Before we start getting into the world of making money from trading stocks, let`s first get into understanding what trading is and some of the basic terminologies, concepts that you will be encountered more often during your trading journey.

They seems to be very basic but will help you understand the concepts with ease in the books and articles specially written on trading or investment.

Some of them might be very specific for the Indian traders but mostly all of them are universal in nature and are applicable to all the markets in the world.

Please bear with us for this long detailed article……

We have tried the best possible to keep it detailed and crisp to help you know all about Trading & Investing in Stock Markets.

Some of the sections has been cut short here & linked up with the articles written specifically on the respective topic….

So, do spare your time to read and refer all the links mentioned in every section to help you get started with all what you always wanted to know about Trading & Investing.

They seem to be more written about how to start trading or investing in India

but these rules and information can be applied to any investing country with little modifications.

We have distributed this whole article in eight sections to help you make money from Trading in Indian Stock Market as mentioned below:-

| Sections | Topic | What to Expect |

| #1. | Know What to Trade / Invest In? | Stocks, Index ETFs, Mutual Funds and Future & Options |

| #2. | Know Who You Are? | Are you a Investor or a Trader? |

| #3. | Know How to Trade? | Long Term Vs Short Term Trading & Technicals Vs Fundamentals |

| #4. | Prepare a Complete Trading Plan | Risk Management, Psychology Management, and Trade Management Rules |

| #5. | Rules for Trading & Investing | 12 Rules to Avoid Human Mistakes & Weaknesses |

| #6. | Get Inspired | Stories of Great Trading Legends & Recommended Trading & Investing Books |

| #7. | Taxation on Trading in India | How to File Income Tax for Your Trading Or Investing Profits? |

| #8. | Trading & Investing Resources | Opening a Trading Account, How to Choose a Broker? Software, Tools, Books & Applications for Trading & Investing |

So, What is Trading?

Trading is a business of businesses (Companies). These companies are listed on the stock exchanges to make them easily available for the investors to participate.

The stock exchanges provide the platform to the companies to raise funds through offering equity shares to the public and in-turn provides way to the general investors or traders meet together virtually to exchange their shares through buying and selling with utmost transparency & guaranteed settlement.

Any a trader who wishes to participate in the growth of the company say (Thyrocare or Dr Reddy Labs) or a wishes to get the short term trading benefit can do so by buying shares of that company through the stock exchange.

Technology revolution has let this business into new heights where anyone can enter the trading world with just few clicks. The process to participate in this business is so easy now that anyone can open their trading account within hours and get started.

This generally mislead the belief of the new traders that it is as easy to trade as it is to open the account to start trading.

So, those who are aspiring and really wants to make a career in this business and be successful should understand the rules and framework of trading and put in the efforts, time required to get deep into the technical and psychological aspects of trading business.

As this business is the real land of opportunities which not only gives you the complete freedom but also big rewards and real life lessons but the most prerequisite is that it needs to be run “only” on the business lines.

Therefore, spend time learning the principles, acquiring basic knowledge of markets, frame up your trading plan, capital management, risk management rules, contingency plan, things we need just like we do in case when we start a real business. As we outlined in our article Have you ever Wondered why Starting Small always Work in Trading Business? the importance of putting everything in place for new traders.

This will help you learn, frame and have a good control over the wide aspects of the trading business – Psychology Management, Money Management, and Trade Management.

There are many traders and investors who had made a mark and achieve big in this business who not only made some real big money but also inspired millions like us to learn and stand back again on our feet to achieve new heights.

Jesse Livermore, the wall street trader of 1920`s, who made millions from trading the markets & still is a source of inspiration for aspiring traders like us to learn the different aspects and behaviors of markets. You can read his complete story How a 14 year Old Kid Transformed Himself to Become the Greatest Trader of the Wall Street? & quotes here Jesse Livermore – The Millionaire Boy Plunger.

We will discuss more about these Trading Legends below in this article in the section VI.

Now lets get straight into understanding some basic terminologies and concepts which are commonly used in the trading business. We have created a list of all the important ones in a separate section which is mentioned below. So, if you are new to this business do visit the page to help you be familiar with them which will make it easier for you in learning more advanced trading concepts and ideas.

Important Stock Market Terms & Concepts

# Stocks

Stock are equities listed on the stock exchange. Stock have an existence of their own so you can invest in them for as long as you want. Say, if stock price of Tata Motors is trading at Rs. 300 then you have to deposit Rs. 300 in your trading account to buy one shares of Tata Motors. You can buy any numbers of shares with minimum of one. You can take positions in the stocks for long time as well as you can day trade in a stock meaning you can buy or sell the stock within the same day. Also, you can sell the stock first and buy later with in the same day to take the benefit of short selling or down price movement.

# Stock Exchanges in India

There are two major stock exchanges in India – National Stock Exchange of India (NSE) & Bombay Stock Exchange of India (BSE) where BSE is the India`s oldest stock exchange whose major index is SENSEX while NSE is the largest stock exchange of India in terms of turnover whose major index is Nifty 50.

When you open a trading account with any broker you can trade on any of the exchange you wish to. So, you can buy shares in NSE & sell in NSE but if you wishes to sell in BSE make sure you have the stocks in your D-mat account.

| NSE | BSE | |

| Index | Sensex | CNX Nifty (Nifty 50) |

| Index Value (As on May 27th 2016) | 26653 | 8156 |

| Number of listed companies | > 3000 | > 5500 |

You can do arbitrage (risk free trade) between these two stock exchanges by buying a stock in one exchange and selling the same in the other exchange to make profit of the gap between the two exchanges. But an important point to consider here, you can arbitrage in the stock you are holding in your dmat account because you have to deliver the stocks to the exchange where you sell shares.

How to make risk free money from arbitrage between NSE & BSE? – Coming Soon.

# T+2 Settlement

Stock exchanges in India follows a T+2 settlement time frame. This means that any stocks you buy today say on Monday will be transferred to your DP account on 2nd Day i.e. Wednesday. Similarly, any stocks that you sold are required to be delivered to the exchange on the 2nd day for which the selling amount is credited to you on that same day (i.e. T+2)

# Short Selling

Short Selling is a trading activity where you sell a stock or futures contract with a motive to buy it back at a lower price. So, short sellers are short term traders who expects a fall in the price of the stock or the futures contract (Index or Stock Futures). As you cannot carry a short position in a stock, so you have to square or buy back the short stock with in the same day but when we are trading futures short selling is allowed for positional also. So, if you are expecting a short term fall in the price of the index (say Nifty) or a stock (say Tata Motors) then you can take the benefit by selling the stock and buying it back within the same day or sell Nifty Futures or Tata Motors Futures contract which you have to buy back before the last Thursday of every month (Expiry Day).

