEN WE BUY OPTIONS – LOSS IS LIMITED TO THE PREMIUM PAID

which is not completely true in all of the cases

The rules or traps are generally similar for any equity stock or equity index futures & options but to keep it clear we have illustrated the same by taking the case of bank nifty weekly options as they are the one we will be trading 3 times more than any other option contract.

# TRAP 1. Not Selling In-The-Money Options Before Expiry

To help you understand the concept well we have tried best to take all the possible cases and events in great detail. So, bear with us and open gates to the new learning…. And this trap generally has to do something with Taxes – STT

So, What is STT?

STT or Securities Transaction Tax is levied on every purchase or sale of securities that are listed on the Indian stock exchanges. This include shares, derivatives or equity-oriented mutual funds units.

This was first introduced in 2004 by the Finance Minister P. Chidambaram to subside the tax loss when they turn long term capital gain tax as zero.

Some Important Points on STT :-

- STT is applicable only on sell transactions for both futures and option contracts

- Each futures trade is valued at the actual traded price and option trade is valued at premium. On this value, the STT rate is applied to determine the STT liability

- In case of final exercise of an option contract, STT is levied on settlement price if the option contract is in the money

- In 2016 Budget, Finance Minister Arun Jaitley increased the STT on options by nearly three-fold to 0.05% from earlier rate of 0.017%

Below are the current STT rates that are charged on Futures & Options Trading in India

| a | Sale of an option in securities | 0.05 percent | Seller |

| b | Sale of an option in securities, where option is exercised | 0.125 percent | Purchaser |

| c | Sale of a futures in securities | 0.01 percent | Seller |

For more visit Securities Transaction Tax on NseIndia.com

STT in case of Bank Nifty Futures Trading

When you trade Bank Nifty Futures, you are charged with STT of 0.01 percent on the total sell value of the contract.

Say, if you have bought one lot of Bank Nifty Futures Contact (July 28th Expiry) on July 22nd at 18650 and sell it in the market before or on the expiry day @ 19000 then a total STT of Rs. 76 will be charged on the sale value which is calculates as below

= (19000 x 40) x 0.01 percent

Selling Price x Lot Size x STT Rate

Also, consider the case where you don`t sell the futures contract in the market till the expiry and let it settled at the settlement price of BankNifty Index value then the similar STT of Rs. 76 will be charged.

Say, if you have bought one lot of Bank Nifty Futures Contact (July 28th Expiry) on July 22nd at 18650 and don`t sell it in the market till the expiry day and let it settled at the settlement price of 18882.40 then a total STT of Rs. 75.5 (calculates as below) will be charged which is similar as the one charged when you squared the long position by selling it in the market

= (18882.4 x 40) x 0.01 percent

Bank Nifty Index Settlement Price x Lot Size x STT Rate

But What if You have Short Bank Nifty Futures and let it square via settlement route through exchange?

If you are short bank nifty futures (sold first), then you have already paid STT and it doesn’t matter if you buy the futures contract through market trade or hold them till expiry and get it settled, as there is no STT on the buying side and no distinction of whether you square the position through market trade or settlement route.

As, there is no distinction whether the long or short bank nifty futures contract is squared through the market trade or settlement route at the settlement price there is no question of STT that will be charged in either case. As it remains same.

So, trader needs not to worry where he/she square his open futures position by self in the market or let it expire and get it settled via settlement route as STT will remain same.

But there is a difference between when such trade happens in options via market trade or exercised through exchange.

STT in Case of Bank Nifty Weekly Options Trading

This generally answers to the question

Why is it Important to Square-Off ITM (In The Money) Options rather let them Expire on the Expiry Day?

which we have explained later in the post.

STT on Bank Nifty Weekly Options Trades Done in the Market Vs STT on Exercised Bank Nifty Weekly Options Contract

STT on Bank Nifty Weekly Options Trade Done in the Market

STT on normal option trades done in the market is charged at 0.05% on the selling side of the premium value of the option irrespective of whether you buy first or sell first.

When you buy options first, then you do not pay the STT as it will charged on the selling premium value when you will square that open position by selling in the market.

Also if you have short/ write options first, then you have to pay the STT first and you will not be charged when you will square the position by buying the position back in the market trade.

Simply put, if you are doing both the side of the trade (Buy and sell or sell and buy) through the market trade, then STT of 0.05% on sell value will be charged.

Say, if you have bought one lot of Bank Nifty 19000 Weekly Call Option at Rs. 100 then you don`t have to pay the STT but when you sell it in market say @ Rs. 110 (before the market close on expiry day) then a STT of Rs. 2.20 (calculates as below) will be charged, which is very insignificant

= (110 x 40) x 0.05 percent

Selling Premium x Lot Size x STT Rate

Similarly, if you have sold one lot of Bank Nifty 19000 Weekly Call Option at Rs. 100 then you pay STT of Rs. 2.00 (calculates as below) and when you will buyback this call options say @ Rs. 90 (before the expiry) then you need not to pay any STT as you have already paid when you sold it short.

= (100 x 40) x 0.05 percent

Selling Premium x Lot Size x STT Rate

Similar case is applied when you bought or write put option and square the open position in the market before the close of the market on the expiry day. Then STT of standard 0.05% will be charged on the selling value of the premium.

But what will happen when you will let your option contract expire and let it settle via settlement route?

Or in other words, when you do not not square your buy or short position till the close of the market on the day of expiry of the options contract?

STT on Bank Nifty Weekly Options Contracts Settled / Exercised / Expired

This will help answer some of the questions which many of our visitors generally ask us.

