Its always important to understand what derives the movement of the underlying specially when you are dealing with a highly volatile instrument like Bank Nifty Futures- then surely there is no escape to it.

Then you need to read this What is BankNifty Index (CNX Bank Index) & How to trade BankNifty?

First and foremost thing that we have to do is to learn and understand all about the BankNifty Index & its futures contract.

But if you are not the beginner then surely you can escape this.

What is Bank Nifty Index?

Bank Nifty or CNX Bank Index or more preferably known as Bank Nifty is India`s second most followed economic indicator after Nifty Index.

Bank Nifty Index is a broad-based benchmark that captures the performance of Indian Banks in India and is diversified across 12 banking stocks (private & public) listed on the National Stock Exchange (NSE). These top 12 banks represents approximately 93.3% of the free float market capitalization of the Banking Sector in India as on Mar 31, 2016.

This means that out of all the banking stocks listed on NSE, 93.3% of the banking space are represented only by these top 12 Bank Stocks.

The Bank Nifty Index composition do not remains same always as the stocks which do not perform and inturn leads to a fall in their market capitalization are replaced by other banks which performs and have their market cap more than these under-performers.

Few years ago, the Bank Nifty Index had a big weight-age of the public sector banks which were later replaced by the private performing banks like HDFC, Axis, Kotak, Yes Bank, Indus Ind, etc.

Even today out of 12 Banks in Bank Nifty index only 5 are public banks which captures only 13% of the total market capitalization as on Mar 31, 2016.

Also, at present out of these 12 banks, top 5 banks has 83% weight-age out of which only one is psu bank i.e. State bank of India.

So, the performance and the price movement of Bank Nifty or inturn Bank Nifty Futures is dependent on these Top 5-6 Stocks only as rest of them do not have significant weightage.

| Company’s Name | Weight (%) As on Apr 29th, 2016 |

| HDFC Bank | 32.41% |

| ICICI Bank | 20.01% |

| Axis Bank | 11.44% |

| Kotak Mahindra Bank | 10.70% |

| State Bank of India | 8.53% |

| IndusInd Bank | 7.43% |

| Yes Bank | 4.49% |

| Bank of Baroda | 2.17% |

| Federal Bank Ltd | 1.15% |

| Punjab National Bank | 0.94% |

To get a deep understanding of the Bank Nifty Index, please visit What is BankNifty Index (CNX Bank Nifty Index) & How to trade BankNifty?

Now comes the center of topic for this article

What is Bank Nifty Future?

Bank Nifty Future is a derivative contract traded on National Stock Exchange of India (NSE) whose underlying is Bank Nifty Index. This means that Bank Nifty futures will derive its value from the BankNifty index which in turn is dependent upon the movement of top banking stocks in the index.

To clear out here, there is no trading happens in the bank nifty index and all of the price movement are dependent on these 12 banks while on the other hand, if anyone wishes to trade bank nifty then he/she has to do so through bank nifty futures.

Bank Nifty Future is the second most trade-able and liquid equity index future with total traded contracts of 13,11,51,460, and turnover of Rs. 56,36,150.91 Crores ($ 900.48 Billion) in 2014-15 after Nifty futures with total contracts of 137,64,22,836, and turnover of Rs. 3,83,80,182.07 Crores ($ 6,131.92 Billion) in 2014-15.

Future contract on BankNifty Index was launched on June 13th, 2005.

| Trading Volume in F&O Segment of NSE (2014-15) | ||||

| Products | Underlying | No. of Contracts | Turnover | |

| _____________________________ | ||||

| (Rs. Crores) | US $ bn | |||

| NIFTY Futures | NIFTY | 137,64,22,836 | 3,83,80,182.07 | 6,131.92 |

| BANKNIFTY Futures | BANKNIFTY | 13,11,51,460 | 56,36,150.91 | 900.48 |

This volume does not include the one happened in Bank Nifty or Nifty Options Market.

Let`s talk a bit about options here..

Getting into real trading is complicated & specially when it is trading options market. As a new trader, it is important to know wide scopes and opportunity in trading and make your trading task more simple. Visit Part VII – Getting Started With Trading – How to Trade Options? to get into the basic understanding of the options market.

If you are unfamiliar with options trading, then let us state here that options contract is the right, but not the obligation, to buy or sell a particular futures contract at a specific price (strike price) on or before certain expiration date.

And if you are familiar with the basics You might have read and heard million number of times that the risk with buying options is limited to the price of the premium paid. Right?

But Do You Know that we can even get trapped and lose more than the value of the premium even when you are buying options and what if I tell you that you can incur loss even after having a profitable trade.

Shocked…. huh…?

Then you really need to read the article below which talks about the Trap with Trading Options that You Must have Never Heard Before..

Read Warning: 5 Traps To Avoid When Trading Bank Nifty Weekly Options on the Expiry Day to know how the theoretical adage of limited loss when buying options is not completely true in all of the cases and how to avoid one of the biggest trap of what we call as a “Contract Shock”.