Another way to take benefit of any fall in the price of the stock you are holding is by selling it and buying it back later at a lower price to make short term trading profits. This helps reduce your buying cost which is followed by big mutual funds or investors who have a big holding in any company and keep trading in the same stock to keep on reducing their buying cost by taking benefit of short term price movement opportunities.

For More : Visit www.justtrading.in/important-stock-market-terms-concepts – Coming Soon.

#1. Know What to Trade / Invest in?

At present, any investor can participate in wide range of instruments including stocks, Index ETFs, mutual funds, bonds or trade in equity, commodity or currency futures to diversify your portfolio, manage risk and in-turn achieve their financial goals to create wealth. So, we can distinguish a participant on the basis of their objective to participate in the market into two categories :- Either You are a Trader or an Investor.

Whatever you choose to being a trader or an investor, you whole career will be surrounded around the levels and analysis of the index which in case of India is Nifty or Sensex. You will have a keep a good track of the index which will give you clear picture of the general conditions of the economy and other stocks. So, to get a clear understanding of the economy one can do so by checking the performance the Nifty or Sensex Index during the same time.

We have elaborated below in the section #2. Invest in the Market via Index ETFs or Mutual Funds.

#A. Traders

Traders are short term market players who enter and exit the market more often which can varies from trade lasting from few minutes to weeks or months. They participate in the equity and futures market with a motive to earn short term profits. When we are talking equity, we mean buying and selling shares of the companies listed on the stock exchanges.

Traders are not like investors who just participates only in the positive movement of the market or stock, they strive to make money in all the three directions of the markets – Up, Down or Sideways.

#1. Trading Futures for Risk Management – Hedgers

Hedgers are also one category of traders who participates in the future and options market to reduce their business risk. They do not speculate or trade to earn profits from the trading business. They are the reason for the existence of the futures market.

If you are a business owner and there is a business risk due to currency or commodity fluctuations then your ultimate objective to enter the market should be to reduce or limit the risk of these underlying commodity or currency price movement which you can do by hedging by participating in the commodity or currency futures market.

For Example, producers such as farmers often sell futures on the crops they raise to hedge against a drop in commodity prices such as potato, onion, wheat, etc. Similarly, other companies like food processing plants often buy futures to secure their input costs.

Other Examples – Information Technology, outsourcing, importing or exporting companies hedge the risk of currency fluctuations. Jewelry manufacturers hedging the cost of gold and silver or investment fund hedging the risk of market fluctuation with index futures or airlines hedging fuel costs. This makes it easier for these companies to do long-term planning, manage price risk and stabilize the cost.

#2. Trading Stocks or Futures for Profits – Traders

Traders generally accepts the risk in the market to take the benefit of the favorable price movement of the stocks, commodities or index futures. They are the one who provide immense liquidity in the markets and in turn helping the hedgers to enter and exit the futures markets in an efficient manner.

Speculators could be short term individual traders, full time professional traders, institutions trading stocks or futures or options in an attempt to make profits. They do not have any effect of changes in price of the asset on their business activity like hedgers, but they are speculating on the direction of the instrument to make trading profits.

Those who are not at all familiar with the working of the future & options market, please visit the below articles to get a deep understanding of what futures and options are? and how futures trades work in the real market?

– Part I – Getting Started with Trading – What to Trade?

– Part II – Getting Started with Trading – Who Trades the Market?

– Part VI – Getting Started With Trading – How to Trade Futures Market?

And,

You might have read and heard million number of times that the risk with buying options is limited to the price of the premium paid. Right?

But Do You Know that we can even get trapped and lose more than the value of the premium even when you are buying options and what if I tell you that you can incur loss even after having a profitable trade.

Read Warning: 5 Traps To Avoid When Trading Bank Nifty Weekly Options on the Expiry Day to know how the theoretical adage of limited loss when buying options is not completely true in all of the cases and how to avoid one of the biggest trap of what we call as a “Contract Shock”.

Whenever we are talking about traders, we are talking about short term trading in Stock, Future & Options (F&O). Future and options are leverage instruments where you are allowed to take a big position in a index future (Nifty or Bank Nifty Futures) or a stock future (Reliance Futures) by putting up a small percentage of margin as every f&o contract has a monthly expiry, so you can take position in f&o from a day to a month. While on the other hand, equities you can take position varying from a day to as many months or years you wishes to.

Most traders are technical traders researching and analyzing the past price movements on the charts to predict the future but even there are many who trades the market on their understanding of the short term fundamentals and general market conditions to trade. They take risk in the market by having a direction view to make profits.

So if you are willing to be a trader, you have to learn to manage your risk by pre-defining your capital, profit, or risk management rules to take the benefit of leverage trading. Trading provides immense opportunities to a trader to make big money on very small capital but provided you are ready to learn this business and follow your risk management rules.

Do Read the article Ten Unavoidable Rules for Aspiring Traders to be Successful to know the core ingredients which are required by any trader (Aspiring and Professional) to learn and understand the mechanism of trading business, help protect them during bad times and keep them alive in the markets forever.

#B. Investors

Investors are the lifeline for the businesses as they are the one who believe in the dreams of the businesses and are ready to part their savings for an investment objective. They are basically long term players often carrying positions for few months to years. Investors could be an individual player or an institution firms like insurance companies, Hedge funds, Mutual Funds or Proprietary Companies. Generally speaking, investors are those who understand the fundamentals of the economy, market or a company they are willing to invest in.

An investor has two options :-

#1. Invest in Individual Companies

An investor invests all his time, researching a company by studying the companies fundamentals including the product, financials, future prospects, competition and investing his capital for long term and makes it a wealth creating asset. He would follows a top down approach and get deep into analysis of economy then further down to the industry and find the company he feels could be a valuable asset to invest in.

#2. Invest in the Market via Index ETFs or Mutual Funds

Also apart from stocks, an investor can invest in the market index by investing in Index ETFs which in case of India is NiftyBees, BankBees, Goldbees etc. ETFs are essentially Index Funds that are listed and traded on exchanges like stocks and are a basket of stocks that reflects the composition of an Index, like Nifty50 Index or BankNifty Index. ETFs can be traded just like stocks by any investor via trading account at any brokerage firm.

So, any investor who wishes to bet on the growth of the Indian economy and not any particular sector or any company can do so by investing in Nifty50 Index via Niftybees which will give an investor exposure to the well-diversified sectors including financials, Information Technology, Energy, Consumer Good, Automobiles, and Pharma, etc and the index will always have the top performing and big companies like HDFC Bank, HDFC, Infosys, TCS, ITC, Reliance, Larsen & Turbo, Sun Pharma, Maruti, etc. from these different sectors.

