You know everyone out there think we traders are not any less than fools… Right?

Trading as a full time career, a business… is surely a mere joke for them

According to them, its nowhere less than pure gambling

Believe me… You try telling your friends and family that you dream to make a career in trading business

I am sure…

they will laugh at you & will suggest you to stick to your job, put savings in something fixed and forget about this Bull Shit. Forever…

Because Trading has a very bad word out there with the people.. And, when it comes to day trading you can`t imagine how many of them got their hands burnt.

Even you might have heard a lot of stories of people who had gone broke and had big losses from day trading in stocks. There are some who even made big for some time but were unable to keep whatever they made earlier and later lost all what they had.

Many of them will surely start yelling and put over the responsibility of their losses on the markets itself

and yes specially those who were so called Day Traders

or the best word would be Trading Everyday Traders

But we can get to the point that its not the market rather it is themselves who are supposed to be accountable for whatever blunders they did when trading the markets…

And many of those common mistakes that the traders share when day trading :

Leniency in following their trading, capital management or money management rules,

Buying and selling without any full proof reason or fact,

Committing same mistakes again and again due to their own human weaknesses…

and there are many many more.. we have discussed them later in the post.

Have you ever wondered how many startup businesses actually fail?

Its actually huge… More than 90%….

Oh my god. Its actually a big number

Then why still people dream to become entrepreneurs & take risk to start on their own

Because they see opportunities….

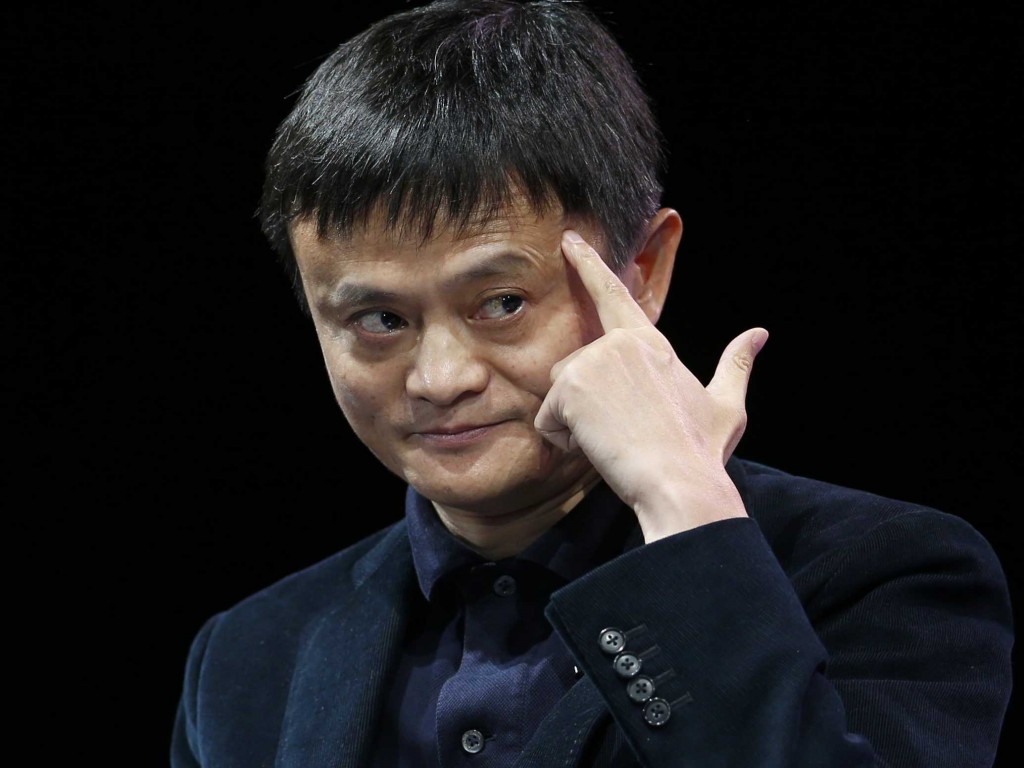

Also, as we have heard a lot of stories of entrepreneurs who have made big… Dhirubhai Ambani, Narayan Murthy, Steve Jobs, Jack Ma and many many more….

Jack Ma said :

“No matter what your current condition, how or where you grew up, or what education or training you feel you lack, you can be successful in your chosen endeavor. It is spirit, fortitude, and hardiness that matter more than where you start.”

With trading, the cold truth is much more similar or might be even more than what is with the start up businesses …. that

95% of traders they fail & end up with losses

Even many who do good, fails to continue with the pace and become lazy strugglers.

Because those who fail to understand that its not just about the money which is behind this business rather to do good and achieve one needs to put in a fair amount of time, effort, learning and ability to cope up with new changes. But these so called new comers are only concerned to ask few questions like –

How to Make Money from Day Trading in Stocks?

How to Make a Living from Day Trading?

How Much Money can I Make from Day Trading in Stocks?

and many many more like that….

Now…..

I can guess the questions which must be coming to your mind.

Should I listen to those who says in a pity tone – that its all risky.. don`t play with your life dude. I know it.. I have seen a lot of those who had a bad taste

Or should I see the brighter side of it and continue…….

running up with the pace towards my dream to become a trader?

Surely, we are optimist and dreamers.. Am I Right?

And, we too have read a lot about traders who made a big mark in trading business and become the inspiration for all the new aspirants like us. Read our section Trading Legends to get to know few of them.