Is it compulsory to Sell Options (Either Call or Put) in the market before the expiry of the contract?

If I bought an options contract and on expiry it is trading at Rs. 0.05? Should I sell it in the market or let this option exercise? If yes, what are the charges and STT that will be levied?

What will happen if the option that I shorted on expiry day rises but bank nifty index closes below my strike price? Whether I will be in profit or loss?

If I don`t sell my ITM call option on expiry, how much STT will be charged?

Let`s dig in deep to get the answers for all these questions

If You Buy Option and it Expires In-The-Money?

The problem comes only in the case of options that you have purchased, are in the money on the expiry and you do not square the open position in the market and let it expire and get it settle through settlement route.

Whenever you let your buy positions in the options expire In-The-Money till the close of the markets on the expiry day, then STT rate will increase from 0.05% to 0.125% and it will now be charged on the total value of the contract and not on the premium value.

i.e. STT of 0.125% of the contract value* will be charged if you buy and keep holding it till the close of markets on the expiry day (in case of In The Money options).

where, * Contract Value (Call / Put Option) = (Strike Price+Option Premium) x Lot Size

Suppose, you have bought one lot of Bank Nifty 19000 Weekly Call Option at Rs. 100, market rises to and settle at 19100 i.e. the call option becomes In-The-Money and you let it expire and did not square your open position i.e. you didn`t sell it in the market and let it expire till the close of the market on the expiry day then it is considered to be as exercised.

As when you bought the call option you don`t have to pay the STT but as this time you didn`t sold the option contact in the market and you let it expire in the money and now it is exercised then a total STT of Rs. 955 (calculated as below) will be charged, which is very much bigger than the earlier insignificant value of STT of Rs. 2 that you would have paid if you sold the options in the market instead of letting it exercised / expired.

STT = (19000+100) x 40 x 0.125 percent

(Strike Price + Premium) x Lot Size x STT Rate

Therefore, this additional STT is charged when you are the buyer of an option (call or put) and it is expiring in the money and you have not squared it off before market closing on expiry day. In such a case the option gets exercised and you are charged STT at a higher rate.

So, it is always advisable to sell the open in the money options in the market rather than letting them expire.

Similar applies in case of Put Option

If you have bought one lot of Bank Nifty 19000 Weekly Put Option at Rs. 100, market falls and settle on expiry @ 18900 i.e. the put option becomes In-The-Money and you let it expire and did not square your open position i.e. you didn`t sell it in the market and let it expire till the close of the market on the expiry day then it considered to be as exercised.

As when you bought the put option you don`t have to pay the STT but as this time you didn`t sold the put option in the market and let it expire and now it is exercised then a total STT of Rs. 950 (calculates as below) will be charged, which is very way bigger than the earlier insignificant value of STT of Rs. 2 which you would have paid if you sold the options in the market instead of letting it exercised / expired.

= (18900+100) x 40 x 0.125 percent

(Strike Price + Premium Value) x Lot Size x STT Rate

So, If the buy options (Call or put) has any value in it or market is settling above in case of call or below in case of put option and you let it expire till the close of the market on the expiry day, then STT will go up from 0.05% to 0.125% and it will be charged on the total contract value and not on the premium value.

So, When Options are Considered to be Exercised?

Options are considered exercised if you hold buy positions in options till close of the market on expiry day (i.e. till 3.30 PM on every Thursday) and with them having some intrinsic value or being ITM (in the money) i.e. where settlement price of Bank Nifty Index is more than strike price of the option in case of call option or where settlement price of Bank Nifty Index is less than strike price of the option in case of cput option.

Additional STT of 0.125% (instead of 0.05%) is charged when you are the buyer of an in-the-money option and have not squared it off before market closing on the expiry day. In such a case the option gets exercised and you get charged STT at a higher rate.

But What if You Buy Option and it Expires Out of the Money?

If the buy options has no value in it till the close of the market on the expiry day i.e. it gets expired worthless then no STT is applicable.

Suppose, you have bought one lot of Bank Nifty 19000 Weekly Call Option at Rs. 100, and bank nifty index expires below 19000 i.e. the call option becomes Out-Of-The-Money. Then the value of the 19000 call option will surely be zero. Then you need not to sell in the market as there is no STT on the Out-Of-The-Money options.

As when you bought the call option you don`t have to pay the STT but as this time the market expired below the call option strike price, so no STT will be charged.

Similar can be applied in case of put option.

Suppose, you have bought one lot of Bank Nifty 19000 Put Weekly Option at Rs. 100, and bank nifty index expires above 19000 i.e. the put option becomes Out-Of-The-Money. Then the value of the 19000 put option will surely be zero. Then you need not to sell it in the market as there is no STT on the Out-Of-The-Money options.

As when you bought the put option you don`t have to pay the STT but as this time the market expired above the put option strike price, so no STT will be charged.

Important note here is that it is considered In-The-Money or Out-Of-The-Money depending on where the Bank Nifty Index settle and not Futures Contract.

So, if the Bank Nifty Index expires below the call option strike price then it it considered to be Out-Of-The-Money while if the Bank Nifty expires above the put option strike price then it is considered to be Out-Of-The-Money.

What if You Write Options and let it Expire?

If you are short/written options (sold first), you have already paid STT and it doesn’t matter if you buy the options in the market or hold them till the closing on the day of expiry, as there is no STT on the buying side.

For Example

If you write option @ Rs. 100 and at the expiry day it’s value stands @ 50 and you let this ITM option expire. How much STT will be charged?