Similarly, by investing the Nifty Next50 Index via JuniorBees, investor will be exposed to the Next top companies of Indian economy in their respective sectors after Nifty 50 companies. and invest in the Bank Nifty Index via BankBees which expose him to the top 12 banks and not betting on any individual bank.

Read below series of posts on Index, ETFs and Index ETFs to get a deeper understanding of ETFs

– What is Nifty 50 Index & How to trade Nifty?

– Part II – Complete Guide on Investing in Indian Markets – Investing in the Index

– What are Exchange Traded Funds (ETFs)? How to Invest in ETF?

– ETFs that Changed the Investing World

– What is Nifty Bees ETF? How & Why to Invest in Nifty Bees?

– What is Bank Bees ETF? How & Why to Invest in Bank Bees?

Similarly, an investor can invest in a mutual fund which is a financial product that pools funds from individual investors & invests in various assets such as equity, debt or gold on their behalf. Mutual funds provide instant diversification as the funds are invested in big sets of stocks or financial instruments around wide financial universeas and that too with as small as Rs. 500.

Theefore, you can invest in the Index or Mutual Funds with a lumspum fund or through Monthly SIP mode.

To know how to start investing in a mutual fund, Visit Part III – Complete Guide on Investing in Indian Markets – Investing In Mutual Funds

Investors like Warren Buffet, Peter Lynch, Rakesh Jhunjhunwala have achieved big success in their investing career who suggest Investing In What You Know Best!

Refer our Get Inspired Section VI in this same article to know more about these legends and their remarkable investing career.

New participant should first list and filter out the stocks or market to follow, track and spend quality time and effort researching and analyzing the filtered list.

As we are specifically talking about the Indian investors, we all investors or traders need to keep a tab on the Nifty Index and its performance. The Nifty Index is one of the best-known icons of Indian economy and among stock market observers around the world is a weighted average of most liquid and top capitalized 51 stocks listed on the National Stock Exchange (NSE) that covers 23 sectors of the Indian economy.

Read What is Nifty 50 Index (Nifty) & How to Trade Nifty? & Performance of Sensex Since 1979 to understand more about the index and how well our markets in the past has performed.

An investor, would prefer to choose equity market (NSE / BSE) to invest in stocks for medium to long term while on the other hand, Speculators, Arbitrageurs, or Hedgers would prefer to choose Futures & Options market by trading in Equity Index F&O (NSE / BSE), Stocks F&O (NSE / BSE), Currency F&O (NSE / BSE) or Commodities F&O (MCX) to achieve diverse trading objectives.

You should never be interested in too many stocks or markets at any time. Restrict yourself in your trading plan with the number of market or stocks to analyse and trade and divide your capital amongst stocks, futures, and index etfs and never put more than 10% of the capital in a single stock or market.

After choosing a market, it completely make sense for any trader or investor to “Know Your Market”. The Idea is to know a market deep, be familiar with it, its habits and trade big.

#2. Know Who You Are?

After opening a trading account with a broker and knowing all the different options available for a trader or an investors to participate in, now starts the real task of Knowing Who You Are?

This is more of a self-evaluating step, where you have to identify and know what you can be good at or what fits in your style. The idea here is to pre define and know what you will do after entering the trading arena.

Human Psychology

Psychology plays a big role in the trading business as your emotions, mental attitude, temperament, and human nature has a direct effect on your trading decisions and in turn the trading results. Every individual interested to be a participant in the market should analyze self on parameters like how good you are at controlling your emotions, what you love to do – reading books, analyzing charts or balance sheets, how much good you are with numbers, understanding your own traits, habits and psychological temperaments? as you have to spend most of your time doing these so the objective is to choose what you Love to do. This will not only make your trading task enjoyable but also will help you deal with your bad days and in-turn help to finalize and come to a conclusion of whether you are a Trader, an Investor or an InvesTrader?

Investing vs Trading

Trading and investing are totally opposite styles of participating in the market and both requires different skills and temperament to be successful. The question here is not whether trading is better or it is investing? Rather it is – What You can be good at – Trading or Investing?

Investing requires a lot of patience, big time waiting and researching the market or stock you are interested to invest in. Investing does not require more time in tracking the market rather more time researching the markets or companies in the background but requires patience and flexibility to analyze your investments with your pre investment thoughts, seeing your paper profits grow, etc. You might be spending a lot of your time reading newspapers, business magazines, annual reports, balance sheets, profit & loss statements trying to understand the economy, industries, fundamentals of the company etc. So, your task here is to analyze the general business conditions of the economy, fundamentals of industries you feel can prosper well and company in terms of their sales and profit growth, etc.

While trading requires lot of your time tracking and tracing the markets, flexible nature to change with the moods of the market, risk taking attitude, temperament to deal with more number of positive or negative trading results than investing, and lastly dedication, sincerity in blindly following your trading rules. This all will help you to remain in-sync with the movements, not having forced long term investments in your trading portfolio and be profitable. You may be analyzing and trading on the technical charts or trading on short term fundamental aspects or results of companies or economic events, etc.

I don’t have Trading Skills

This does not mean that if you want to be a trader but don’t have that skills or flexibility to change your trading thoughts with the market, or being a non-risk taker then you cannot be a trader. You can learn the art of trading but provided you are ready to spare our years of hard work and learning to learn the Art of Trading.

In beginning, it`s not about restricting yourself to one style of trading. Beginners should get well into all the different styles to understand the frameworks of both, their drawbacks as well as benefits and later after being in the market and knowing which one you can use to achieve your goals you can choose to stick to the one.

But, the important point here is never ever mix the two.

Never let your Trading calls become your Long Term Investments

The idea is that you trading calls should not became a part of your long term investments or your long term investments become your trading bets just because you have paper profits. Patience and sticking to your objective is the key to the success of most trading legends.

Any confusion will surely put the trader in trouble as very soon you will have stocks in your portfolio which were not supposed to be there. The stocks which you traded for the short term can become your long term investments if you did not followed up your short term trading rules, capital protection rules and reluctance to book small losses.

Trading and investments has its own rules, and require different skill sets to achieve the different trading objectives. So, utmost care must be taken to make sure and Know Who You Are?

Be Clear with Why You are Buying or Selling the Market or a Stock?

The problem with the all the new breeds of traders is that they become investors after some time not by wish but by force and become “Forced Investors”. They start trading the markets and stocks with a short term trading objective but without pre-defining the rules and trading plan. So, they do book short term profits in some of their positions but get stuck up with those which do not move as per their lines and becom so called Long Term Investors.

Investors who pick stocks and as soon as their positions start showing them profits they become anxious and book the profits and became short term traders and seeing their investments growing many folds as they expected. The confusion with which investors become traders and traders becomes investors is the only reason for failure of 95% of the people who enters the trading business.