So, now.. what we can do that help us avoid the trap and transform us from being a trading dreamer to a great trader? Just like those trading legends who fall under the 5% bracket

The question which comes into picture that can help us is by knowing

what these 5% of successful traders do which 95% of the others fail to understand & follow?

or

is it that they have some secret idea or rule that no one else knows and that`s why they are successful while others are not?

or just that..

the rules are all the same, but those who are successful really know the practical abilities to implement and follow their rules.. Blindly

So what is the trap or the biggest mistake that most traders commit and fell into the dig?

They trade everyday.

Actually, they think that they can trade everyday….

Yes, its just this…

This is the reason which leads to failure of most traders and the only biggest cause which has thrown away most of the dreamers out from the market arena.

“It was the game that taught me the game. No man can always have a reason to trade daily. The traders thinking that they should make money everyday and every time is one of the biggest cause of the failure of traders on wall street and around globe.”

So Right Away.. just

stop thinking that you have to trade the markets and make money every single day. Trading every day is a myth

stop dreaming what some of your friend had told you about the big profits they had some day earlier..

I Know

Before this … You might be having a lot of excited thoughts and dreams of making money from day trading and that too day on day .. every day… and some day make it big

And, It surely makes us feels good. Right?

But… Let me tell you very straight… It cannot be done.

Sorry to break your dream of becoming a labor working hard everyday to make a daily wage..

OK tell me or rather tell it to yourself….

How can you be right trading every single day?

How you can find trading opportunities as per your comfort zone and understanding for the next 10,000 trading days?

And, most importantly..

How you will know that today is your special trading day so that you can make it big?

Still have some doubts.. Listen to what that man has to say who even broke the Bank of England once and had made billions of dollars from trading the markets.

George Soros said:

“The trouble with you is that you go to work every day [and think] you should do something. I don’t, I only go to work on the days that make sense to go to work. And I really do something on that day. But you go to work and you do something every day and you don’t realize when it’s a special day.”

Even if you recognize it once, the feeling of beaten down in some earlier trades will force you to feel that even this can be a big mistake. And again you play….. Conservative

Just like any other trading day

So, how do we get to know that today is that special day?

Let me tell you – the only rule that can help you make big and achieve your dreams

is

You..

We will get to it later in this post on what to do to avoid these trading mistakes and become successful in trading business.

This post will surely help answer a lot of new comer questions on day trading like What is day trading? What are the common mistakes most traders commit while day trading? How to make a living from intraday trading? Why do people day trade if they can’t beat the market? How professional day traders trades? How you can make money from day trading?

Let`s now get into understanding of the difference between what really day trading is & what people think that day trading is all about?

The Mystery of Day Trading

Most of the new traders generally get too excited thinking of all the fortunes that they can make from day trading the markets.

They have heard a lot of stories of day traders using multiple trading screens, sitting all the time watching the markets and making big money from day trading, buying Ferrari and enjoying lavishing dinner at five star hotels.

They think that day trading is all about being in front of your trading desk every single day, buying and selling the stocks left and right.

And, feels they are all set to start trading the markets right after opening their trading account, buying a charting software, a laptop with multi screens. They are on their toes and start their trading terminals at 9`o clock, reading newspaper, watching CNBC to keep in touch with the pulse of the market and start buying left and right whatever the broker, dealer or the expert on TV suggests them to do

without even knowing what, where, how and why they are buying or selling it?

Foolish…

Jesse Livermore said: –

“The reputable newspapers always try to print explanations for market movements. It is news. Their readers demand to know not only what happens in the stock market but why it happens.”

Also, those who do a lot of research on their markets generally felt into the trap of trading every single day.

They think most of the professionals also trade every trading day.

Rubbish…

If you think it is about making money every day the market opens then get ready to have a bitter taste. Because it is really not about being in front of the trading desk all the 375 minutes market remain open.

Trading in itself is very tough and when you are planning to make it a career then be sure to keep it simple to be consistent. Don’t fall under the trap.

Also, if you really want to avoid big trading losses, you need to have some facts and reasons to trade. And believe me you will need to learn a lot of patience to understand the market, framing up and following your trading rules.

And,

Patience and trading as per your pre-defined facts and reasons are the only keys to the success of most trading legends.

These so called professional day traders who are all the time in-sync with market moves, sitting in front of their trading desk and making big money from day trading actually do not trade the markets all the time.

Rather they enter the market when it makes sense for them to do so. These day traders trade the markets when they see some setups forming up. They wait patiently for the market to show them their way..

Even you may have justification to say there are millions of day traders who trade all day. But they are not to be called as day traders. They are just Traders. Or pattern traders.

These 5% of traders know when they have to trade & when they don`t have to…

Therefore, as a trader it is important to find out the patterns you are comfortable with.. The trades which are yours..

Jesse Livermore said: –

“In addition to trying to determine how to make money one must also try to keep from losing money. It is almost as important to know what not to do as to know what should be done.”

I will share with you how Livermore (The Great Bear of Wall Street) changed his philosophy from being a day scalpers to become a Trading Legend…

Wait patiently. Sit calm. & Let`s keep going.

I am impressed that you have read all above and reached till here… Amazing.. Shows your passion for the market..

We are also learning how to have patience…

Day Trading & Trading Every Day are two different things. Any confusion between the two will force you to get big deep into the dig.

Actually, saying I day trade makes people feel that we usually make trades everyday. To make it more clear and straight we don’t call it day trading rather we call it as YOUR Trading or Pattern trading or simply

JustTrading…

Whatever word or phrase you use to define your trading activity,

the idea is to enter the market not just to trade rather to trade profitable.

If your setups are like you can trade 5 times a day and you can put your trading plan on a paper.. Your Entry. Your Stop loss. Your Trailing stop loss etc.. Good..

Do follow it. Stop listening to me.. Just say he is an ass hole…. He is talking rubbish & close the post here.. And enjoy your profitable trading days.

