Exchange-Traded Funds (ETFs) are increasingly finding favors in the global financial markets; Foreign Institutional Investors (FIIs) and retail investors are taking the ETFs route to participate in the different markets to achieve their investment goals.

As ETFs provide the most efficient and low cost ways for investors to construct a well-balanced and diversified portfolio, investors can gain exposure to nearly every corner of the invest-able universe, utilizing very simple and straightforward strategies. ETFs have generally changed the way investors invest in the markets now. ETFs having given a flexible way for investors (retail & Institutional) to gain exposure to various markets with great trading flexibility at lowest possible cost.

Below are the two ETFs which actually revolutionized the investors way of investing.

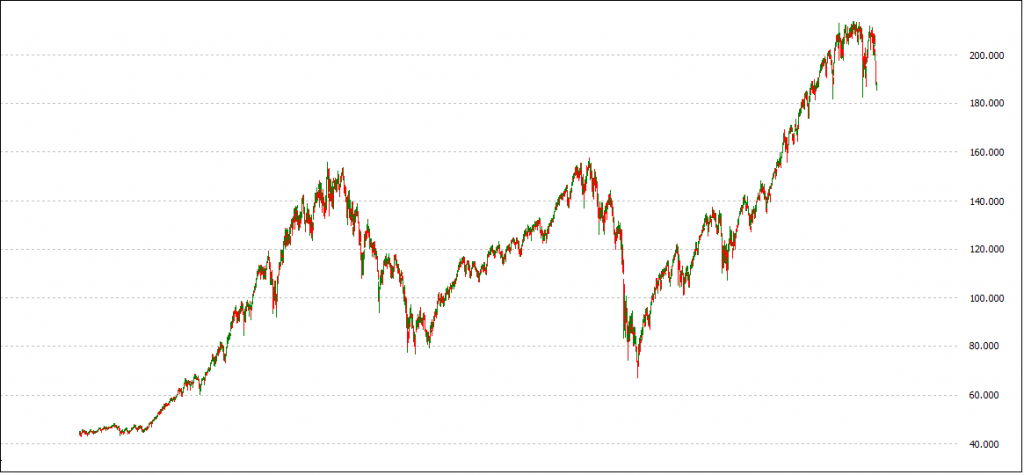

SPDR S&P 500 ETF (SPY)

SPY made its debut in 1993 and is now one of the largest and most popular investment vehicles in the world. With over $160 billion in assets and one of the most heavily-traded ETFs in the world (with trading of over 100 million shares in a single trading session), SPY is considered to be as the King Kong of the ETFs market.

SPY ETF seeks to replicate the performance of the USA S&P 500 Index. The S&P 500 is widely regarded as the best large-cap U.S. equities index which is based on top 500 leading companies of United States of America with assets approximately USD 2.2 trillion.

Therefore, the index measures the performance of the large capitalization sector of the U.S. equity market and utilizing a market-cap weighting structure, this index invests in the 500 largest U.S. firms like Apple (AAPL), Microsoft Corporation (MSFT), Exxon Mobil (XOM) and General Electric (GE).

The SPY fund is not only serve as a great tool for retail investors to build a long-term portfolio of large cap U.S. stocks, but is also an ideal market for active traders. So, any investor who wishes to invest in the growth of the US economy can invest via SPY fund which gives an investor exposure to all the different sectors from technology to healthcare to energy and real estate, etc.

The value of one share of the ETF is worth approximately 1/10 of the cash S&P 500’s current level.

Sector Weightage of SPY*

| Sector | Weightage (%) |

| Technology | 18 |

| Healthcare | 16 |

| Financial Services | 15 |

| Consumer Cyclical | 11 |

| Industrials | 11 |

| Consumer Defensive | 10 |

| Energy | 6 |

| Communication Services | 4 |

| Utilities | 3 |

| Basic Materials | 3 |

| Realestate | 2 |

* As on Jan 2016

Top 10 Holdings of SPY*

| Company | Symbol | % Assets |

| Apple Inc. | AAPL | 3.29 |

| Microsoft Corporation | MSFT | 2.52 |

| Exxon Mobil Corporation Common | XOM | 1.95 |

| General Electric Company Common | GE | 1.63 |

| Johnson & Johnson Common Stock | JNJ | 1.62 |

| Berkshire Hathaway Inc Class B | BRK.B | 1.43 |

| Wells Fargo & Company Common St | WFC | 1.4 |

| Amazon.com, Inc. | AMZN | 1.35 |

| Facebook, Inc. | FB | 1.33 |

| JP Morgan Chase & Co. Common St | JPM | 1.27 |

* As on Jan 14th, 2016

Historial Timeline (Since 1993)

Similarly for investors, who wishes to get invest in Indian markets via ETFs can do so by investing in Niftybees and Juniorbees where both of these combined together give you exposure to Top 100 capitalized companies of Indian Economy.

SPDR Gold Shares (GLD)

SPDR GLD offer investors an innovative, secure and cost efficient way to invest in the gold market. GLD which is a Gold ETF seeks to replicate the spot price of gold bullion. The spot price for gold bullion is determined by market forces in the 24-hour global over-the-counter (OTC) market for gold. GLD made gold affordable for numerous retail investors to invest in and is the largest physically backed gold exchange traded fund (ETF) in the world and one amongst the most liquid ETFs in the world.

GLD is certainly an efficient tool for adding gold to a portfolio and more commonly used by hedgers by establishing the short term positions to hedge against equity market volatility, dollar weakness, or inflation or by investors to get long term exposure to the gold market without actually going through the stress of owning physical gold.

The fund has a total of 657 tonnes of Gold and has a asset size of $22 Billion.

GLD is traded in various stock exchange including New York Stock Exchange, Singapore Stock Exchange, Tokyo Stock Exchange, The Stock Exchange of Hong Kong and the Mexican Stock Exchange (BMV).

Historical Timeline (Since 2004)

Also, in case of Indian Investors, they can participate in Indian Gold market by investing through GoldBees ETF.

Investors can buy and sell ETFs just like stocks through their stock brokerage account and can also employ traditional stock trading techniques; including stop orders, limit orders, margin purchases, and short sales using ETFs. They are listed on major World Stock Exchanges.

KNOWLEDGE IS POWER!