Many individual are a combination of both who are very good at differentiating their trades as investments vs trading like Mr. Rakesh Jhunjhunwala who is combination of an Investor and a Trader (an InvesTrader) where he do short term trading as well as long term investments and allocates all the profits from short term trading for long term investments.

Why Trading when Markets are all about Investing?

Someone asked this question to Mr. Rakesh Jhunjhunwala in a conference that when markets are all about investments why do you keep saying and talking about T rading for which he replied who will give me the capital to invest your father or my father?

So, if you lack capital to trade / invest with then today or tomorrow you will have to trade the market to earn your capital first. It does not mean that you just jump into trading arena and start trading big quantities here and there but rather start framing up rules to understand this business to earn big.

Rakesh Jhunjhunwala – The Inspiring Story & Philosophy of India`s Most Successful InvesTrader

So, the objective of every new aspiring trader or investor should be to have a “Long Term Vision” to attain the market knowledge, learn and understand the wide aspects of trading business, frame up trading rules which can help you learn the art of successful trading rather than being bothered for making short term money as and when you start.

It should be kept in your mind that trading is a long term learning process which requires a lot of efforts on the part of the trader that can help them create and acquire long term valuable assets – Knowledge, Skills, Positive Belief, Experience and Psychological Control. These valuable assets will not just help you make money from the market but also help you learn the skills to keep the money with you forever whether you choose Trading or Investing.

#3. Know How to Trade?

After getting into the parameters and characteristics of both the different styles – Being a trader or Being an Investor which helps you distinguish the motive of entering the markets and differentiate your trading as well as your investment picks comes the task of knowing how a trade or invest in the market?

Differentiating and choosing the style as per your own characteristics will make your task simple and easier because overlapping of these two different styles can put the participant into big time confusion and stuck with unwanted positions in the portfolio. We will elaborate this section into two: – How to Invest & How to Trade.

Fundamentals vs Technical`s

Fundamentals is the study of how well a company or a market, you are interested to invest or trade in, is likely to perform in the future. An analyst work starts from gathering and assembling all the information about the company, economy and the industry to evaluate and judge the growth prospects of the investment while on the other hand, technical`s is the study of the behavior of the participants exchanging trades among them in that particular market or stock.

So, fundamental analyst analyses the company (Say “A”) he/she is interested to the invest in while a technical analyst analyses the buying and selling behavior of the market participants trading in the same company “A”.

Charts are the basis for the technical trader to record, construct and monitor the market movements as these price movements will help him/her to determine when and how to enter a trade and how to continuously manage the trade and determine the exit point as per the movements on the chart.

How to Invest – Let`s Invest in India

An investor can participate in the growth of the companies or the economy by investing in index or Stocks.

Any investor can participate in the market via investing in Index thru ETFs and individual companies as we discussed above. When we are talking investing, we are talking about long term investments which lasts for atleast few years. This requires an investor to analyze, being patient and wait for right opportunities to invest with the cycles of the market.

Indian investors needs to keep a good track of Index i.e. Nifty or Sensex to keep a tab on changing situations in the general economic conditions which can impact the investments in the index or individual companies.

Also as capital diversification is very important, so the investor should create a diversified portfolio between the Index & Stocks where most stocks have a tendency to perform in sync with the cycles of the general economic conditions.

There are companies who are able to beat inflation, drive up more sales, growing continuously, control their cost, enjoy a competitive advantage and in turn able to generate profits at the year end.

Companies with the competitive edge and higher profit margins enjoy the benefit of the fall of interest rate like Nestle, Britannia, Maruti, Lupin, Jockey, Bharat Petroleum, etc.

The problem for investors is – in which companies to invest? When to invest? What is the risk? etc.

Investing with the cycles of the market will help make your investment in stocks more at ease. So, if you can make up that the bull market is getting ready to start then your investments in stocks can also rise multi folds. Also, consider the case where markets are into bear or consolidation cycle then you investments might not rise that much during that period. It does not mean that we cannot do the investments in stocks by researching them in isolation but analyzing the market conditions will make the investing task in stock more simple and high rewarding.

Investing in the Index – The Broad Market

By Investing in India means Investing in Nifty or Sensex.

Any investor who wishes to invest in the growth of the Indian economy and not any particular sector or any company can do so by investing in Nifty50 Index via Niftybees.

Nifty is average of 50 top capitalized companies of Indian economy. Consider Index as a Company & its stocks as the employees. Index follows the PRINCIPLE OF REPLACEMENT where companies which are performing and growing are the part of the index and those who are not are thrown away and replaced by performers.

Niftybees gives the investor the exposure to the broad market and replicate the performance of the Indian Economy. Therefore, the task of the investor in index requires you to analyse the economic performance, gdp growth rate, etc to understand the cycle we are in.

Also, if you are interested to invest in Gold, Mid cap companies, banking sector then you do so by investing in the respective ETFs which in this case will be GoldBees, JuniorBees, and Bankbees respectively. Every sector or market has its own cycles, so we need to analyse separate for each market we are interested to invest in.

Index ETFs also serve as the best tool for Crises Investing for beginners as well as professionals so whenever markets are in correction and you would like to start investing in, then you can do so by buying the index ETFs as investing in stocks makes the investment more prone for large fall than investing in stock. Index ETFs are a boon for the retail investors specially those who are new to the markets as investing in Index ETFs will help diversify the risk of investment among-st the big stocks of the economy.

So, long term investments can be done via fundamentals factors as well by studying the cycles of the market on the charts. An investor can analyze the past time cycles of the market to know in which cycles the market is in at present or is ready to enter into as these cycles repeat in itself and can give you a glimpse of the position of the market.

What is Nifty Bees ETF? How & Why to Invest in Nifty Bees?

What is Bank Bees ETF? How & Why to Invest in Bank Bees?

How to invest in markets by understanding the cycles of the market? – Coming Soon

Investing in the Individual Companies

Filtration of the stocks to keep in track for investments can be done on the basis of the companies which are in great performance cycles. You may find renowned name under this category. So the idea here is to understand how well the company can perform in the future. Some important parameters to filter the stocks to invest can be :-

- Companies with high growth in no growth industries

- Sales & profit growth of the company more than 20% (as inflation is 6-9%)

- Companies with all time going product during the bad or good times – Britannia, Hindustan Unilever, P&G.

- High Profit margin Companies – Nestle Industries

- Companies with a niche control on a market segment – Apple or Amazon

- Less debt / Loans

Also, there is another category of investors who wishes to invest in companies which are unknown to the investing community with big potential of business growth and transformation.

How I Can Find Companies to Invest In?

Invest in What You Know & Understand

Peter Lynch & Warren Buffett has the Answer for this question. They believes that the everyday investors have an advantage of making money by investing in the companies or industries they understand and those which are growing around you.