The best recipe for you to learn how you too can make money from trading the bank nifty weekly options is below

Read to know how to big professional traders make sure consistent money from trading bank nifty weekly options by writing the options and putting the benefit of the time value decay in their favor. Also, how they use weekly bank nifty options to buy the markets instead of taking positions in the bank nifty futures… How to Turn Bank Nifty Weekly Options into a Regular Income-Driving Machine?

Lets come back to Bank Nifty Futures…

Sorry to divert it and take this interim break from futures and get into options.

But it was really important….. Trust me

Contract Specifications of Bank Nifty Futures

Ticker Symbol

BankNifty

Lot Size

40 Units

Contract Value

Rs. 7,60,000 (19,000 x 40) (Index Price X Lot Size)

Total Margin

Rs. 62,000 (Approx. as on Oct 07, 2016)

Tick Size

.05 (Rs. 2 per Tick Size)

Price Fluctuation

1 index point = Rs. 40

Trading Hours

Monday – Friday : 9:15AM – 3:30PM

Expiry Date

Last Thursday of the contract month

Trading Cycle

3-month trading cycle – the near month, the next month and the far month.

Daily Settlement Price

Last half hour’s weighted average price

Final Settlement Price

Final settlement price for a BankNifty futures contract shall be the closing price of the underlying index (CNX Bank Index) in the Capital Market segment of NSE on the last Thursday of the contract month.

Final Settlement Procedure

Final settlement will be Cash settled in INR based on final settlement price.

Settlement

All the Future Contracts are Cash settled in INR.

To understand in detail all the key terms or terminologies used and how a futures trade work in the real market, Read Article: Part VI – Getting Started With Trading : How to trade Futures Market?

Want to be a full-time trader? But this is the first time you are dipping your shoes in the trading world. Then do spend some time reading the article and other links shared with in to help you getting started with understanding all what you always wanted to know about making money from trading or investing in India.

Here are eight steps to follow to start making money from trading. How to Make Money from Trading in Indian Stock Market?

Trading Plan

Planning is crucial for the success of any business. So to get started with trading you need a proper plan, a plan to design a road map to follow to achieve you trading goals.

“Every aspiring trader should emphasize the importance of developing a System of Trading by framing up a trading plan with a long term trading objective which can help them to stay in the markets and protects their capital forever, a system that helps make consistent profits from the market and restrain the trader from making similar mistakes again and again and more importantly a trading system that gives a trader A REASON TO TRADE.”

Read Article – Getting Started with Trading : Importance of Developing a Trading Plan

Capital Required to Trade Bank Nifty Futures

Bank Nifty futures has a lot size of 40 units per contract for which an initial margin of Rs. 62000 is required which is approximately 8.15% of the total contract value of Rs. 7,60,000 (40 x 19000) on Oct 7th, 2016 i.e. we have to deposit an initial margin of approx Rs. 62,000 to initiate a long or short position in bank nifty future and carry it till the expiry of the Contract i.e. Oct 27th, 2016 (provided we have a ledger balance to take care of any daily mark to market losses (M-M Losses)), if any.

There are two options available for future traders to meet out the margin requirement for the contract obligation.

- Cash Margin – Bank Nifty traders are required to deposit approx Rs. 62,000 for initial margin in cash to their broker. By cash here, we mean a clear credit balance in the Ledger of the trading account with the broker.

- Stocks as Collateral – To meet out the initial margins of the future contract, stocks can be used as a collateral with the broker to take the day position or even for the positional.

By Stocks as Collateral, we mean that if you are holding some stocks in your DP account, then same can be utilized as the security margin, provided such stocks are under approved list and the total value of the stocks (After haircut) is enough to meet out the margin requirement of Rs. 62,000.

So, if you are holding A-category stock (Eg – Dr. Reddy) in your DP then 80-90% of the value of the stock can be used as a security margin. So, there is no need to deposit the cash margin or a clear ledger balance.

For traders, who don’t have any holding in their DP, and are maintaining a clear ledger balance in their trading account can buy Liquid Bees of the same value of Rs. 62,000 (i.e. 62 units) which can be used as a collateral for the margin money and same can fetch you approx 5-6% return in a year.

In year 2014-15, Liquid Bees has generated a dividend return of 5.712%. For more. visit Dividend Calculator of LiquidBees.

So, traders who are planning to use the DP Stock or Liquid Bees as a collateral for the margin security are required to take care of any mark to market losses, if any.

So if you have a loss in your first trading loss of say Rs. 2000, then you have to pay your broker Rs. 2000 or sell stock or liquid of the same value.

But on the other side, if you have your first trading profit of say Rs. 3000, then this amount will be credited to your ledger and now you have a clear balance of Rs. 3000 to take care of any mark to market losses if any in the future.

Such a strategy is best suited for day traders as they need not to maintain extra margin for trading.

Suppose, we have deposited a total capital of Rs. 70,000 for trading purposes then Rs. 62,000 will be debited in the ledger by the broker if we will carry the position overnight.