As we are writing options (i.e selling first) we would have already paid the STT (@0.05% of the premium). So, in both the cases whether we buy from the market or we let it expire, we don’t have to pay any STT at all, i.e STT would be zero since we have already paid STT when you had shorted the options contract.

An important point to consider here is that settlement price is weighted average of last 30 minutes. So, make sure you know whether it is beneficial to square by buying or selling in the market or through exchange.

If it seems confusing, then only remember that higher STT of 0.125% instead of 0.05% will be charged only in case of options :-

– If you have bought options, they are expiring in the money and you are not selling it in the market rather letting it expire though settlement route.

Therefore, if you have bought options and they are expiring worthless (With value 0) or are expiring out of the money then you don’t have to sell it to save STT because STT on options which has no value is zero.

Also, if you have sold short or write options, then you need not to worry for the STT as you have already paid it at the usual rate of 0.05%. So, it makes no difference whether you square the short position by buying them back from the market trade or let it expire at the settlement price.

So, the only problem comes when you have bought options, they are expiring in the money and you are letting it expire/exercised via settlement route. So, It is advisable to sell it in the market than let it expire/exercised.

The question which must be coming to your mind is why on the Expiry of Contract, STT charges are different for options?

Why is the rate of STT for a buy exercised option is so high 0.125% compared to 0.05%?

Theoretically, the buyer of the option (whether Index or Stock) gets the right to buy or sell certain quantity of underlying at the specified price by paying a premium price. It means that if the option position which has some intrinsic value in it if is not squared rather the buyer of options let the contract expire at the settlement price means he is ready to buy or sell the underlying @ that particular strike price. Because the option contract has still some value in it which requires the buyer to take the benefit by selling the contract in the market and if not then he is ready to to buy or sell the underlying.

So at the expiry, if you are not exercising the In-The-Money options contract it is assumed you will take or give delivery of the underlying which in our case if Bank Nifty.

Thatswhy only In-The-Money are settled at the expiry settlement price which requires higher STT to be paid while Out-The-Money which are worthless for the buyer of the option is left untouched and does not require any STT to be paid.

So, the buyer of the option who has exercised the contract means that he has exercised his right to take delivery of the underlying if he has bought a call option or ready to give the delivery of the underlying in case he has bought the put option.

As in India all the derivatives (future or options contract) are cash settled and there is no actual exchange of delivery. But since theoretically this accounts to an option buyer asking/giving delivery of the underlying the STT is now considered as per delivery based trade which is 0.125% of the entire value of the contract and not just the premium value.

This is also the reason why income from Future & Options is considered as Non Speculative Business Income.

Many traders generally get fooled and fall into the trap by buying the options trading at less than their theoretical values before the close of the market on the day of expiry. But this trap generally let them with no wonders so it is really important to understand the reason for it so that you do not fall into this another trap.

# TRAP 2. Buying Options which are Trading at Less Price than the Actual Theoretical Value on the Expiry Day

Now we are clear with why, how and when STT is charged and burdened on the shoulders of the traders who fall into the trap because of not clear guidance and awareness. For many, it must be a nightmare when they get a Contract Shock and feels to be like a really expensive learning.

Now another important to ask

Why do options trade at lesser than theoretical value on the expiry day?

There are generally two reasons why some of the options which are close to the current traded price starts trading at different price than the theoretical values on the day of expiry: –

1. STT

2. Settlement Price

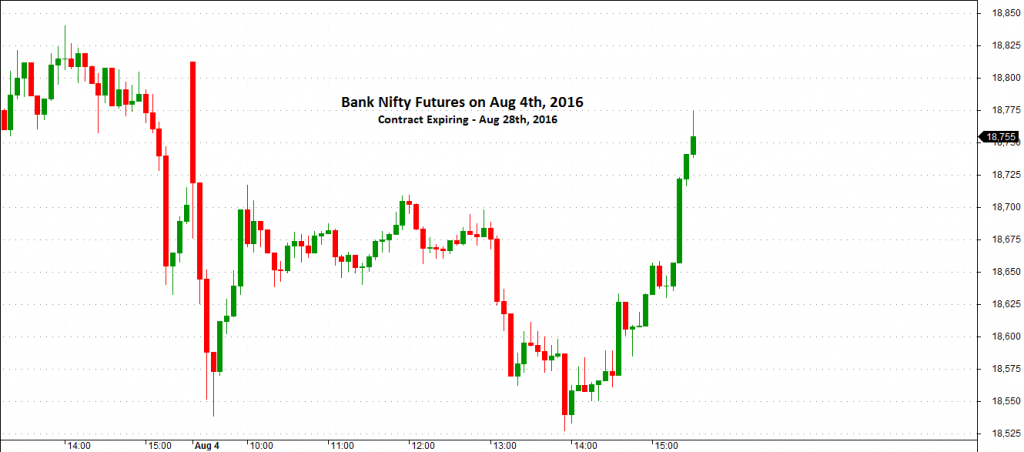

Chart 1 – Bank Nifty Index Intraday Chart (Aug 4th, 2016)

Let`s take the case of August 04th, 2016 expiry from the chart 1, where Bank Nifty Index rallied from 18450 to 18638 in the last hour of the trade.

Question 1 – Then why did the Bank Nifty Index get settled @ 18571.70?

Question 2 – Also, why did 18500 & 18600 calls traded and settled at different prices than the theoretical prices before the close of the market on the day of the expiry?

Below are the details for the Bank Nifty 18500 & 18600 Weekly Call Options that expired on Aug 4th, 2016.