Because my only objective is to help you find the right key to the door & realize what you are or can be good at to make it big and enjoy a satisfactory life.

Do you sometimes get frustrated during the trading day that you spent all the day and didn’t had any trade at all?

You didn`t made any money and wasted your 6 hours just watching the markets..

When this happens.. I feel that’s good.. I am learning patience.. I am waiting for my setups.. Its OK if I didn’t made any money today but this is making sure that I am learning to be patient and anxiously waiting for setups to form.

And, all set to make big money when setups will be there and we will be waiting big time for it to get completed..

Why its important to wait so much?

Livermore said it is always important to enter at the right time and at the right place. This is what he call as entering at the psychological mark. This will ensure that you have a cushion to stay in even after the market had normal reactions in between.

Day traders really find it difficult sometimes when the false breaks trigger their stop losses and throw them out from the trade. The only solution is to trade as much as close to the psychological reversals. This will increase the probability of successful trade and that too with close and small stop losses.

He said: -“I have always made money when I knew that I am right well before I initiated my trade.”

So,

Make your plan.

Know all well in advance. The only way to do good in trading is to know what is your setup or pattern.. You should recognize it once it is forming… Never fight with it.. Never trade just because you are sitting in front of the trading terminal. Wait for the market to give you indications to enter. Trade when it make sense to do.

Really interested in avoiding the trap, Read How to Overcome Biggest Human Mistakes & Weaknesses in Trading? to learn to avoid committing the same mistakes again and again..

Also, there are some very basic yet the most important rules to not avoid during your trading journey to ensure your safety. Go through these 12 Step-wise Trading Rules for New Traders to be Safe in the Market and stay alive in the markets forever.

Why Trading Every Day is a Silly Plan?

You know

when we ask traders the reasons for their biggest losing trading days?

we generally get very similar replies, which is

- overtrading

- not following the stop losses

- And, the biggest of all – covering the losses within the trading day

There are many more reasons why traders incur big losses on some trading days which relates more to our own human weaknesses.

Unable to follow the trading plan, Being too optimist or too pessimist.

And this all surely happens when a trader is there in the market trading every day. With no pre planning.. no thought process. no ideas. They don`t enter with any kind of plan.. of knowing

what to trade, how to trade, where to trade, when to trade, where to put stop losses, where to exit.. nothing…

they just start buying and selling with impulse.

Trading everyday will make following and strictly adhering to your trading plan, risk management and capital management rules too difficult

and this will surely put you as a trader in trouble as very soon you will have stocks in your portfolio which were not supposed to be there.

The problem with all the new breeds of traders is that they become investors after some time not by wish but by force. They start trading the markets and stocks with a short term trading objective but without pre-defining the rules and trading plan.

Peter Lynch said: –

“The worst thing you can do is invest in companies you know nothing about. Unfortunately, buying stocks on ignorance is still a popular American pastime.”

So, they do book short term profits in some of their positions but get stuck up with those which do not move as per their lines as they failed to follow their short term trading rules, capital protection rules and their reluctance to book small losses.

and become so called Forced Long Term Investors.

Differentiating your trading and investing is one of the most important decision a trader needs to take. And trading everyday will surely make yourself your own culprit.

The idea here is to stick to your trading plan so that your trading calls do not became a part of your long term investments or your long term investments become your trading bets just because you have paper profits.

Rakesh Jhunjhunwala highlighted it very precisely.. to not let your love for price momentum make your long term portfolio of stocks.

“You have to know what you are, and not try to be what you’re not. If you are a day trader, day trade. If you are an investor, then be an investor. It’s like a comedian who gets up onstage and starts singing. What’s he singing for? He’s a comedian.”

Also, traders start thinking that day trading is all about maintaining a daily ledger of profit and losses of each trading day. So, the only thought which comes into mind after a losing trade is…

“I am having a loss today. And I need to cover it today before market closes?”

When you think something like this its like “to axe one’s own foot”

Many traders incur big trading losses just by trying to recover the losses they had in the day as if the markets will not open after today. They do not want to take home a negative balance.

This is where lies the difference between a professional day trader against “the trading everyday” Traders.

Because those who are professionals trading and tracking the market most of the time do not evaluate their trading performance for each trading day.

Do you know that when you are day trading, all your emotional, psychological and mental elements are involved with a higher intensity which needs a better control to help you stick to your trading plan?

– You had losses and you start fighting with yourself and incur more losses

– You had profits and you start feeling over confident, commit mistakes and incur losses. Over confidence is the biggest of all.

Many traders after having a loss in a day keep juggling with themselves to recover the losses. You are already hit after having a losing trade. Now you should be more conservative.

You have to trade when patterns are there to trade. Not just because you had a loss and you have to cover it today before 3:30 anyhow.

When a hedge fund tells you that they made a return of 20% a year, does that mean they were profitable every day? .. no

You may be a bank nifty or stock futures trader, but that does not mean you have to make a trade each day?

No.

A one single 200 point profit is worth more than 10 times of taking 10 trades of 20 point profit.

You might be trading bank nifty weekly options on the expiry days to write options, to take the benefit of the time decay in your favor, and let this options contract expire out-of-the-money. But does that mean you need to do it on every single expiry day?

No..

So in each and every case or trading day, you need to see if the you are able to grasp and understand what the market is doing.. If not, then stay on sidelines and wait for opportunity to come the next day or the another next day….

Wait a Minute….

Are you are an options trader?

Then I really have the best recipe for you to learn how you too can make money from trading the bank nifty weekly options. Read How to Turn Bank Nifty Weekly Options into a Regular Income-Driving Machine? to know how professional traders write options to make consistent money from markets.