Day Traders can trade BankNifty futures by getting intraday exposure provided by brokers by having only 1/3 to 1/2 margins of the actual required i.e. Rs. 20,000 – 31,000 in their ledger thus over-leveraging the leveraged vehicle but no position can be carried overnight or against the stocks holding in their DP as discussed above. (Not advisable for Beginners)

Number of Contracts to trade?

Beginners should only start trading with one lot size (i.e. 40 units) to first understand the mechanism of the market and know how well their trading strategies performs and once they start to make consistent profits from the market and their capital starts to grow then only they should increase the lot size to trade.

So, if you are able to double your capital and had a margin requirement fulfilled for another lot from your profits rather than adding up a fresh capital, then add with one more lot size and start trading with 80 units (i.e. 2 lots).

This basically proves the fact that you are learning the trading business and now you are ready to take more responsibility for trading bigger contract size than before.

Risk Management

Capital protection should be the utmost priority for any trader especially when you are trading a high leveraged and volatile product like BankNifty Futures.

So, every trader should develop a risk management mechanism which can help to save their seed capital and protect the profits too. Always protect your trade by using stop losses whenever you buy or sell short BankNifty Futures.

Traders should not ever risk more than 5% of their capital to any single trade i.e. a maximum stop loss of Rs. 3100 (62000 x 5%) or 77 points. Stop loss could also be set fixed according to risk profile of the trader.

We usually take smaller risk of 20-40 points (i.e. Rs. 800-1600) on any single trade be it day trade or positional by entering on smaller charts to take low risk trades. Then market will have to prove us wrong atleast 38 times to knock us out of his capital of Rs. 62000.

So, do not enter the trade if you cannot decide where to place your stop losses. Stop losses are your protective tool and will always keep you alive.

This will generally help you to achieve a higher end of Risk : Reward ratio by taking more points when you are right and giving our small whenever you are wrong. Even a accuracy of 50% will ensure that you are profitable at the end of the year or month.

Read Article: How to use stop losses to reduce your risk? Coming Soon.

Read the article 12 Step-wise Trading Rules for New Traders to be Safe in the Market to frame-up and understand the most important rules and aspects of trading for the survival and growth of a trader:-

#1. Never being too Anxious to Start Big Early

#2. Knowing Who You Are – A Trader or An Investor or An InvesTrader?

#3. How to Choose & Know Your Market to Trade?

#4. Reasons & Facts to Trade

#5. How Not to Screw With the Market – How to Follow the Trend of the Market?

#6. Know Where to Place Stop losses to Protect Your Capital & Profits?

#7. Evaluating Risk to Reward of Each Trade

#8. Never Changing Your Stop Losses with Good Reasons

#9. How to Trail Stop losses to Protect Capital & Profits?

#10. Knowing the Reasons to Exit a Trade

#11. Never OverTrading

#12. How not to have too many Open Positions at any time?

What returns to expect from Trading Bank Nifty Futures?

It depends on the expectation of the traders. But the easiest way is to target it according to your stop loss i.e. by calculating return: risk. Beginners should focus and target on achieving 2:1 trades and as soon as your experience and market knowledge improves you can target the higher side of the Return: Risk scheme to 3:1 then 4:1 etc.

This means that for every day trade, if you are taking a stop loss of 30 point, then target your profits of atleast 60 points.

But as your trading experience and knowledge starts to grow, you can strive to achieve a differnet trading style to take big trades of 300-500 points on BankNifty futures with small risks of 20-40 points.

As we are trading a 10:1 leverage product, so any 1% move in BankNifty will be a 10% return on your capital.

The idea here is to strive and achieve the higher end of the Risk : Reward with more trading experience and knowledge of the market so that we can make our trading on some fronts were we have the ability to make big profits from a single trade with less managed or even no risk at all.

Read Article: Where and how to protect and book your profits? Coming Soon…

Time Frame to Trade Bank Nifty Futures (Whether Day Trade or Positional Trade)

Its actually both. Try to know a market very well that it starts to talk about it by itself what it us going to do in the coming hour, or day or week or the whole month or year.

So always start with big charts because small moves are the part of the big moves. As big players prepare and trade for big moves, they undergo preparation for the few days to weeks or months as someone who is managing some $50 billion will not be entering and exiting the market very soon.

It takes time for them to accumulate and distribute that is why when a trend starts it stays for long – For Days to Weeks to Months or Even Years.

It s always important to follow the big players.. They are the one who knows more than us or are an expert in their business, or we should say Market Knows More Than Us. So, Always Follow The Market.

When market is showing weakness – Go With It. Don’t start feeling bullish till it shows you signs of buying or bullishness.

Always start with analyzing and finding trades on the big time frames (Daily or Weekly Chart) then get into the intraday charts (continuous) 5 min, 15 min or 30 min and keep a close tab on the market movement to get a closer entry and with small risk.

Then as soon as you enter the market and you have placed in your stop loss, then again go back to the bigger time frame and see how well the market is performing according to your expectations.