Peter Lynch said the best place to look for picking winning stocks is to look for the companies growing around you and you don`t need to be a big researcher, a scientist, a Vice president to spot out opportunities to invest in multi-bagger stocks. You could be a passionate biker, a traveller on a holiday to Ladak where you see a lot of biker riding Royal Enfied bikes, a news reporter covering the automobile industry, etc. You could be an employee, distributor, insurance agent, clerk, accountant, sales executive, lawyer, supplier dealing with Eicher motor selling Royal Enfield.

Thanks largely to Royal Enfield which helped the stock Eicher Motors to rise from 135 to 21000 generated a return of total return of 15400% within seven years from 2009 to 2015 i.e. a return of 2200% every year.

You don`t need to be a doctor to spot the rise in demand of some drug in the market. You might be a patient, working at a chemist store, or a marketing manager at some pharmaceutical company, a pharma sales representative to spot a big radical change or spurting demand of a medicine in the market.

Also, there are many companies who do such great business in front of us and with who we may interact as a customer say from the store at your near shopping mall, something you bought, heard from your inlaws, etc. There are many companies with whom we interact a number of times in a month or say every year – the bank we transact with HDFC Bank, Axis Bank, Yes Bank or the beer we drink of McDowell or paint we use at our home Asian Paints, Berger Paints or oil we use in our cars or motorbikes Bharat Pertroleum, Hind Petroleum or medicines we use from Cipla, SunPharma, Lupin. The best example of this would be FMCG products the one we consume every day in our day to day life – The shampoo, soap, cooking oil, hair oil, biscuits, sugar, groceries, toothpaste, etc from Hindustan Unilever, ITC, Britannia, Emami. You could have spot the one while buying a product from a local store and chekced how many of these products in the shelf of the shop are from which company. Also, you could be a local shop owner or a helper at the shop spotting out big demands of Hindustan Unilever products.

Comparitive analysis between the stock within he same industry helps pick the right stock to invest. So investment in the stock which has better fundamental aspects than other in terms of their sales growth, profit growth, cost controlling and low NPAs makes sense for the investor.

Visit our Trading Legends Section – Peter Lynch & Investment According to Peter Lynch to know more about him and his investment philosophy.

Books By Peter Lynch

#1. One Up On Wall Street: How To Use What You Already Know To Make Money In the Market

How to Trade?

When we are talking trading, we are talking short term trading – something from day trades to short term positional trading. As most of the short term traders including future & options trading which are leveraged products and requires a trader to be very strict in following their trading rules. Because any failure to do so can lead to big disastrous results. Therefore framing and strictly following the trading rules are must and very important for the growth and survival of the trader in the markets.

Therefore, frame up all the trading rules before you step in the trading which are discussed in the next section below.

Majority of the traders use technical charts to understand and evaluate the behavior of the markets to predict the future price movements of the market or the stock you are interested in while there are others who predict the movements of the market through understanding and analyzing the general market conditions and specific factors affecting the companies like quarterly results, sales numbers, global events and market situations, etc. Analyzing the price performance of the market you are interested gives you an opportunity to predict the future movements and trade with pre managed risk and earn big rewards and profits.

Any trader has options to day trade or do positional trading in individual stocks in cash market, stock futures or index futures. Traders have the option to trade in any direction of the market and they can be profitable not only when the markets are rising or falling but also when the markets are sideways by the use of options. So, being a trader you can sell short a stock or index using futures.

How to Find or Filter Stocks for Trading?

Follow the Trend of the General Market Index – Nifty

Always remember when we are talking about short term trading stocks, we need to be insync with the trend of the market. Make it a habit to find stocks which has the trend similar to the trend of the market. This again will make your trading task much simple, and rewarding. Say, if the trend of the market or Nifty is strongly positive and you find a stock which is falling say Tata Steel then you may find trouble going on with the short term trade as trend of the general market is up and most of the stocks will find any kind of surprise and move inthe direction of the market. This does not mean that the stock cannot fall when the markets are rising but its always better and advisable to be insyc and trade with the direction of the big picture of the market as 80% of the stocks follows on with the market trend.

This also does not guarantee that the stock you choose will surely rise if the markets are rising but it increases the probability of such happening. As every stock and sector has trend of its own and its always advisable to follow the trend of the stock or the sector you are interested in. But also try and find the stocks or sectors which are in sync with the market trend.

So, short term traders first task is to determine the trend of the market and then find stocks whose trend are also in sync with that of the market.

What is a Trend?

Some one once asked a trader you keep saying follow the trend and trend is your friend but what actually is the trend of the market when i see a lot of tops and bottom only. Then the trader take that men to other end of the room and asked him to see the chart showing on the screen of his computer and said Trend is something which is visible with blurred eyes. So, if you see an up line from a distance that means the the trend is up while if you see it to be falling consider the trend o the market to be down.

We outlined in the article Getting Started with Technical Trading – What is a Chart? that Charts are the true reflector of the trend of the market as price movement register the total demand and supply in the market. Price movement tells us what the overall market participants are expecting as the price cannot move up unless there is more buying than selling and it cannot go down unless and until there is more selling than the buying. Buying and selling activities of the market participants are in-turn influenced on the expectations of the future events or situations which forms the basis of the price movements in the market.

How to Hand pick a Trading Stock out of the Bucket List?

List out the Outperforming & Under-performing Stocks

Charts show the out-performance or under-performance of any company in respect to its competitors or the general market index by the performance of the price movement of the stocks or market. So, as we discussed above that the trader should always be in sync with the market trend to put him in more comfortable zone and at ease. This can further be enhanced up by picking the out performers stocks to go long when the markets are rising and trading short in the under-performers when the trend of the market is down. Because this will ensure that you are going with the trend of the market.

As markets have a tendency to give higher ratings to the company with better growth trajectory and prospects than the average industry standards which will in-turn have much more interests from the market participants thus higher growth in the stock prices than the others in the industry. So, any good prospecting company with much better growth in sales, earnings, business stability and better future prospects compared to its competitors will surely attract more buying interest in the market than others in the industry. This will surely be presented on the charts with much higher and sustained prices in the outperforming company than the under-performing one.

Simply put it, any stock which rises more than the market in up trend and falls less in the down trend is a out-performer while any stock which rises less in market up trend and falls more in markets down trend is an out-performers. Also, we can stick tag of out-performers or under-performers by comparing the performance of the both stocks in rising and falling market. Say if stock A rises more than B in rising market and fall less than B in down market is an out-performer.

We will continue with the same example we quoted in the article Getting Started with Technical Trading – What is a Chart? to elaborate the out-performance and under-performance of the stocks with in the same industry and how to choose the one to go long when market trend is long and going short when the market trend is short.