And if you are new to options, then how you can avoid the trap most new trader fell into.. Read the post below….

You might have read and heard million number of times that the risk with buying options is limited to the price of the premium paid. Right?

But Do You Know that we can even get trapped and lose more than the value of the premium even when you are buying options and what if I tell you that you can incur loss even after having a profitable trade.

Read Warning: 5 Traps To Avoid When Trading Bank Nifty Weekly Options on the Expiry Day to know how the theoretical adage of limited loss when buying options is not completely true in all of the cases and how to avoid one of the biggest trap of what we call as a “Contract Shock”.

Let`s come back to the post

One of my known trader used to say that its like pyramid trading but in different aspect.. where people make small profits and keep on accumulating small all the time and once they get stuck they lose all in big.

Therefore, it`s not the quantum of trades you execute in the market which is important rather how many of them are profitable and how many of them are not…

How much we make when we are right and how much we loose when we are wrong?

So, to get this ratio in your favor, you have to wait with lot of patience then only you will have big profitable trades and small losing ones.. Because if you keep on trading in ziffy then there will be similar losing and similar profitable trades – Just like tossing a coin.

George Soros said: –

“It’s not whether you’re right or wrong, but how much money you make when you’re right and how much you lose when you’re wrong”

Whether you trade 5 times a day or a single trade during the day.. It is important to ask did you traded as per your trading rules?

Did there was a setup which was Your Setup or did you just traded with the momentum and got lucky?

Steve Cohen said: –

“This is not a perfect game. I compile statistics on my traders. My best trader makes money only 63 percent of the time. Most traders make money only in the 50 to 55 percent range. That means you’re going to be wrong a lot. If that’s the case, you better make sure your losses are as small as they can be, and that your winners are bigger.”

And the only way to achieve is to trade only when it makes sense to. Don`t be so anxious to trade everywhere, anywhere.

Know your trading patterns, setups you are comfortable with.

And, have a lot of patience for market to complete them first.

Then only pull the trigger. Anything before or later will not help you in gaining big.

If you really want to make a success in this business and make consistent profits then you have to learn to keep them with you.

And believe me the only way you can do so is by learning and improving yourself. Never have the idea that you know it all. Never feel that now the market is into your control

And, most important of all…. Never ever fight with the market. Just keep it simple, and enjoy the journey.

Trading in itself is a very tough business so don’t make it tougher by not following your rules or trading randomly.

You were not born with these problems and these human weaknesses.

These are what we have learnt during our life. So, things we have learnt can be unlearned too… So get ready.

We are not leaving you here with the problems we face as a trader… Let`s solve each to help us deal with our human instinct. So, the question which needs to ask after knowing why trading every day is a silly plan is …

What to do instead?

To put it plain, follow what professionals do…

Do what 5% of traders implement and what 95% of traders don`t follow

i.e. work hard like them

know and understand your business very well… Just like them

Very simple …. Huh.

Not actually… This may sound a lot simple on paper but needs a lot of commitment, hard work, proper planning and training self to follow and implement.

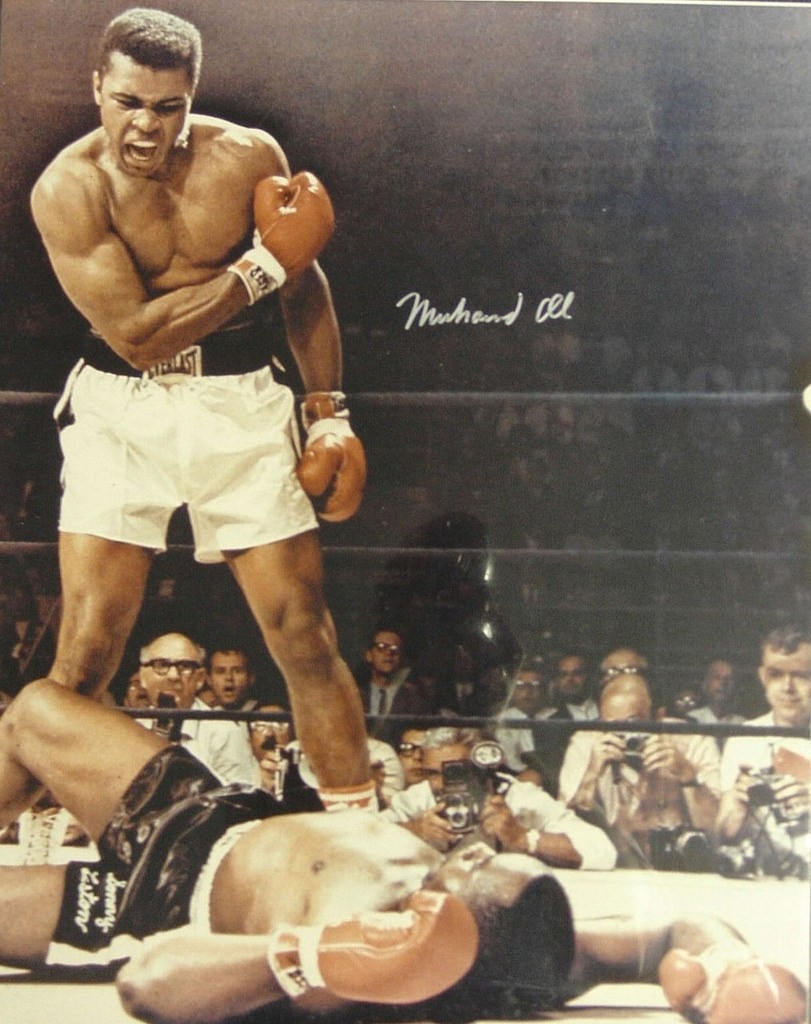

Muhammad Ali said:-

“I hated every minute of training, but I said, Don’t quit. Suffer now and live the rest of your life as a champion.”