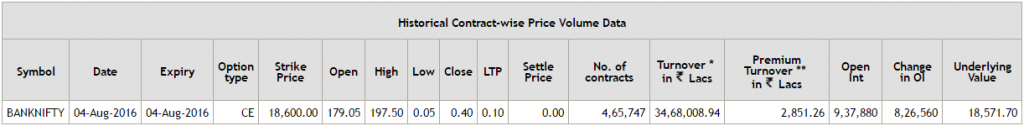

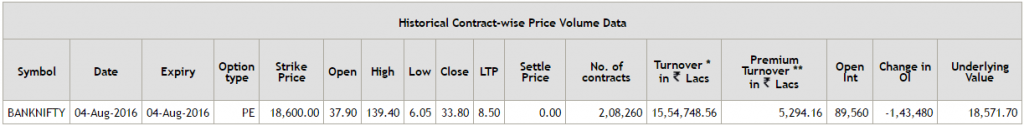

Table 1 – Bank Nifty Weekly 18600 Call Option (Weekly Expiry of Aug 4th, 2016)

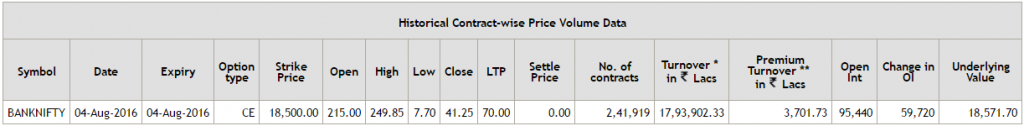

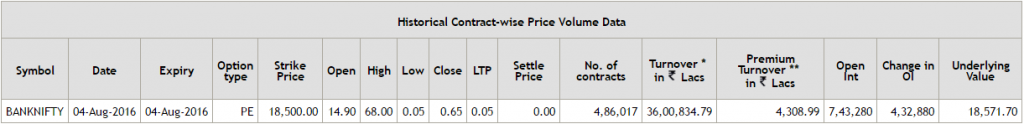

Table 2 – Bank Nifty Weekly 18500 Call Option (Weekly Expiry of Aug 4th, 2016)

From the above, we can see that the bank nifty 18500 call option traded at the last price of Rs. 70.

The reason behind such a discrepancy between the theoretical and real traded prices of both of this call option is due to the settlement mechanism of underlying where market settles at different price than the last traded price and discounting the value of the STT.

First, as settlement price or closing price is the weighted average of last 30 minutes on any trading day. So, if market has rallied in the last say 20-30 minutes then the average weighted price will come lower than the last traded price where as if the market has fallen in the last say 20-30 minutes then the average weighted price will come higher than the last traded price.

Therefore, it should not be of any surprise where if Bank Nifty rallied from 18540 to 18638 from 15:00 to 15:30 and still 19500 call option must be trading at very lower prices of say Rs. 70 which as per the theoretical value should be trading around 138 on the expiry. This is due to the fact that the settlement price will comes around somewhere between 18540 & 18638 and market is also accounting the value of STT to be paid by the buyer of the In-The-Money options contract if they do not sell their open positions in the market.

Because if the buyer of the 18500 call will let the contract expire and get it settled through the settlement route will incur the STT cost of approx Rs. 930 which comes out to be 23 points for 1 lot size of 40 units.

Also, as all the option contract are cash settled at the settlement price of the underlying which in our case is Bank Nifty Index where settlement price is the weighted average of the last 30 minutes. It is important to not get confused the last traded price with the settlement price.

Also, when the Bank Nifty traded @ 18638 at 15:30, then the 18600 call option should be trading at theoretical value of Rs. 38 but as the average will come somewhere in between 18540 & 18638 and market is also discounting the STT value that is why it was trading at Rs. 0.10. So, this 18600 which seems to be in the money will settle at out of the money i.e. why it was trading at Rs. 0.10.

Therefore, If you see options which seem to be cheap (trading lesser than theoretical value) during the last half hour of the trade on expiry day, do consider the fact that the market is discounting that the settlement price will be different than the current traded price (if bank nifty has rallied or fall in last 30 minutes on expiry) and also because of the higher STT rate that which will be charged if you do not square your position in the market but rather will let your In-The-Money options expire and get it settled via settlement route.

Therefore, during the last 30 minutes of the trade, the 18500 call must not be trading around its actual theoretical value of trading at Rs. 100+ and did not closed at its theoretical value of Rs. 138 (18,638 – 18,500) is first because of the fact that Bank nifty index has rallied in the last 30 minutes and the weighted average price will settle much lower than the current market price and second because of the higher cost of STT that will be charged if we do not sell the contract in the market and let it expire and settle via settlement route.

Another important to consider is that if on the expiry day, bank nifty index falls in the last 30 minutes then the weighted average price will come higher than the prevailing market price so traders are require to account the higher settlement price and deduct the STT cost to understand which options will be In-The-Money and which will be Out-The-Money.

I will try to share some real time examples on the expiry days later in the coming days. Till then observe these on the expiry days and trade accordingly.

Now, as we are clear with how this works, now lets come to the example which took earlier in the beginning of the post

So, if you have bought hundred lots or 4000 units (100 x 40) of bank nifty weekly 19000 call option on the day of expiry for Rs. 3 when bank nifty index is trading @ say 19000 and market settles @ 19010.

Then the total profit from the trade will be 4000 (19010-1900) – 3 = Rs. 28000.

Because during the last half hour of trading, when market was trading at marginally higher than 19000 levels then the call option of 19000 must be trading at a value close to zero only because of the cost of STT which needs to be accounted. So, the call we bought at Rs. 3 cant be sold at profit even if the bank nifty index is above 19000 levels. Therefore, we are forced to let this expire and settle via the settlement route at the weighted average price of the bank nifty index on the expiry.