Avoid the trap of thinking that trading everyday is the key to success in this business. It is actually a myth. And the only reason why 95% of new traders incur losses and fail in trading. Why Trading Every Day is a Silly Plan (And What to Do Instead)

My style is to watch EOD, Weekly and Intra-day charts all together. Our Minute and EOD charts are always in-sync with each other. By minute chart we don’t mean we are just watching the chart for a day, rather minute chart for the whole month or two or more.

As EOD don’t tells us what the market has done within, so to get a feel of it, we try to get in. So any setup on EOD charts or big 15min charts led us to enter the market on small charts and whenever we are not able to get a point what the market doing, we stick to intra day charts and trade for the day. And scalp the market..

A trader needs to have two different brains working simultaneously to get in deep of the intraday chart to understand whether the markets are showing patterns of selling as indicated by the bigger charts or when the markets are not doing so then evaluating whether to trade with the short term current patterns or wait for these patterns to get in sync with the bigger time frames.

So for day trading it would be for 100-400 points as market has an Average Daily Range of 400 points. So on an average, we can get 400 points any day.

Maintain minute charts on software like NinjaTrader or Amibroker or Metastock and analyse the past market movements to get an understanding of market movements, and its habits. Get Min data for banknifty futures from here.

Those who are working or don’t have time to watch the Markets intraday, can maintain a EOD chart on the software.

Visit the link to download BankNifty Index & Index Futures Data (EOD OHLC Data – Open, High, Low & Close).

When to Trade Positional & When to Trade Intraday?

A dilemma every new Bank Nifty Futures Trader have..

There are times when the markets are forming big setups and patterns on big charts (EOD Charts) so it becomes important for traders trade these big moves on big charts to earn big profits.

These situations necessarily requires traders to look the market in bigger context and keep entering the markets in bigger way by keep on pyramiding with the favorable moves.

So it becomes important to know why you are trading it? Like we have a rule while trading stocks that we never let our trading calls becomes our long term investments. Similarly we don`t have to let our day trade become our positional trade because we are fearful in booking our loss in intraday.

Therefore, it is always important to know whether you are planning to enter for intraday or positional?

Read the story of inspiration of a young dreamer who started back in 1985 at the age of 25 years with limited capital of only Rs. 5000 but with big dreams, who spent day and night to understand the rules of the games, whose courage and dedication made him a billionaire & surely one of the most followed and respected investor / trader in India & across the globe.

The one who broke all the fixed rules of trading and laid down the foundations for others to follow.

Rakesh Jhunjhunwala – The Inspiring Story & Philosophy of India`s Most Successful InvesTrader

I am not a Day Trader

Some of you might be thinking this while reading the above thoughts but really intraday charts are very important because they actually help us in managing our risk. We cannot take up a risk of 500 points on Bank Nifty futures when trading with say 800 units (20 lots) or 1600 units (40 lots). This will be a risk of Rs. 4,00,000 or Rs. 8,00,000 on a single trade.

So, whenever we are planning to achieve on trading the big lot size of the market, the only way to stay in the market is by managing the risk. So, the idea is to take risk of say average 40 points on 800 units or 1600 units and take risk of Rs. 32,000 or Rs. 64,000 by entering the markets on the smaller charts (1 Min, 5 Min or 15 Min) by having a big time view on the bigger time frames.

Even the risk stated here can be further reduced and later turned to “Risk-Free Trade” by following the rule of pyramiding by entering the trade in different tranches whenever the earlier position shows you a profit.

Such a strategy can help you to trade any number of lots or quantity to attain biggest profits possible at No Loss.

Pyramiding Rule for Entering & Exiting the Market – Coming Soon

Why Not Trade Nifty Futures?

As Nifty has a small Average Daily Range as compared to Bank Nifty. So it reduces the probability of big profit as compared to the one possible in Bank Nifty. As we are planning to manage our risk by using small stop losses and protecting our capital. Then its OK to trade high beta index like Bank Nifty.

Beginners can start with Nifty Futures then later supplement your study to Bank Nifty Futures.

Know Your Market

Deciding the parameters to trade is one side of the game and getting in and applying into the market successfully is the other and yes more important one. So, before gushing in and entering the trading arena, the first and foremost thing that a trader should do is “Know Your Market”.

Back-test each technical tool you know to the bank nifty futures market and see what really works for you. Try to filter out the tools which you feel fits under your belt like retracement, double or triple tops or bottoms, etc.

The idea here is to be an expert in one market. So, its better to know more about a market then knowing some about many markets. So, start analyzing the markets on bigger as well as smaller charts and try to understand the habits and characteristics of BankNifty Futures.

Knowing a market or a stock in deep will give the trader/investor a positive edge that will help him to manage his risk wisely, be safe and remain in the market forever. Ask yourself how can you make it big trading & investing stocks or markets you know nothing about?

Read Article: Part V – Getting Started With Trading – Know Your Market

Control Your Emotions

Don’t trade when the markets are violent. It always make sense for traders (specially new ones) toto enter into a trade when the markets are silent and exit when the markers becomes very violent.

Trading volatile marketsmarkets surely gives a trader an excitement and eagerness to make big profits but even many professional traders avoid trading when markets are very volatile and specially on some news days or events.