So, what these big professional traders do?

They trade big. Yes we all know that

But have you ever wondered how they are able to trade that BIG?

Just because they have a lot of money to invest and trade with?

No.

Rather because they know and understand their business very well.

Just like any professional do. They plan.

They have all to justify their reasons for investing or a trading in a stock or a market

And more importantly, they can do the reasoning BEFORE entering the trade & Not AFTER.

How many of us have seen CNBC, where a lot of traders send their trading queries and ask for the advice from the TV experts?

I think all of us.

Also how many of us have recognized that most of the traders who seek the advice are those who are into losses? Have we ever seen anyone coming for advice for any stock they are into profits.. I think very less

Traders specially those considering this as a mere profit vending machine than a business fails to follow the rules of trading and get stuck up with lot of stocks which they invested or traded without any proper research and reasoning.

You know the best answer to those seeking trading advice should be –

As you have invested in a stock then you should know more about it and tell me why you have invested?

But that does not happen.

I will be very straight and tough with you. Because market has always been just this tough with me and other traders.

So don’t take anything light.

BE hard enough to understand that this is the toughest job in the world and surely needs a lot of you and your time to make things right.

But Why?

Because the opportunities are huge. You can make such big money that you can imagine of.

So… Forget any dreams to make it big by doing it as a side business. You have to do a lot of efforts and spend much of you time understanding the market and learning from your mistakes.

Lets come back to the important point – What these professional trader do?

They train them-self at every stage of their trading career. Whether they are new or an experienced one – training and learning self is an ongoing process to keep in sync with changing dynamics of the market.

Usain Bolt said: –

“Worrying gets you nowhere. If you turn up worrying about how you’re going to perform, you’ve already lost. Train hard, turn up, run your best and the rest will take care of itself.”

These professional traders have their own ways of seeing the market. This doesn’t mean that just because they have costliest trading and charting software so they are at the advantage. You can have any number of software’s as costliest as possible but the way you see at charts is what makes all the difference in your trading and your trading results.

Similarly, they have their own trading systems, setups to trade

And, their own ways of seeing, analyzing, judging and trading the market…

They don’t fight with the market, they have all the patience to wait for the market to start telling them what it is doing.

Put it simply, whenever they understand what the markets are doing… They plan their trades.

That is whenever market movements are under their comfortable zone they start entering the markets – in a Real Big way.

Anyone can buy a cricket bat just like Sachin Tendulkar, Virat Kohli or Chris Gayle, but does that mean they are going to perform just like them? I doubt…

Anyone can buy a cricket bat just like Sachin Tendulkar, Virat Kohli or Chris Gayle, but does that mean they are going to perform just like them? I doubt…

So, its not something in the bat which let these legends perform like hell. Its something within themselves, their self training and learning, and their ability to adapt to changes and taking quick actions is what that makes all the difference and in their results.

Every trader has his own comfortable and understanding universe & its important that we remain stick to it.

So to take high probability trades, you will have to wait patiently for the market to complete pattern then only you can enter at the very right time.

Read along success of any trader.. You will get to know how they predicted an event and made big from it.

Search the internet and you can find out how George Soros made billions when he went bearish on pound in 1992..

And, Hedge funds generating positive returns during the sub prime crises in 2008

So, its all about knowing when it is yours..

That does not mean you should wait for that big one once in 4 years. Rather know what works for you.. you could be comfortable with trading the daily chart of the market or the trading the intermediate trends of the moves

And, success is in successful implementation of it…

Because you will know the pros and cons of it. You know when it don’t work and when it works best.

Its not about being right most of the time.. Rather being right big some of the times..

Livermore said when I was a kid I used to record the behavior of the stocks before it breaks down 10 or 20 points and whenever I see some stock doing the same I repeat the process..

So some patterns need some perquisite to work. It’s like a great product comes with great inputs only…

Similarly a great up move comes after some great bullish patterns only…

Bullish patterns may also reverse with no up moves later. That a trader whose pattern it is will know that it is not behaving as it should.

Everyone says trend is your friend. But it’s also important what makes up to conclude that the trend will continue.. Know all what it takes…

They say buy at double bottom. But does that means market always rise after every double bottoms?

No…

And that bottoms do not break?

Yes they do…

So there are all prerequisite

If you are double bottom trader.. You may know some conditions that is required for the double bottom to works & also when it will not….

So, stick to it, know all you can about your ways of seeing and trading the markets to make it real big.

Jesse Livermore, one of the world`s great speculator of 1900s also started his trading career as a day trader. He was working as a quotation boy writing out stock prices on the board felt that these prices are not mere prices rather they are number which represents something as they were changing and changing all the time.

So, he started keeping a mental record of behavior of stocks to anticipate the future movements and find out whether they repeat in the similar fashion in the future. He kept on plunging in big lines of stocks at different brokerage houses for many years looking for small margins trading day and day out.

After getting broke a number of times because of his own human weakness of trading on excitement and in big quantities. He felt to be successful in trading he has to change his bucket shops trading methods and he started to analyze and see the market in the bigger ways & felt that the big money cannot be made in the individual moves but only in the big moves.

He transformed himself into a Real Trader or a Legend – waiting patiently for weeks or months for a stock to come to right price before initiating a trade. He made millions from trading the markets though his own instinct of going big.

So, how did he made big? Trading every day, every moves of the market.