As the bank nifty index as in our example settles @ 19010 i.e. our 19000 call has expired In-The-Money where we will be charged with the STT tax of 0.125% on the total contract value which is as:-

19000 x 4000 x 0.125%

= Rs. 95000.

So , net loss from the transaction will be Rs. 67000 (95000-28000)

But an important point here is that as the market on the day of expiry will already consider the cost of STT in the pricing of all the in the money options specially which are away from the current market price. So, even the market is at 19330 and you buy 19200 call at 114. Then as per the market price the 19200 must be trading at Rs. 130 so it is including some Rs. 16 for the STT cost. But if you calculate the real cost which will be incurred it will be Rs. 965 i.e. 24.5 points. So, you will incur a loss of 8.5 points if you buy 19200 call at 114 and let it expire say @ 19330.

It will not be the complete loss of STT but remaining which the market has not discounted in the price of options.

So, how does this work?

Generally as you will witness that the options which are already in the money i.e. say those which are atleast 100 points away from the current Bank Nifty index price would have already discounted the STT cost as the traders get a feel that there is higher probability that this call option will expire In-The-Money. So, you will see them trading at the price lower than the theoretical price.

While, the call options which are say 30/40/50 points away or those which are At-The-Money very close to the current index level will still be trading at a higher premium price with full intrinsic and some time value in them as no one is sure that the current options will expire In-The-Money.

For Example say at 2 P.M., the current bank nifty index level is at 19320 then the 19200 call will be trading @ say Rs. 100 (below its intrinsic value) as there are more chances that it will expire In-The-Money so it is discounting the STT cost and some time value in it where as the 19300 must be trading at Rs. 25 because no one is sure whether this will expire In-The-Money or not as it is very close to the current market price and still has 90 minutes to go.

Rest below mentioned are not traps rather mistakes that an option trader generally incur due to lack of understanding of the mechanism on which options trading and settlement is based on :-

# TRAP 3. Waiting too Long to Buyback the Short Options

This is one of the biggest mistake most options trader fall into – they don`t buy back their short options rather keep waiting for the market to get close or waiting for the last bits of points by thinking they will buy @ Rs. 0.05.

They traded right by writing the options which may expire out of the money (worthless) but fall into the trap by thinking why to incur additional transaction cost when the options are going to expire worthless and settle as per the settlement price.

Some of them even fall into the trap looking for last few bits of points by not buying it back even at Rs. 0.50 or Rs. 1 and saying I will buy only at the last price of Rs. 0.05.

It is important to understand and follow one piece of advice: Always be ready and willing to buy back short options early. Don’t wait for it to become Rs. 0.05.

This is because we have seen a number of times market reversing big in the last hour of the trade. You might have short some options with the thought that they will expire worthless today and till 14:30 or 15:00 you might be at a good profit and you short option must be trading at very low price of say Rs. 2 or Rs. 5. for which you felt confident that the market will expire below you call option strike price and you will be pocket in all the premium value of the call option.

But suddenly market reverses and starts moving up and kept on going for some 200-300 points within the last hour of the trade which forces your profitable trade to turn up into a losing one. Just because you strive for the last few bits of points.

This is specifically for those who trade and write big quantities of options with a thought that the short options will expire out of the money or worthless.

So do not fall into the trap by looking for last few bit of points. Rather square you position and sit calm and relax.

# TRAP 4. Buying Deep In-The-Money Options

Buying far away options can put a trader into trouble as he may find it difficult to exit due to less liquidity. So, if the market is far away from the the options you bought, you may get stuck up with position as it may happen you may not get the buyers to sell you open position which may lead you to incur huge STT tax.

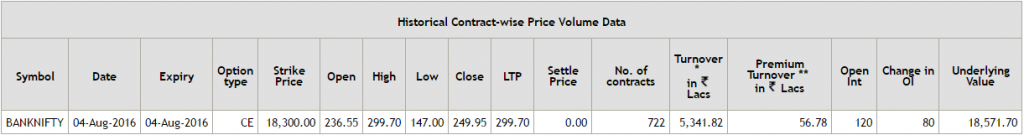

In the above case, where bank nifty index was trading between 18450-18550 levels and you purchased 18300 call option at the price of Rs. 200. Bank Nifty index rises to 18638 levels and your call option of strike price 18300 will be worth more than Rs. 300. But what if there are no buyers available for the 18300 call option?

Table 3 – Bank Nifty Weekly 18300 Call Option (Weekly Expiry of Aug 4th, 2016)

From the above table, you can see that the 18300 call option has traded with only 722 contracts on the expiry day, even when bank nifty was trading near 18450-18550. This is because most of the traders felt that the market will not touch 18300 mark so had lack of interest from the participants. Similarly, the contract of 18200 and 18100 will also have less liquidity.

It may happen that there may be no buyers of this 18300 call option during the close of the market on the expiry day or there must be big gap between the bid and ask prices which may force you to not sell the option in the market.

Then you cannot square your long 18200 Call option in the market but will be forced to let it expire and settle via settlement route as per the levels of bank nifty index on the expiry. This may force you to incur huge STT cost as this call option is In-The-Money and will be considered as a delivery trade. Such huge STT tax will not be there if you would have been able to sell it in the market.

The reason behind lack of liquidity is these deep in the money options has huge premium price in it which requires a lot of capital to be stuck up in carrying the position. As similar results can be obtained by trading in the near In-The-Money or At-The-Money options which are close to the current or expected traded price.

