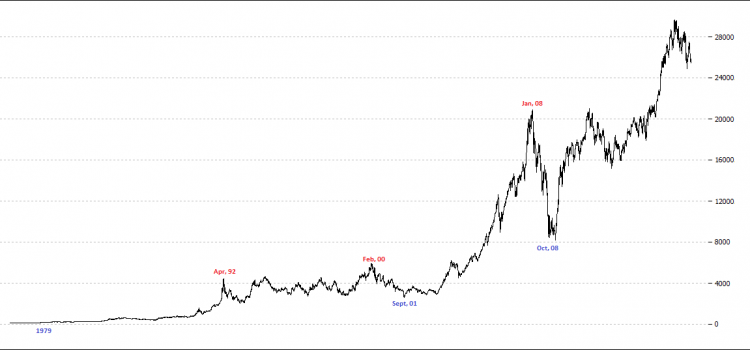

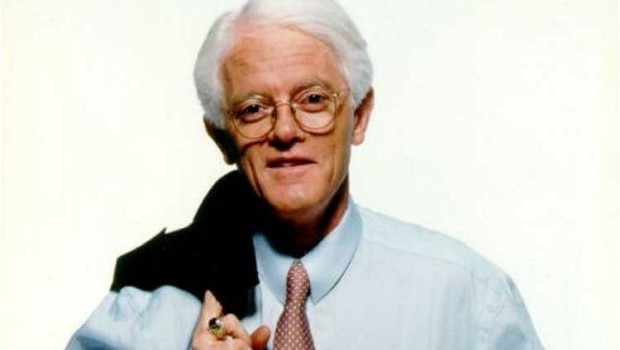

Rakesh Jhunjhunwala started trading the markets in 1985 at the age of 25 years right after completing his Charted Accountant (CA). He got the inclination to invest in the markets from his father who himself invest in the stocks. But from the

Trading According to Rakesh Jhunjhunwala