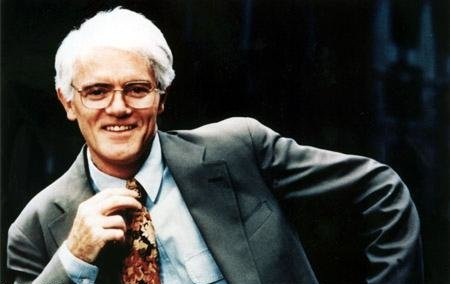

Peter Lynch, a stock investor and author of many stock investment books, is one of the most followed money manager in America. He was the head of the Magellan Fund till 1990 managing some $14 billion in assets.

Peter Lynch, a stock investor and author of many stock investment books, is one of the most followed money manager in America. He was the head of the Magellan Fund till 1990 managing some $14 billion in assets.

Lynch believes that everyday investors have an advantage of making money from stocks over wall street professionals because they are able to spot good investments in their day-to-day lives and their familiarity with the market place.

His First Ever Trade Actually Paid his Graduation Fees

While he was in college, he did some research on the freight industry and invested $1000 in a company called Flying Tiger. After his investment, the Vietnam War started and the stock started going up and he sold all the way up to $80 per share and made “tenbagger” return on the stock investment.

His Secret Success

Always let your winners run. Don’t cut the flowers to keep on watering weeds.

He says whenever you invest in many companies, some companies do well, some do okay while some will do fabulous. When some of them do well, add to them and that becomes one of the winning stock for you. In any business, you can be right only five or six times out of ten and not nine. So, you have to let the big ones make up for your mistakes.

He originated the word “MultiBagger”.

Famous Quotes By Peter Lynch

“Time is on your side when you own shares of superior companies. You can afford to be patient –even if you missed WalMart in the first 5 years, it was a great stock to own in the next 5 years. Time is against you when you own options.”

“Owning stocks is like having children — don’t get involved with more than you can handle.”

“The worst thing you can do is invest in companies you know nothing about. Unfortunately, buying stocks on ignorance is still a popular American pastime.”

“If you can follow only one bit of data, follow the earning – assuming the company in question has earnings. I subscribe to the crusty notion that sooner or later earnings make or break an investment in equities. What the stock price does today, tomorrow, or next week is only a distraction.”

“Equity mutual funds are the perfect solution for people who want to own stocks without doing their own research”

“You can find good reasons to scuttle your equities in every morning paper and on every broadcast of the nightly news.”

“People who want to know how stocks fared on any given day ask, “Where did the Dow close?” I’m more interested in how many stocks went up versus how many went down. These so-called advance/decline numbers paint a more realistic picture.”

“Gentlemen who prefer bonds don’t know what they’re missing.”

“If you hope to have more money tomorrow than you have today, you’ve got to put a chunk of your assets into stocks. Sooner or later, a portfolio of stocks or stock mutual funds will turn out to be a lot more valuable than a portfolio of bonds or money-market funds.”

Well Known For

Books

#1. One Up On Wall Street: How To Use What You Already Know To Make Money In the Market, By Peter Lynch

#2. Beating the Street, By Peter Lynch

#3. Learn to Earn: A Beginner’s Guide to the Basics of Investing and Business, By Peter Lynch

You can buy books from the Amazon links mentioned above.

For our US readers, Visit the link & Buy our Complete list of Trading & Investment Resources from US Amazon store.

Articles on Peter Lynch