# TRAP 5. Option Pricing are based on Bank Nifty Futures Contract

This might be one of the very basic but yet very important to consider while trading weekly bank nifty options. As the futures contract on bank nifty has only monthly expires where weekly options on bank nifty settles every Thursday.

So, most of the time bank nifty futures will be trading at a huge premium than the levels of bank nifty index due to time value and cost of carry in the futures contract.

Therefore, it is very important for any trader to consider that all the weekly bank nifty options contract will expire and settle as per the closing settled price of the bank nifty index on every Thursday and not as per the Bank Nifty Futures closing.

Another important note here is that, traders who are writing the weekly Bank Nifty options on the day of expiry with a view of letting them expire worthless or out of the money should consider the support and resistance levels of bank nifty index and not bank nifty futures.

As In our above case, where bank nifty index was trading at 18638 during the close of the market day but on the other side the bank nifty futures contract was trading at 18755 with a premium of more than 100 points. So, it is important to evaluate the pricing of the weekly bank nifty options as per the bank nifty index levels and not futures contract.

Chart 2 – Bank Nifty Future Intraday Chart (5 Minutes – Aug 4th, 2016)

As per the chart above, we trader may be interested in writing the 18500 or 18600 put option with a view that market has found support @ 18500 levels and has started going bullish during the last hour of the trade on the expiry day so it may not go below 18500 or 18600 till the expiry of the contract.

Table 4 – Bank Nifty Weekly 18500 Put Option (Weekly Expiry of Aug 4th, 2016)

But as we see the Bank Nifty 18500 put option traded at Rs. 0.05 but 18600 put option was trading at Rs. 8.50 even when the bank nifty contract rallied till 18700+.

Table 5 – Bank Nifty Weekly 18600 Put Option (Weekly Expiry of Aug 4th, 2016)

This is because of the fact that the above chart is for the Bank Nifty Future contract expiring on Aug 28th,2016 and not that for the Bank Nifty Index.

From the below chart, if we see the levels as per the Bank Nifty Index it is important to write 18400 and 18500 put options and not 18600 put options. where both of the put options of 18400 and 18500 expired out of the money or worthless as bank nifty settled and closed @ 18571.70 after rallying from 18450 to 18650 in last hour of the trade.

Chart 3 – Bank Nifty Index Intraday Chart (5 Minutes – Aug 4th, 2016)

Also, do consider that the options will trade before the closing of the expiry as per the settlement price which will come as per the weighted average of last 30 minutes of the the Bank Nifty Index. As in our case, as bank nifty has rallied so the weighted average price will come lower than the traded price in last few minutes.

Finally…..

Are You Ready to Get Serious?

The reason most new traders fall into these traps isn’t because of lack of interest but because of lack of information which is available there in the market.

If you’ve fall into any of these traps, It is OK. All is not lost.

Even if you are a new trader, now that you know the traps, you can avoid them with ease.

And, I can expect that

you’re going to be different, right?

You’re going to commit yourself to not fall into these mistakes and traps..

And, make the better use of opportunity by making big bucks from the trading…

All the best…

Leave a comment, telling me your experience with any of these….

KNOWLEDGE IS POWER!

Related Posts

Good information. Thank you.

Dearest Sumit

Happy to know that you find it useful…. We are amazed to see how quick you commented on the post just after we published it.. You commented it first. 🙂 Awesome…

Where can we get weighted average price on real time

Dear MK Devi

Same we can get it in the charting trading software. We will share the same in this same article on how to calculate the volume weighted average price manually… Do check the article again later in the day..

Thanks you for your prompt reply. Instead of calculating manually ,is there any way to get price real time.you are doing extant job in giving valuable information .kudos to your team.

Dear M K Devi

Which charting software are you using for trading? Also, yes I too feel its difficult to calculate it manually in real time market.

Generally, we take a close guess on as per the movement of the market in last 30 minutes. So, if market has rallied in the last 30 minutes then it will adjust lower than the last traded price which may hover around 50% of the last 30 minute range.

You can use the charting software indicator sector to come up with the weighted average price…

By The Way, Thanks for you kind words…

And Yes, Happy Independence Day… Jai Hind

I am using zerodha 5 minute heikinashi candle chart.rsi and stocastics.

Do check the study and indicator section – there must be an option to add the weighted average price for the stock or index. Till then let me try to find from my end on how to add it in your charting software and other used by other traders. We will update you via email once I get the info.

Also, If you are an experienced trader or an investor, do share your story or ideas on how you trade the market and how you use options market and specifically Bank Nifty Weekly Options to make profit..?

Do check the one we written specifically How to Turn Bank Nifty Weekly Options into a Regular Income-Driving Machine?

Hi.

You can get the weighted average price in you Market Watch by adding an additional column Predictive Close. This gives the estimated closing price of that particular scrip which helps you to know On expiry days, whether the option will expire in the money or out of the money.

very very useful information here and it will really help lot of traders to avoid such mistakes and save their hard earned money.

We are delighted that you liked our work. Yes, there are many such mistakes that traders generally fall into due to lack of awareness and information available. For this we have taken an endeavour to share all possible info to help traders not fall into such traps…

if i buy bank nifty both call and put and it exercise by exchange then what would be stt in the money or out the money

Dear Harish

All the options which expire out of the money will not attract any additional STT.

Say, BankNifty Index expires @ 19900 so all the call options above 19900 will expires out of the money and on the other hand, all the put options below 19900 will be out of the money.

But all the call options which are below 19900 will be in the money and if are not squared till the expiry will attract STT @ 0.125% of the (Strike price + Premium) x lot size.