No

He defined his own rules from experience what worked for him & what does not. He started to see the market in big ways and waiting patiently before executing any trades. So he has its own of trading.

Trading at the Right Time & at the Right Place

Patience to enter and exit the market has always helped a trader to have an added edge in Trading. He said after forming a opinion about a stock, do not be too much impatient to enter into it. Wait for the right indication to enter into a trade.

So, for any trader entering and exiting a trade at the very right time is crucial for his success as a speculator. Entering at the right time at the right place and surely at the right price gives a psychological advantage to a trader.

If you are a bear in the bear market well and good but timing has to be right. Not soon not to late..

He said: –

“After spending many years in Wall Street and after making and losing millions of dollars I want to tell you this: It never was my thinking that made the big money for me. It always was my sitting. Got that? My sitting tight! Men who can both be right and sit tight are uncommon.”

He has outlined his trading system (the Livermore Key & Pivotal point theory) and many of the trades which helped him made millions from trading in his book How to trade in Stocks?

Read his story at How a 14 year Old Kid Transformed Himself to Become the Greatest Trader of the Wall Street?

Therefore, To make it big. You have to sit patiently before entering a trade. And when you enter you have to sit tight.

George Soros once said : –

“There is no point in being confident and having a small position.”

And my objective here is to train you to learn to make it real big.

And by big, I really mean that in a real BIG way.

But Remember, This shit is hard though…

And it sucks.

You’re probably like, “Man, can’t you just give me a step-by-step plan that I can follow and implement? Something simple and which is to the point?”

The good news is I can give you a road-map. But it’s full of tough decisions, twists & turns, and roadblocks, but at least it’ll get you in the right direction.

Many ’ll read it and think, “It make sense, and i’ll to do that someday.” But that day won`t come till they suffer. They’ll go back to their own glittering here and there trading and will forget all about it.

As you have reached reading to this end of the post, I am feeling you as different and feels you are the one who is willing to put in whatever it takes to make your trading really Awesome & great.

I’m hoping that you’ll one day become such a great trading legend that you will start helping other traders in their journey & will become a source of great inspiration for others.

The world needs more great traders like that. Desperately so.

Here`s the blueprint:

#1. First, consider trading as a business rather a mere activity of making quick bucks.

#2. Prepare and put your trading plan on paper – Define all what you think you can? What to trade? why to trade? where to enter and exit? Contingency plan? Stop losses? max number of trades to take and everything.

#3. Learn the skills to implement and follow your trading plan.. And I really mean that in a very serious way. Implementation requires different skill sets than analytical skills.

#4. Plan everything in advance – Know your setups, know how to enter those setups.. their positive and negatives.. Make them yours.. They are not mine, they are not any ones.. They are yours.. Spend time on it.

#5. Have patience – Trade only when you should. Markets will open again tomorrow. so do gates of opportunities. Ask yourself is it the best setup or pattern? Do I know this pattern? If not, wait for the one you know. How can you find setups or patterns everyday? You cannot do it. Trade whenever you have a good piece of trade. Let the market spend time to complete patterns.

#6. Stop evaluating every day. There is no such thing as I had a profitable day or a losing day. There is no such thing..

#7. Keep Learning – Learn from your & other traders mistakes as today or tomorrow you will also commit one.

#8. Keep your profits big and losses small. Achieve a High reward to risk ratio. Because you will have losses so keep them small

#9. Consistency can only be achieved when you trade only as per your setups or recognizable patterns.

#10. Restrict numbers of max trades you will do in a day.. Consecutive losing as well as profitable.

#11. Do not trade in isolation of the trend of the day.

#12. And, Stop thinking to trade every day, that’s actually bull shit.

Do you want to stay where you are right now? Or really interested in making it big?

Because

“After a while size means nothing. It gets back to whether you’re making 100% rate of return on $10,000 or $100 million dollars. It doesn’t make any difference.”

Just train self hard, put in whatever you have, do the best possible, and everything else will take care of itself. Just you watch and see. And Remember its not anything than JustTrading.

I am not sure whether you have got any benefit from reading this or not… But I felt it is my duty to share with you things that helped me with my trading. So I did.

Leave me a comment with your thoughts. I’ll be watching closely.

KNOWLEDGE IS POWER!

Related Posts

Dear sir, thanks for your detailed information on Why Trading every Day is………..It was good article showing

how traders makes wrong decisions and their money is lost dueto not following trading plan. From this article

I have to know my shortcomings in trading and will try to avoid the same in future. You have mentioned about using DAILY CHART. I know nothing about using charts. I shall be thankful if kindly guide/advice me how I can learn use of charts. kindly name any person/institution in JAIPUR ( raj ) from where I can learn charts. Again thanks for your excellent article. Mahesh Prasad Sharma

Dear Mahesh

I am very much thankful to you for sharing such words. Its really motivating to know that it helped you in your trading. We don`t know anyone who guides on technical`s.

Very soon, we will be writing one on chart reading and how traders can use chart reading to refine their trading further and get an edge just like professional traders. We will update you on your email or whats-app.

Till then you can read a short one on Charting. Getting Started with Technical Trading – What is a Chart?

Great read man… !!! i echo your thoughts too… been trading for 2 years now and profitable for a year… i swing trade only Nifty futures and use only price ( candle )

It seems to me you are heavily influenced by Jesse Livermore and so am I.

Would like to get in touch if you want we can discuss strategies.

Dear Akshay

I am very happy to know that you have turned your trading profitable. You are one of the inspiration for those who blames market and says that its impossible to trade profitable. It will be amazing to know your story and connect with a trader like you.

Also, i am delighted to know that you loved our work. Satisfactory feeling. Thanks.