Excitement within the traders even force them to trade the violent marketsmarkets by entering the long trades when the markets are having a big blow up and forgetting all their money management rules of trading with close stop losses which surely forces them to enter the market at wrong time and at wrong prices and incur big losses.

Human element is a very important aspect in trading as market consists only of human beings. They are the one who regulate and trades in the market.

So, markets are surely governed by the human characteristics and behaviors and the factors which influence the behavior and psychology of people also influence the markets. To be successful in a human managed and governed business, its a prerequisite to understand the elements which controls and govern our behavior.

Trading decisions which are based on any unknown reason will lead to only one result – Losses & Yes More Big Losses.

A well defined trading plan which is according to your trading style will clearly state your plans to enter and exit a market, rules to protect your capital & profits, and number of trades you are restricted to take and many more.

Trading journey is all about transforming yourself from an inspiring trader to a “Great Trader”.

Any successful trader learns how to control and reduce the element which will force them to commit mistakes and prevent them from making money and being successful. And one of the biggest among all those is Human weaknesses.

Traders should prioritize to understand and learn more about human behavior and psychology that can help prevent them committing similar mistakes again and again otherwise people with snatch your money away from you and believe me they won`t feel bad at all.

Read How to Overcome Biggest Human Mistakes & Weaknesses in Trading? to avoid small human mistakes in trading.

#1 – Being Too Optimist Or Too Pessimistic

#2 – Trading on Hope & Fear

#3 – I Know It All

#4 – Quick Rich Philosophy

#5 – Its Not My Mistake At All

Trading Objective

Our ultimate objective of trading Bank Nifty Futures is to develop the trading skills that can help us be consistent in your analysis, trade implementation, execution, staying in the trade and exiting the trade with big profits in hand. So develop the real inside to trade pre-determined setups or patterns and places to get some confirmed points with big volumes and lower risk edge.

The objective is to start with Trading with one lot size of bank nifty futures to learn the mechanism and reach to the higher end of the Trading volumes of 800 or 1600 units or even more than that.

So, start with Trading one lot, make consistent profits, double your margin money and keep on increasing your lot size to trade without adding any fresh capital. So, the initial objective of any new trader trading with one lot size should be to earn Rs. 62,000 in profits so that you can achieve trading two lot size without putting any new capital.

So, to achieve this objective, traders need to achieve a profit of approx. 1550 points to earn Rs. 62000 in profits and reach to target of trading two lot size.

Once you achieve trading two lot size of BankNifty futures, we need to get only 775 points in profits to achieve the target of reaching three lot size and then 516 points to earn 62000 profits with 120 units and then 387 points with four lot size to earn Rs. 62,000.

Suppose with trading 1 lot, you have developed your trading skill and getting consistently on an average 100 points in a trade i.e. making Rs.3000 per trade then you need not to make wide changes in your trading rules but what you need is just increase the lot size to trade (from the profits you make) and reach the higher edge of trading with say 4 lots and making some Rs. 16000 per trade.

Or even if you starts to make say 50 points per trade with 4 lot size, the. It will be Rs. 8000 per trade.

Double reward and that too with half efforts.

How a 14 year old kid Transformed Himself to become the Biggest Trader of the Wall Street?

Taxation of Futures Trading in India

If you are trading futures & options on a recognized stock exchange, then you have to declare yourself as a Trader for taxation and your trading will be considered to be as a business activity & will be taxed as Business Income.

As per our tax rules in India, any income from trading Futures & Options (F&O) (Equity, Commodity or Currency) is considered as Non-Speculative Business Income.

These income must be added to your total income and taxed according to your new respective tax slab.

As these incomes are considered as business income, so you can offset it to reduce the taxable income from Speculative/Business Income with business expenses you incur to earn it like Brokerage Charges, Internet Charges, Advisory Fees, Research Reports, Computer & electronics Depreciation, Electricity Bill, Telephone, Software & Data Feed Charges, Newspaper, Books, STT and rent, etc.

Any loss arising from trading F&O will be considered as Non Speculative Business Loss and can be offset against any other business income including speculative business income (Income from Day Trading) except salary in the same year.

The balance, if any, can be carried forward and set off only against non-speculative business income within eight assessment years immediately succeeding the assessment year in which the loss was first computed.

We traders are obligated under the income tax law to file their returns before July 31st and it is September 30th for companies.

All the taxation rules for an trader is illustrated and detailed in Section – II of the article Part VIII – Getting Started With Trading – Tax Guide for Traders in India.

Also, Read Income from Equity Trading – Business Income or Capital Gains? on how you can be a Trader & an Investor at the same time.