In the above case, say we let 19800 call expire at the expire then STT of Rs.1000 will be charged (19800 + ~100) x 40 x 0.125%..

Today 21st Jan 2020

Bought

Weekly Bank Nifty 21st Jan expiry 32700 PE @600

Bank Nifty at expiry was 32186.90 and price closed at 507

It’s still showing active in my zerodha account and showing exit option. My 6773 amount is showing under Option Premium label. In my Funds statement.

How do I close this active session or exit this session tomorrow. Is there any profit n loss that will be calculated on this?

My P&L for the day was closed at 34k

Will this exit activity or this active session impact my P&L

Also what would be the STT calculation. As per my knowledge as on current date i.e 21st Jan 2021, the clause of increase in STT from 0.05% to 0.125% is removed.

I wanted to exit. But some error in zerodha connection with exchange didnt allow to sell till the last moment and I got stuck.

Please Help. I’m new to the system.

hi kiran really not sure what this really is. better to exit or connect with zerodha if some issue in exiting.

Hi can you please explain to me what happens when you short an OTM call @ 14 (3 days before expiry) and on expiry day, the price of the call goes to 0.5 as the call is still OTM. What if there were no buyers and i was forced to let it settle. How does this settlement happen and who buys them if exchange settles it after expiry.

Wanted to congratulate in this wonderful informative write up. Kudos

Dear Kariyil

As the option has expired out of the money, then you keep all the money you received when you shorted it @ Rs. 14.

An example to illustrate this say you wanted to sell a mobile phone for Rs. 19800 and some friend comes to you and said he wishes to buy it but will need three days to arrange the money. To grant him three days you asked him to pay a security amount say Rs. 14. So, if he is able to find a buyer for that phone above Rs. 19800 then only he will come to you and exercise his right.. Else he will let the right expire and lose Rs. 14 which is the maximum profit you earn.

*His intention is to make profit and not keep the phone for self (as all the F&O contracts in India are cash settled).

So, the 19800 call option you shorted @ Rs. 14 three days before expiry will expire worthless if market did not expire above 19800. Then surely the buyer of the 19800 call option will not exercise his right. So you keep all the money you received i.e. Rs. 14.

Regarding STT, as you have shorted the call option then you would have already paid STT as per the premium value of the option and need not to worry whether you buy the contract in the market or let it settle via exchange. Because there is no STT on the buy side of the contract.

Hi there,

The above was an extremely informative article.

Would be glad if someone may throw some light on a doubt of mine.

What happens if I short an OTM call of 19000 @14 (3 days before expiry) and create a short vertical spread by buying 19100 !@ 6. Now, on the day of expiry say spot stays at 18700 and both these positions are trading below Re1. Is it safe to let this trade go into expiry and how exchange settles this trade? or is it always safe to settle this position at market even with less profit? Would also like to know how exchanges settle both of these positions after expiry.

Thanks

Dear Kariyil

Because the bank nifty index settles @ 18700. So both 19000 & 19100 call option expired out of the money. So, you will keep Rs. 14 on 19000 call option while you loose Rs. 6 on the 19100 call option.

So, either you let it expire and get it settle via exchange or you square it in the market it makes no difference. As both are out of the money so there is no question of higher STT to be charged.

Regarding settlement, to keep it simple its just like you shorted a stock @ Rs. 14 and it becomes zero so you made Rs. 14 on that stock while the other one you bought at Rs. 6 also becomes zero so you loose Rs. 6 on the second stock.

Only important consideration when trading options is when you bought an option and it is expiring in-the-money. So those are required to be squared of in the market than letting it expire and settle at the exchange due to higher STT cost (As explained deeply in the article)..

Hope this clarifies, If still you are in doubt please share. I will surely help to sort that out.

I am a new trader, and a new reader of your blog. Just felt one thing – you are writing too long. You are telling lot of stories before coming to the point. Please come to the point fast. Otherwise it becomes boring. just take it as a feedback.

Hey Rahul

Appreciate your feedback. Will make a note while writing new articles.

Can you please guide how to Start trading in weekly option? A blog which will guide a beginner to start? Also a step by step guide to Start for beginners

Does this mean that when I enter into a Short Straddle (short 1 ATM call and 1 ATM put) and the underlying expires at any other price than the strike of these options, its best for me to not close my positions at all?

Lets assume that the settlement price of the underlying is between the two break-even points and my short straddle has resulted in a profit.

Hey Nikhil

STT is paid only on the selling of the options contract. So, if you have short call and put then you have already paid the STT and need not to worry to fall under the STT Trap.

The only thing need to consider is for Straddle whether you are more profitable squaring that in the market or by letting it settle as per the settlement price of the underlying.

really helpful

Thanks @sreejith. Hope to keep on getting such words…Again and Again.. Thanks

Started option trading with a hope to make huge money and lost 42l…. huge huge loss… been trapped to all your mentioned 5 traps and trapped to unwanted elements who had little or no knowledge… but no one mentioned or enhanced my knowledge…your post and explanation are so useful tt given me a little moral boost up not to let go market and keep continuing with whatever little am left with….

Thank you for such detailed post and giving your valuable time for small traders

Dear Somen

I can truly understand the pain you must have gone through & I know how bad it feels when things doesn`t work out as planned specially when trading.

But it makes me feel good that you have find another hope and boosted self to try back again which really shows that you have found something in life which gives you happiness.

And i am sure this time it will be different – With big valuable knowledge, with a pre defined plan and list of mistakes not to commit again.

As Spryte Loriano once said – Every great story on the planet happened when someone decided not to give up, but kept going no matter what.