If we refer to the chart above of Punjab National Bank, the bank had a big line of Non-Performing Assets (NPAs) which leads them to suffer big losses as compared to others in the banking space that is the only reason why the stock under-performed and suffered big blow down than the others.

For Example, on May 18th, 2016, Punjab National Bank (PNB) announced the highest quarterly loss ever reported by an Indian Bank of Rs. 5367 crores If we compare the performance of PNB with HDFC Bank fundamentally, HDFC outperformed the performance of PNB where HDFC posted a quarter net profit of Rs. 3374 crore with a 20% growth while PNB posted net loss of Rs. 5367 crores during the same quarter.

Chart 1 – Punjab National Bank EOD (Oct 2015 – May 2016)

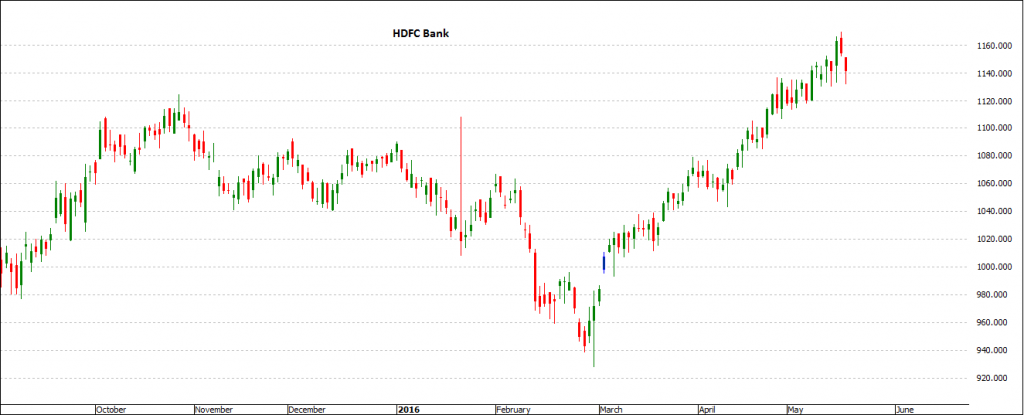

That is the reason why HDFC Bank outperformed PNB on the charts where HDFC Bank hovered within 950 to 1150 during the time when PNB hammered down from 150 to 70 price levels. Refer Chart 2

Chart 2 – HDFC Bank EOD (Oct 2015 – May 2016)

This proves to the point that the out-performance / under-performance on the charts are solely dependent on the fundamentals of the companies under comparison and it becomes important to note that whenever the you the trend of the Bank Nifty Index is down it makes sense to short PNB then HDFC Bank as PNB is an underpfromer in the banking space while hdfc bank is a performing stock.

#4. Prepare a Complete Trading Plan

The simple secret sauce for trading success is when a trader plans for trading as a business rather than an activity to make “quick money”. Many enthusiastic aspiring traders enters the market without a proper plan as they fail to understand that trading is a business which needs to be run “only” on the business lines. They start trading the markets and commit the same mistakes as incur by most of the traders so they lose money or go broke and market throws them out from the trading world “forever”.

Trading decisions which are based on any unknown reason will lead to only one result – Losses & Yes More Big Losses. To overcome taking decisions on the inherent human habits, traders need to frame up mechanical ways to trade the markets and that can be achieved only by developing and framing “A Right Trading Plan”.

A pre-defined plan will help you take your trading decisions only on your willful thoughts and on pre-verified rules and reasons. These rules will reduce and help control your eagerness to enter and exit the market more often or trading on news, rumors, greed, fear which will ensure you are trading according to your planned rules and setups.

Framing your trading plan and developing a habit of following your plan strictly go hand in hand.

Your trading plan should cover all the wide topics and questions related to What to Trade, How to Trade, Capital Management and Trade Management including your plan to enter a trade, managing a trade, capital or profit protection rules and lastly a plan to exit a trade. Make sure you have your trading plan for all the diverse sets of important elements of trading as mentioned below to answer all if`s and how’s well before you enter a trade :-

#1. Division of Capital (Diversification)

#2. Number of Markets to Trade

#3. Protection of the Seed Capital

#4. How to buy?

#5. Time frame to trade

#6. Planning your Execution & Trade Management

#7. Planning your Exit

We have cover all the above mentioned aspects in the article Part IV – Getting Started With Trading – Importance of Developing a Trading Plan to get all the answers on how to plan a trade before trading real time.

The trading plan must be designed so simple that it can be written on paper to help develop a clear view about all the aspects of trading business well in advance i.e. It should be designed such that it can be tested in the real markets and can be improved & modify after the evaluation process.

This will make sure you are free from all the regrets later.

A well defined trading plan is very crucial for the success of a trader as planning laid down predetermined rules that a trader must be following while executing a trade and helps avoid trading on hope or fear or on emotional impulse which puts the odds of the success in the favor of the trader. A considerable time is required to define a trading plan based on each traders trading objective and risk profile. A well written trading plan helps make comparison and future modification process simpler and easier.

#5. Rules for Trading / Investing

Every aspiring trader requires a set of rules and groundwork on which their trading activities will be based on. So, each one of them should spend considerable time and effort to frame out such rules to build the foundation that can help them to conduct the trading on the business lines. The right and consistent implementation of these basic ingredients has revolutionized the life of many traders today as well as in past. These rules will ensure trader and investors safety in the market by avoiding trading mistakes due to human weaknesses to help keep them financially alive in the markets forever. Some of these rules might be applicable only to traders but more or less they can be applied to investing as well as trading.

Never Trade on Hope, Fear, News & Rumor

Every trading decisions should be based entirely on the pre-defined rules, parameters and setups. Investors and traders should take utmost concern while entering into a trade as if any trade which is based on any unknown reason will lead to – Losses. Many traders ask for recommendations and opinions of experts on news channels about a losing position in a stock that they have entered into. They should understand that if they would like to do this as a business then they should know well in advance why they are entering a trade or investing in a stock and not later. So, always do your research before you enter the trade and not after that.

Always enter or exit a trade only based on your pre evaluated and verified parameters. Understand the working and mechanism of the markets and do actually news or rumors can provide your positive trading results. Markets move on a principle of discounting so you may not know how it will react on some specific positive or negative news as markets can even fall on a good news if it has already rallied before the news actually broke out. Markets discounts and adjust in the price movement all the information available with all the diverse market participants well in advance i.e. it discounting the future events.

A trader`s or investors job is to evaluate whether these events are already discounted or not. Trading and investing in Your Way will help you be in-sync and safe in the markets. This can only be ensured by taking a good care of strictly following your trading plan – Your Entry & exit rules, stop losses, risk management rules etc.