Day Trading Bank Nifty Futures

Average Daily Price Range

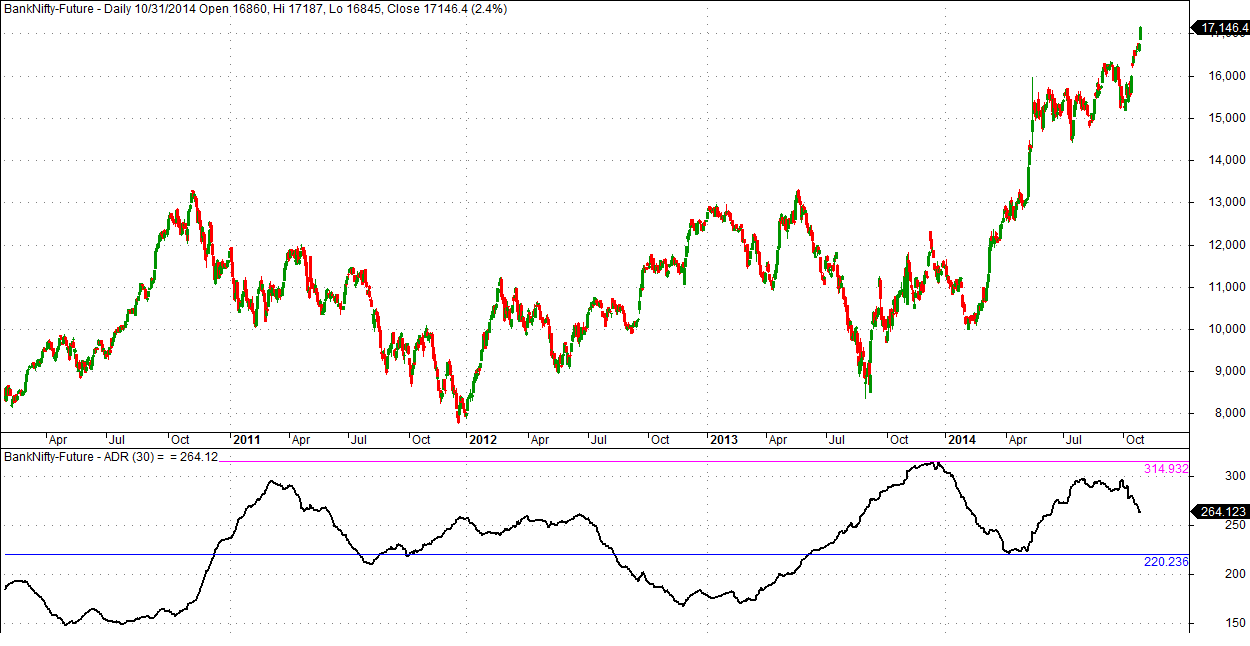

Chart 1 – Bank Nifty Future (Continuous) Daily Chart with Average Daily Price Range

Since 2014, BankNifty Future is trading with a average daily range of 220 to 315 points.

This means that any day trader who is smart enough to understand and enter the market at the days` low price can expect a profit of at-least 220 point i.e., Rs. 88000 (40 x 220).

Similarly, on the other hand, the trader who is misfortune to buy the market at the top of the day and don`t follow the risk management mechanism (Stop losses) can expect a minimum loss of Rs. 8,800 any day.

Avoid the trap of thinking that trading everyday is the key to success in this business. It is actually a myth. And the only reason why 95% of new traders incur losses and fail in trading. Why Trading Every Day is a Silly Plan (And What to Do Instead)

Also, if you have been trading futures market, then its important to note that trading is all about planning and following your trading rules strictly and nothing else. So, preparation is generally the key for the success of most professional traders and for traders it all about understanding the importance of designing a trading plan and implementing it.

They are no different than us, but just they remain stick to what they planned and follow it blindly. There are 12 Step-wise Trading Rules for New Traders to be Safe in the Market which can help you stay in the market forever and be successful.

And there is no better way than to learn from the Legends themselves. Refer to the below books, movies and other recommended books on investing and trading to help you learn how some of the successful traders or investors deal with their losing steak, recovered from the bad days, make a mark from this business and made millions.

# Hedge Fund Market Wizards: How Winning Traders Win, By Jack D. Schwager

# Reminiscences of a Stock Operator By Edwin Lefevre

Director: Adam Mckay

# Wall Street – Money Never Sleeps

Director: Oliver Stone

Advice for Beginners

- Start with paper trading to get the understanding of the futures market and developing of the trading strategies and plan.

- Do not be anxious to trade big in the beginning.

Charting Data Required

EOD Data

Visit our NSE EOD Data Resource Center to download the BankNifty Spot & Futures EOD (OHLC) Continuous data.

Intraday Data for BankNifty Futures

Day traders will require intraday data to trade BankNifty futures. Minimum time frame required is one minute data.

Visit our NSE Intraday Data Resource Center to download BankNifty Futures Intraday data.

For New Traders, Here are a couple of articles to help you learn more about Futures Trading, Important Aspects of Trading, Taxation of Futures Trading in India & get inspirations from Trading Legends.

Part VI – Getting Started With Trading – How to Trade Futures Market?

What is BankNifty Index (CNX Bank Nifty Index) & How to trade BankNifty?

Top Ten Selected Quotes & Lessons From The Trading Legends

Part VIII – Getting Started With Trading – Tax Guide for Traders in India

KNOWLEDGE IS POWER!

great work,,,Really enjoyed reading. Thanks 🙂

Well detailed & yes simple to understand.