And, Yes i am a true fan of Jesse Livermore and he is the one who gave me a lot of inspiration and motivation to keep on going. Have you liked reading his book Reminiscences of the Stock Operator?

Hey yeah man…. i have read the book. Great book but its more like his thoughts and doesnt touch upon systems and trading stuff much.

what kind of system have you developed ? are they as long term as Jesse or you do shorter term trading from Larry Williams also?

Dear Akshay

I havn`t read any work of Larry Williams till yet.

Yes, Jesse didn`t outlined the trading system in Reminiscences but shown a great piece of information on trading psychology and how big traders used to trade markets that time. As this is the only business where nothing changes, things just repeat in similar fashion but yes of different magnitude, so whatever he said in 1900s actually make sense even today.

You should read his book – How to Trade in Stocks where he outlined a lot about pivotal and his own trading system. A Worth buy actually..

Mostly the trading system that i work on is based on patterns and behavior of the moves and they tend of repeat in nature.

hehe…my story i guess is similar to every trader who has stuck around the market and tried to be successful at this…

I quit my job and started trading full time. learnt from scratch everything. I have read lots of books and done crazy amount of analysis. For a year i made losses. Tried all sorts of indicators and strategies.

Then finally hit me that the problem is in my mind and nothing with the indicators. Dropped all my indicators and just used momentum ( price ) and then all of Jesse and larry made sense to me. Been profitable since though i have had 3 losing months but kept the losses pretty low.

Awesome. You got all the qualities of a successful trader. Keep up the great work. You let your losses remain small and focused on what works for you.

Every trader should have his own way of seeing things and should focus on working deep on things that make sense to them and things that they actually understand. Because I feel after a while it doesn’t remain Livermore or any Larry`s work. Rather as it becomes Akshay Iyer`s Work.

Amazing to know about your efforts, hard work and flexibility to improve self to turn your trading profitable. A great inspiration for those struggling to keep in sync with the market.

We would love to know more from you on how you transformed self from being an aspiring trader to a full time trader.

I have started trading 2 years back.My business was not doing well,so with little capital I opened my trading account with Sharekhan & started trading.I was not knowing anything about trading,i just wanted to supplement my income.Slowly I started to read about trading on internet & I came to know about discount brokers.Then I came to know how much more I was paying as brokerage fees.My strategy that time was to take Suzlon share with margin trading & sell it with little profit.

Then I opened a account with discount brokerage & slowly I learnt about options trading.That time I was trading only on my instinct,i didn’t know anything about technical,fundamentals etc.I would just see the tip gainers,top traded stock& trade in it.

I am happy to come across your site Just Trading at the right time.

Dearest Abhijit

Heartful thanks to you for your kind words. I can truly understand your pain as I have also committed similar mistakes in early days. I am happy to know about your willingness to learn about the markets and the opportunities available, and you started trading more on facts and reasons and were able to fix up your mistakes.

I truly believe that learner and effortful people like you will surely have a reward full and better trading career. All the very best.. and remember “ALL GREAT THINGS START SMALL”.

Thanks a lot and I am delighted that you liked our work. Let`s work together and achieve big success in trading.

Cheers..

I have to admit here that inspite of trying to learn charts,analysis,I have found iam not able to grasp the knowledge.Somehow iam very weak in figure.I have read about different strategies of options but I am not able to implement it.Iam only comfortable with naked put & call

Sure, We can understand that. But initial learning phase is the most difficult one as it requires a lot of time and effort to deal with all the new concepts. Because later what remains is the successful implementation of it.

With trading, it is the technical knowledge and implementation skills. So to be successful one needs to understand the concepts first and later learn the skill sets to implement successfully to achieve results.

We are in process to write some high quality articles to help our new traders understand the concepts of technical trading and investing. Hope that might help you learn and understand the market framework in simple way.

Hoping for a long term learning relationship with all the new aspiring traders..

Cheers….

Very comprehensive detailed article, thanks for sharing it.

Awesome feeling…. Thanks Murthy… This really gives us a feeling of satisfaction for our effortful work. Thanks a lot and we are delighted that you liked our work.

If you are an experienced trader or an investor, do share your story or ideas that worked for you with other aspiring traders to help them in their trading journey…

must read article for all traders in indian market ….really a refresher man ,thank u

Very Happy to read your comment… Thanks Rajesh. You are Awesome. 🙂

Excellent post! really an eye opener for me.

Can you PM me or email me, I would like to ask you some questions, if you don’t mind helping me out with my trading.

thanks,

Ashish

Dear Ashish

I hope you enjoyed reading it…

After reading your comments I just read it back again and was wondering how someone can write such a great content. Hehe 🙂

But yes, it all make sense and a pre requisite for every trader to understand and work under some framework.

Also, you can post your questions and comments with the other traders here so that everyone can benefit and learn how to avoid and rectify the mistakes we commit in trading.

By The Way , I am sending you an email and we can get in touch, connect and discuss things more often with time… Also, added you email to the subscribers list and you can further add your whatsapp number.

I will be very happy to know and connect with you…. 🙂

Thats a wonderful piece of gold you have written. I have had few years of trading experience but I always made money and lost it. Till now this fact was running in the back of my head, but your article helped me point the problem – which is – trading too often. Also another problem I identified is that so far I have been looking at trading only as a passtime. Now my transformation to seeing it as a business will make things better hopefully. After all its plugging the holes in your psychology at the end of the day that makes us successful. Thanks a lot for the article.