“The reputable newspapers always try to print explanations for market movements. It is news. Their readers demand to know not only what happens in the stock market but why it happens.”

Protect Your Capital & Profits

Capital is the only biggest important asset for a trader / investor and a great care must be taken during the initial trading days to protect your seed-up capital. Capital protection is not just a need for any trader but a necessity for long term survival and performance and the only way to guard your capital is by using stop losses. So, never ever break your risk management rules which will ensure your capital and profit protection.

Do not Over-trade

Always follow the maximum number of trade you are allowed to take in your trading plan. Over-trading is one of the culprit of success of traders which can turn your profitable account into losses and will increase trading cost. This is one if the biggest reason for losses for day traders especially futures trader. Whether it is profitable or losing trades, restrict yourself with number of trades.

Traders should prioritize to understand and learn more about human behavior and psychology that can help prevent them committing similar mistakes again and again otherwise people with snatch your money away from you and believe me they won`t feel bad at all.

We have outlined big list of 12 trading rules which can help trader be safe in the market forever. Do visit the article 12 Step-wise Trading Rules for New Traders to be Safe in the Market and tattoo on your arm that I will never ever break these Rules.

12 Action Steps for Trading

#1. Don`t be too Anxious to Start Big Early

#2. Know Who You Are?

#3. Choose & Know Your Market

#4. Always have Reasons or Facts to Enter a Trade

#5. Don`t Screw with the Market – Follow the Trend or Market

#6. Know where to Place Stop losses before Entering the Trade – Protect Your Capital

#7. Enter each Trade as per Risk Reward Trade-off

#8. Never Change your Stop losses without Good Reasons

#9. Always Shift & Trail Stop losses to Protect Capital & Profits

#10. Always have Reasons or Facts to Exit a Trade

#11. Do not Over-trade

#12. Don`t have too Many Open Positions at any Time

#6. Get Inspired

It’s the time to meet the Legends. Those who made us believe that Yes It can be done. Opposed all the verdicts and negatives. They all started just similar like us with no experience, with big bunch of doubts but a dream inside their heart to learn and achieve Big. Started small, learned all the rules, acquired skills, knowledge by themselves and made a mark with their innovation, creativity and contribution to the trading community. The one who transformed the Trading World.

In 1985, a 25 years old young boy used to stand outside the ring of Bombay Stock Exchange (BSE) with a dream in his inside of achieving big but he had no capital to start with. He started investing with the borrowed money and pushed right away with leveraged trading.

He become a crorepati within just 2-3 years of his trading. Someone who sees the growth of companies when India opened their arm for the foreign investments. Picked Titan Industries which generated him some 8000+% return in 14 years. Also his other major disclosed stakes in nine companies, including Crisil, Lupin, Aurobindo Pharma makes his portfolio of 8000+ crores, out of which his three holdings is more than half of the portfolio value where Titan accounts for approx 2500cr, Lupin 1250cr, and crisil 790 cr.

He said sometimes you get such great opportunities to invest in that you invest first and investigate later. He is a true Indian centric investor where most of his investments are based on the growth of the indian economy.

A great combination of a Trader and an investor. He said Be clear with whether you are trading or investing. He advised traders to not let your love for price momentum trades make your long term portfolio.

For more quotes by Rakesh Jhunjhunwala, Visit Trading According to Rakesh Jhunjhunwala

Rakesh Jhunjhunwala – The Inspiring Story & Philosophy of India`s Most Successful InvesTrader

When we are talking investors, how can we miss the biggest legend of all – Warren Buffett

The man of great inspiration to all the investors and traders community in the world. The one who has seen all different types of market. An investment guru and one of the most respected businessmen in the world. He is well known for his patience and long term investment in Wells Fargo, Coca Cola, IBM, etc.

Buffett first announced his $290 million investment in Wells Fargo in 1990s and is still holding the stock from last 24 years. the stock has generated him an Annual average compounded return: 21% & Total return of 9,417% in 24 years. He invested in Coca-Cola in 1988 and is still holding it with an unrealized gain of 766% approx some $9.2 billions.

Some of his other big time investments include American Express, Gillette/Proctor & Gamble, Petro China, Moddy`s, GEICO

His top major holdings are :-

| Company | Portfolio % | No. of shares |

| KHC – Kraft Heinz Co. | 20 | 325634818 |

| WFC – Wells Fargo | 18.04 | 479,704,270 |

| KO – Coca Cola Co. | 14.43 | 400,000,000 |

| IBM – International Bus. Machines | 9.57 | 81,232,303 |

Buffett`s Best Investment Philosophy

#1. “The big mistake which we made in the early years was to try and buy a bad business at a really cheap price. It took me about 20-30 years to figure it out that it wasn’t a good idea.”

#2. “Whether we’re talking about socks or stocks, I like buying quality merchandise when it is marked down.”

#3. “Our approach is very much profiting from lack of change rather than from change. With Wrigley chewing gum, it’s the lack of change that appeals to me. I don’t think it is going to be hurt by the Internet. That’s the kind of business I like.”

For more visit – 20 Golden Quotes by Warren Buffett – A Must Read for Every Investor

He recommends books to his shareholders in his every annual meet. Some of his best picks are listed below:-

#1. The Intelligent Investor, By Benjamin Graham

#2. Security Analysis – Foreword by Warren Buffett, By Benjamin Graham

This is another story of a how a 14 year Old Kid Transformed Himself to Become the Greatest Trader of the Wall Street?

This is a story of a boy who started trading the markets at the age of 14 and made a profit of more then $1000 (that too in 1915) and became familiar to everyone as the “Boy Plunger” or “Boy Trader“. he started keeping a mental record of behavior of stocks to anticipate the future movements and find out whether they repeat in the similar fashion in the future & developed his understanding and knowledge of the markets which helped him made big million of dollars and later became the greatest speculator of the wall street.

This is a story of a boy who started trading the markets at the age of 14 and made a profit of more then $1000 (that too in 1915) and became familiar to everyone as the “Boy Plunger” or “Boy Trader“. he started keeping a mental record of behavior of stocks to anticipate the future movements and find out whether they repeat in the similar fashion in the future & developed his understanding and knowledge of the markets which helped him made big million of dollars and later became the greatest speculator of the wall street.

He was Jesse Livingston Livermore. He is also known as “The Great Bear of the Wall Street” as he went short in the great depression of 1929 and made millions from the market.

You can read his writing from his book How to Trade in Stocks by Jesse Livermore & his complete real life story and trading style in Reminiscences of the Stock Operation by Edwin Lefevre. Reminiscences was written back in 1920s and is still one of the most favorite and recommended books for current traders.