Dear sir,

Thank you for your swift response…

Kindly advise on your paid advisory service on whatsapp

Dear Somen

At present, We have not started the paid advisory services as registration with SEBI and many other formalities are required to be done. We are under plan to start the advisory soon.

And also, we are in process to start the premium newsletter services to help traders be in-sync with market.

We will intimate you on your whats app number or via email.

Just checked.. You have added your number and email to receive the newsletter. Also, do share what else information or knowledge center you want us to build to help you with your trading. You can share it here or send me an email on support@justtrading.in.

Happy Learning!

Hi there,

Firstly I must thank you. You have provided so much information with all the necessary details.

As I am not new to trading (I trade in mostly cash equity market) and also know all about the call and put options, but that was all theoretical. Till today.

Today I traded for the first time in options. I Bought 2 lots of BANKNIFTY 19300 CE at Rs. 15 and settled it at Rs. 23. A small profit. But I must say that it rallied to Rs. 160 later on till 3.10. After that it finally settled at Rs. 150.(almost).

I thought I could have made a lot of money using just Rs. 232 (Rs. 116 per lot). Alongside I thought that if I had bought 50 lots and carried the same to Rs. 150 and squared off at around 3.10 pm what would have been the profits.

But I don’t get too excited, so I searched about some options values and how they are valued in reality. And really you have explained quite a bit more than expected detail. :-).

I just want to know one thing. When I looked in the span calculator, the 19300 CE scan risk was only Rs. 116. Why is that?

Am I not required to pay the total amount of Rs. 15 * 80 i.e. Rs. 1200. Or am I mistaken?

Is the Rs. 116 the amount I am required to pay while buying the call option. Or the full amount is required to buy the option?

If the full amount is required to buy the option, then what is this Rs. 116 i.e. the scan risk. And how to calculate the number of lots that can be purchased?

Regards

Mayank Singh

Hey Mayank

Seriously, It was really good reading your thought. Kicked me with a motivation punch to keep sharing more great useful ways for trading… Thanks!

I am really happy for you that you just started trading options today and had a profit. Congrats on that.. The party is due on you now! Also, that you traded and exited the trade as per your plan and not bothering where the market is heading. Keep following your rules and plan…

To take the benefit of the big moves and not letting profits run into losses, professional traders generally enter with multiple lots and exit some in the early moves and keep trailing the rest to keep following with the market moves.

Regarding your question for margin, you are right – as you are buying you are required to pay only 80×15 = 1200. I am unsure of what this Scan risk is about. It might be showing for leveraged position where you place stop losses along with the buying orders which requires you to pay less than the usual margin for intraday trades.

Share further details so that i can check and we can discuss further.

Anyways, Congratulations to you… I am really happy for you. Keep learning, maintain your calm and stay profitable… Hope to add another profitable trader in our list of JustTraders.

I wish you all the very best for future… Stay Connected.

Happy Trading!

Never Short Sell large quantity of the Options let it be Nifty ,Bank Nifty or Stock Options!!! Easy way to lose money

Deep out of the money Sell call or Sell Put ? Answer No… You will lose money …..

Example Short 50 Qty of Bank Nifty at the price of Rupees 50 , Price 50* Lot Size 40=one contract Rupees 2000 Credit * 50 Qty =100000 Credit …. even when the price comes down to 20 Rupees or 10 Rupees , when you wait for more price dip to happen. Market will not work on favour of you all times , one trade reverses.. Price moves to 10 Rupees to 150 in span of Minutes or gagup opening

think of your losses

Yes, its always sensible to trade safe and sound. One should develop and follow his trading rules well in advance and work under that framework only.

Thanks for the Useful Information. I have already fell into 2 of the above traps mentioned. I have learnt a lot from this article and this information will be very useful for trading.

Thanks Prashant. I can understand the pain of falling into stupid mistakes.

but actually MISTAKE IS NOT COMMITTING A MISTAKE RATHER STAYING WITH THE MISTAKE. So, its important not repeat it again.

Wish you a great trading career ahead.

Thanks, you r doing great job…keep it up, and god bless you.

Thanks Arjun…

the comment is quite late though, but what an amazing article! Nowhere on the internet I could find such a great write up on the options.

Thanks Amit…. Tried my best to share….

Now bank nifty nifty is around 24100 and if i want to sell 24600 put option with 23800 call option will it right trading or not and what i have exercise on weekly expiry

Thanks for the abiab Good & important information

Hello,

I really enjoyed your article,

i have one query,

Suppose:- If Bank Nifty is trading at 25000 and i write a call of 26000 option 3-4 days before expiry @ 200, And Bank Nifty settles in the money say around 26050 on expiry day… And i buy back the options before setllement say around 3pm. With keeping time value and STT costs effecting the current trading value of that option …. Will i incur loss? Or due to STT and time value the call option would trade very low say as around 10 or below ?

In simple words, i tend to ask is what will be the price of 26000 cal option in the last hour of expiry ,,, Will it be very low considering STT and time value ?

Thanks,

Sahil

Very good article. I really appreciate your efforts and thanks for providing such educative articles.

Nice and valuable info indeed.. specially for the BankNifty option traders ! But, recently there have been some implements or major changes in the charges by the exchange since last july 2018. Request you to pls update the same to us, if possible.. Thanks! Sanjib

Sure sanjib

Was stuck up in self things from months.. now will update the new info asap.

I bought bank nifty call option strike price 28600 expiry 23rd Aug 2018

at buying price of 33 X 920 qty.

Now the LTP is 6.10

on 21 aug 2018

22nd aug is holiday

what to do on 23rd Aug 2018 Please suggest.