Hey Sashank

Really happy to read your wonderful thoughts..

thanks a lot for taking time and an effort to share such kind words…

What an article!! To be frank its one of the best article i’ve read so far regarding options trading. You got such an amazing tips where a beginner in trading should focus on..just like me. I strongly believe these tips will help everyone like what to do and what not to do while trading. I made huge losses in a year and nervous too, but I am pretty confident that one fine day able to step up in profits. As a full time employee , its too hard for me to concentrate in minute to minute trading.

Kindly , share those ideas that could be helpful for a trader like me in acheiving consistent profits and to be a successful trader of all the time.

Dear Rohith

I am delighted to read your thoughts. I am surely confident that one day you will be a successful profitable trader. I can understand how difficult it is to when you are on a job and you think of markets and trading. Gone through the same ….

I will try to keep sharing more great content to help traders make a mark in trading… I wish you all the very best and hope you find your way of trading very soon…

Very hardwork would have been put here to produce such a nice article!! I really appreciate it.Please add me to your what’s up mobile group if you have any.

Pankaj Gupta

Updated your number and email in our JustTrading members list. You will receive all email and Whatsapp communications from now on. And yes, thanks for praising out the hardwork put in writing that masterpiece.

Excellent article on day trading, I am day trading since last 11 month but not successful.I make same mistakes given in this article like overtrading, Revenge trading, Trading without proper stopp loss, Trading daily, Booking profit early and taking huge amounts of losses, In last month I was profitable for 70%trades but loss all gains and my trading capital in 25% trades.

I have to account one for day trading and another for positional trading. In positions trading I make frofit by following cup with handle pattern.

Please write an article about stopp loss.

Hey Shashi

As you stated, trading is not about profits and losses. Rather it is more of how much money you make when you are right and how much you lose when you are wrong. So, it is always important for a trader to manage his risk wisely to be profitable.

And yes, i will surely write some more about my risk management and stop losses rules which is helping me with my trading in the near future. Till then refer to the articles below which i have written few articles earlier which surely will help you make a simple yet effective trading plan to manage your risk.

Part IV – Getting Started With Trading – Importance of Developing a Trading Plan

12 Step-wise Trading Rules for New Traders to be Safe in the Market.

I wish you all the very best for your trading.

Hi there,

I was just googling around for ‘how to trade BANK NIFTY’ weekly option writing for income. Google brought me on this wonderful article. This Article is ocean of knowledge for new inspiring day traders. An eye opener and what to do, what not to do and quotations of the legends are just adding beuty to the article. Really enjoyed reading it.

Thanks,

Prakash Chandra Bishnoi

Dear Prakash

I too enjoyed a lot reading your thoughts… Really made me feel good, and heart-full. Such words really inspire and motivate me to share more and write down all I have learned during my journey as a trader..

Thanks a ton and all the very best for your trading.

Dear sir, i am an intraday trader not using daytrader word after referring your article. I started a year back and made heavy losses. I have been currently working on Gann methods and so far they have been going good. but as always there are lot of drawbacks in the system that m trying. Would you mind sharing some intraday trading recipes. Of all indicators i have used so far, ichimoku clouds is what i have found to be better than all others. Would like to learn as much as i can and be a successful trader like you all.

Just spare me some time.. will write some articles on that and also planning to conduct webinars and realtime trading room to share the knowledge and trades.

Great article…thanks indeed!!

Sir, Thanks a lot for the articles you publish.

I was trading equity stocks and made big losses, recently I met a person and he showed me trading in Bank Nifty is better and you can earn good. He taught me and gave me some hints, But still I am not ready as I want to learn in a better way.

I read and still reading your articles and find it very useful. I am patiently studying the market and noting the trends of it, I will enter the only when I am comfortable and confident.

I thank you again for the efforts you took to guide everybody.

I request you to send me more of learning things, so I get the knowledge and start trading.

Dear Salim

Thanks for writing in and we are happy to see your anxiousness to know about the markets. Very soon I am planning to start a private community where traders can get updates about our real live trades, ideas and reasons behind such trades. This will help all the newcomers in market to learn market knowledge or for the existing traders to refine their trading skills.

Regards

JustTrading.in

Thanks, and I appreciate your prompt reply.

Anxious in knowing more about the new strategies of market.

Can you suggest a book designed for option trading?

Dear Friend

There are two ways to approach the options market. One, by learning all the Greeks of options trading which is knowing more about Delta, Vega, Gamma, Theta. They are indicators just like a car has speed, RPM and fuel..

Delta tells you price risk, Gamma is change of price risk (how fast the Delta will change), Theta is more of time risk (loss or gain due to time) while Vega is volatility risk (loss or gain due to volatility). There are many ways traders use options like trading for time decay by shorting options, Event based trading (Quarter results), pair trading, options future arbitrage, etc etc… For this there are numerous courses and YouTube channels to learn from like Options Alpha, Tasty Trade etc. You can find number of options traders in India who are expert in this field and they do conduct paid workshops, seminars… some i know via social media Pran Katariya, Shubham Agarwal (Quantsapp), Jegan.

(PS – Just to share, i am no where related to these traders and i have never attended any of their workshops, or seminars. Do check on your own and take actions as seem appropriate)

While the other way is to keep it SIMPLE… analyse the chart of the underlying (as in your case BankNifty Future) and trade in options. (This is what i do)..

So the idea here is to do and follow which is suitable for you as per your psychology, trading style etc and be proficient in one.. as the objective is not to be good in too many things but being best in one you know and understand more about. Just like Bruce Lee said — ‘I am not afraid of a person who knows 10000 kicks. But I am afraid of a person who knows one kick but practices it for 10000 times.’… So know yourself and find out one thing which suits you and practice it 10000 times just like a surgeon who specialize in his chosen field.

Hope this helps.

Regards

Your Friend.