It really helped me a lot to prepare for my trading. Rules on managing risk and starting small really make sense for a trader like me.

Feels like written by a trader himself.

Thanks for sharing great ideas. Waiting for more awesome work..

Really a very useful matter for beginners…thanks for sharing.

topic is very helpful for beginners like me,thanks 4 promptly sharing best ideas,also want to know how to adopting(best) indicators for intraday trading ,sharing ideas will be appretiated,thanks again……….

Cleared a lot of doubts from my mind. I am trading from last few Years but at the end I am always on the losing side as i kept on losing what I make every time.

Also.. Awesome article on preparing a Trading Plan.. please share some ideas and ways for trade entries..

Keep up the great work. Really Inspiring.

Thanks.

Thanks Sumit for your appreciating thoughts.. Yes, maintaining a great balance between the reward to risk ensures survival and growth for any trader. Will surely share some of the setups we use for Entering long or short positions..

Inspiring comments always motivate us to share more amazing and inspiring thoughts.. Thanks @Sumit for sharing the word.

Amazing article. Keep up the good work.

Thanks SriKanth for your positive thoughts. Motivating words always inspire us to write great content.

Also, thanks for taking time for commenting.

JustTrading.in

Great please read for beginner…helped me a lot

Dear Veeru

Thanks a lot for your wonderful & motivating thoughts. We are really happy to hear the positive outcomes of our heart full efforts & initiative to help traders across to be independent and learn the skill of trading.

Also, we are very happy to know your interest and willingness to learn about the markets and the opportunities available.

As you are a beginner to the trading world, we recommend you to please take some time and read the below articles to help you learn the importance of formulating your trading plan & strategies, rules to be safe in the market forever to achieve your trading goals :-

– Part IV – Getting Started With Trading – Importance of Developing a Trading Plan

– 12 Step-wise Trading Rules for New Traders to be Safe in the Market

– Have you ever Wondered why Starting Small always Work in Trading Business?

Please let us know if you have any further questions; We are more than happy to help.

Thanks

JustTrading.in

Hi there,

I just stumbled upon your website. I am NOT trading the Bank Nifty futures currently. I was wondering if you could clarify my confusion. In your article “How to Trade Bank Nifty Futures”, you mention that one index point move is equal to Rs.30 profit/loss. So that means if Bank Nifty moves from 15000 to 15050 (a total of 50 index point move), the total profit/loss will be 50*30: Rs. 1500 on one trading lot.

But when I plug in the same values in my broker’s brokerage calculator,

I get a profit of Rs 43 (after brokerage and taxes of course). My broker is Zerodha.

Could you please clarify my confusion?

Thanks for your help.

Nick

Dear Nick

Thanks a lot for writing in.

Regarding your question on Bank Nifty Future. The present lot size of Bank Nifty Future is 30 units which means any trader who wishes to trade in Bank Nifty Future has to take position of minimum or in multiples of 30 units.

Let`s take the example as you mentioned. if Bank Nifty future is currently trading at price level of 15000. So, you have to take a minimum position size of Rs. 15000 x 30 i.e. Rs. 4,50,000. If you purchased Bank Nifty Future @ 15000 and sold @ 15050 then you make profit of 50 x 30 = Rs. 1500.

So, as per your question regarding in your broker`s brokerage calculator, you have to change the quantity to 30 instead of 1. That will give you correct picture of the profit & loss situation.

To extend it further, Nifty Future has a lot size of 75 units which means you have to take minimum position of 75 units or in multiples of 75 (75 / 150 / 225) units for 1 lot / 2 lot or 3 lot size. So, any one point change in Nifty future will give you a profit or loss of Rs. 75. So, when you are calculating for Nifty Future in your broker`s brokerage calculator, put quantity as 75 units instead of 1.

Also, when you are trading stocks or equities you can buy or sell a minimum of one unit but when you are trading futures market, there are minimum lot size where the minimum contract value of any futures contract (Index or Stock Futures) should not be less than Rs. 5 lakhs.

You can refer to the articles below to get answers to your questions. These will give you a better understanding on Trading Index Futures, and learn more about money management and trade management rules.

– Part VI – Getting Started With Trading – How to Trade Futures Market?

– What is BankNifty Index (CNX Bank Nifty Index) & How to trade BankNifty?

– What is Nifty 50 Index (Nifty) & How to Trade Nifty?

– 12 Step-wise Trading Rules for New Traders to be Safe in the Market

Please let us know if you have any further questions; We are more than happy to help.

Thanks

JustTrading.in

Hi Thr,

First of all i’d like to congrates the team for this wonderfull,motivating initiative Justtrading.in,

I want to thank author for this inspiring & guiding article for me and for millions others like me.

Sir,my name is amit,a research student,i want to learn trading options but now at current scenario of hiked lot size,will it b a smart choice for person with limited money in hands as the mobile shop person in this article https://tradeacademy.in/the-good-the-bad-the-ugly-of-sebis-fo-contract-size-hike-a-traders-view/ what are the alternative we have now to get in to FnO segment ? Pl Guide.

Thanks

Sincerly

AMIT

Dear Amit

Thanks a lot for taking you time for sending us your wonderful and motivating thoughts. We are really happy to hear the positive outcomes of our heart full efforts and initiative to help traders across to be independent and learn the skill of trading.

Also, we are very happy to know your interest and willingness to learn about the markets and the opportunities available.

Please bear with us for this big reply.

Regarding your question for a trader with limited resources, We believe that “Big Businesses are big because of Big Ideas not Big Money” and we have a strong belief that “ALL GREAT THINGS START SMALL”.

Also, being a trader myself, I strive to learn and improve my market knowledge & understanding so that I can achieve higher end of Reward to Risk.

The idea here is to be good with your market research so that you can enter the market with very small or less risk. So, for this hiked lot size, the trader has to prepare a trading plan with strict money management rules which can help him manage and risk small part of his capital on every trade.

And as the article Have you ever Wondered why Starting Small always Work in Trading Business? says, at first learn the mechanism of the market, structure and formulate rules your trading plan & strategies, putting your strategies to test, trading on facts and strictly following your trading plan and strategies and keep on refining it to achieve your trading goals. Then you will be in a position to look at the nuggets all together.

To put it simply, if you are trading Bank Nifty Options then understand the mechanism and price movement of Bank Nifty Future to come up with some directional and trading view on the index so that you can enter the market very close to the reversals with strict stop losses in options. You can also refer stop losses as per the Options Chart. Then keep on refining your trading system and plans accordingly as per the results.

So, start analyzing the bigger time duration say Weekly, Daily & Hourly chart of Bank Nifty Futures and get in close by analyzing the small time frames like 15 or 5 Minutes to get close entry level with small stop losses. Take a directional view as per the big charts and setups and take close entries on the smaller time frames to achieve higher reward to risk ratio, i.e. Risking less to Reward with more on every trade.

One day, you will be able to enter the trade with very small risk and hopefully with very large number of lot size.

We truly believe that learner and effortful people like you will surely have a reward full and better trading career. All the very best.

You can refer to the articles below to get answers to your questions. These will give you a better understanding on Trading Index Futures, Learning from the Story of Trading Legend – Jesse Livermore, and how to frame a trading plan and learn more about money management and trade management rules.

12 Step-wise Trading Rules for New Traders to be Safe in the Market

How a 14 year Old Kid Transformed Himself to Become the Greatest Trader of the Wall Street?

How to Trade Bank Nifty Futures?

Part IV – Getting Started With Trading – Importance of Developing a Trading Plan

Thanks for giving us an opportunity to serve you and we are very happy to connect with the traders like you & be of any help.

Please let us know if you have any further questions; We are more than happy to help.

Thanks

JustTrading.in

Great written . i really liked it. I m not a trader but i want to do so . so i am reading articals and watching cnbc zee business etc since a long time. Tpday i fount this site and read this artical now i am prepare to trade with small risks . thanks

Thanks Mahendra. We too were under a lot of ambiguity when we started. Thatswhy we started this website and writing posts to help our new dreamers to get started.

Happy to know it helped you and motivated you to enter the arena in a right way. Looking out for more awesome thoughts from you..Do let us know more about your improvements in trading. Cheers.

To the point articles and resources which are informative, educative in an easy to understand language and style. Highly appreciate your trading strategies.

Hey Lalit

Thanks for your kind words… Feeling refreshed and awesome to read your thoughts. You`r Awesome.

Hi All,

I want to trade Bank Nifty but I am confused as to how much tick size and tick value is. If I use 1 lot Bank Nifty at 8000 buy and get stopped out at 7950, how much have I lost? How much movement is 1 Index point? How much will I lose?

Hey Kumar

I can understand your concern.

Let me try and clarify. There are two different index futures. Nifty & Bank Nifty. The levels you are talking about is of Nifty Futures. As Bank Nifty is trading at some 18000 levels.

Here, Nifty Futures has a lot size of 75 units where as Bank Nifty has a lot size of 40 units which means 1 price movement in Nifty is Rs. 75 while in case of Bank Nifty it is Rs. 40.

So, as in the case you mentioned, if you bought nifty futures at 8000 and stopped out @ 7950 then you will incur a total loss of Rs. 75 x (8000-7950) which is Rs. 3750 (75 x 50).

You can visit the article. Part VI – Getting Started With Trading – How to Trade Futures Market? to clarify other doubts regarding futures trading.

How did you find that weights of banks on Bank-Nifty?

Dear Manoj

The weights are based on the market capitalization of banks in the banknifty. The bank whose marketcap is higher will be given high weightage and so on. The current weightage as on MAr 31, 2017 is HDFC Bank Ltd. 31.90%, ICICI Bank Ltd. 17.64%, Kotak Mahindra Bank Ltd. 11.41%, State Bank of India 10.24%, Axis Bank Ltd. 9.12%, IndusInd Bank Ltd. 7.83%, Yes Bank Ltd. 5.59% etc.

very good