#1. Reminiscences of a Stock Operator By Edwin Lefevre

#2. How to Trade In Stocks, By Jesse Livermore

We have dedicated a complete section Get Inspired to Honor Trading & Great Traders. Do visit our section to get all the inspiration, knowledge, and learning from the Trading Legends.

Inspiring Thoughts from Trading Legends to Keep You Going

For more trading and investing books written or recommended by Trading Legends, Do visit Recommended Trading & Investing Books

Some more Articles on Trading Legends

Top Ten Selected Quotes & Lessons From The Trading Legends

Investment According to Peter Lynch

#7. Taxation on Trading in India

It becomes important for any trader to understand the taxation treatment of trading business in India so that they can plan their trading activity accordingly and achieve their goals.

Income tax regulations in India treats the activity of a trader and investor in different ways and have in-turn different taxation treatment and obligations. An investor can treats his short term income from equities as capital gains and pay a flat tax of 15% while a trader has to declare his income from short term equity trades as business income and is obligated to pay tax as per his taxation slab which in case of higher tax slab individuals can mount up to 30%.

The first and foremost decision that any market participant has to make before filling Income tax is to declare whether he / she is an investor or a trader? or Both?

Taxation for Trading in India

If you are trading F&O and doing frequent short term equity then you have to declare self as a trader but even then you can declare your long term profits as long term capital gains and be exempt from taxes. So, you can be a trader as well as an investor at the same time.

So, taxation rules are clear for speculative day trading and non-speculative futures trading, as any income from these two sources will surely has to be declared as business income.

But for long term investments, all the stocks that you have sold after holding for more than one year can be declared as long term capital gain and thus exempt from tax while if you are trading stocks frequently then all these income should be declare as speculative rather than capital gain.

Refer the below metioned taxation guides to help you deal with the it at ease.

Tax Benefits & Implications of Declaring Trading as a Business Activity

Part VIII – Getting Started With Trading – Tax Guide for Traders in India

Income from Equity Trading – Business Income or Capital Gain?

Q&A : Taxation for Traders in India

#8. Trading & Investing Resources

After doing all the planning, understanding the frameworks of the trading business, knowing all what it takes to be a successful trader or investor, learning from the legends, getting all the inspiration now is the time to step our shoes in the real trading world. We will list here all the resource any trader or investor needs to stay in sync with the market to make your trading task more easier & result oriented.

#A. Open a Trading & Dmat Account

So to get started with trading, we need to open a trading and dmat account with a stock broker. Just like we open a bank account with a bank after completing all the formalities done similarly we have to complete the account opening formalities done with a broker. So, to get our account opened, an account opening form including the KYC needs to be signed and few other documents are required to be given including our address, identity and bank proof.

Every broker charges for account opening and maintenance for DP account and commission. Account opening, dp maintenance are one time charges while commissions are charged on every transaction we execute in the market. So, whenever we buy or sell a share we have to pay a commission to the broker and this commission could be in terms of percentage of total trade value or a flat fees.

We could differentiate the brokers in two different sets :-

– Discount Broking Vs Traditional Broking

– Self Trading vs Full Service Platform

How to Choose a Broker? What Factors to Consider while choosing a Broker for Trading?

Active Trading vs Investing

If you are willing to do an active Trading means buying and selling shares very frequently or trading future & options then it is better to go for a discount broker while on the other hand, if you are a long term investor or non frequent trader then you may choose to go for a traditional full fledged broker.

Technology

All of the brokers be it traditional or discount provides almost similar platforms to trade. Where there are some who have developed their customized software to serve the needs of specific market participants – Traders. Mostly all the brokers provide the similar software for desktop trading and mobile trading.

But if you want to do it via Call n Trade facility then it is better to opt for full fledged service providers as the discount brokers do not provide these facilities.

#1 TRADING PLATFORM FOR TRADERS & INVESTORS Zerodha innovated the broking industry in India by introducing the concept of discount broking / flat brokerage structure. They supplemented this low cost trading platform with innovative and advanced charting platform (Pi, Kite) giving an opportunity to traders to make better use of technology in trading at affordable cost. I highly recommend using trading platform of Zerodha, and you can trade all your equity deliveries for free & Rs. 20 flat per order for every other trade. Open you account by contacting Zerodha directly. Click here!

TECHNOLOGY FIRST LOW COST BROKERAGE FIRM Backed by Mr. Ratan Tata, Kalaari Group and GVK Davix, Upstox (formerly RKSV Securities) is one of India’s top broking firms specializing in the zero brokerage costs model. Upstox now accounts for 2% of daily turnover of NSE. Just like Zerodha, you can trade all your equity deliveries for free & Rs. 20 flat per order for every other trade. You can open your trading account with Upstox in less than 10 minutes with your Aadhaar card & that too absolutely free. Click Here! You can download the NSE NOW application from the Google Play store, Apple Store on your mobile phone, or tablets to check daily prices of stocks or future & options for which you don`t need any user id or password. If your provides you access to NOW then you can also trade via this NSE NOW application. NSE MOBILE TRADING at Google Play NSE MOBILE TRADING at Apple iTunes Store If you are active trader and wishes to opt for a professional charting software then you can buy them from the software vendors like Spider, Python, etc. These are online charting softwares which provides you access to live charts of any market segment you are interested to trade. Also, there are some offline software’s like Metastock, Amibroker with which you have to buy online data feeds from NSE authorized data vendors to get real-time charting on your offline trading softwares. Trading & Investing Books We have compiled a big list of recommended trading & investing books written by Trading Legends here. Recommended Trading & Investing Books Some of the best ones are already shares in this article above. For more Trading & Investment Resources, Visit JustTrading Resource Center If you’ve used this guide to start thinking of trading, I’d love to hear from you in comments below. Disclaimer: Please note that all the information shared is solely for the general information purpose only. No information, views, opinions or examples constitute a solicitation or offer by JustTrading.in to buy or sell any securities or to furnish any investment & trading strategy / advice or taxation advice or service. Every attempt has been made to assure accuracy & completeness, we assume no responsibility for errors or emissions. KNOWLEDGE IS POWER!

Whether you day trade 1 share or 10000 shares, you will be charged flat @ Rs. 20 per order.

#B. Software, Tools, Books & Applications for Trading & Investing

NOW Mobile Trading Application from NSE

Professional Charting Softwares for Trading

We are also compilying up EOD & Intraday data to provide convenience to our fellow traders at very affordable prices. Visit JustTrading Resource Center for further details.

Have your Started your Trading Yet?

JustTrading.in advises you to consult with your certified professional finance advisers, chartered accountant & tax advisors before making any investment, trading or taxation decisions. For more, Please Visit & Read: DisclaimerRelated Posts

I came across this site accidentally when i was seraching some information in google. I am very happy that i found this website as it is one of the first of its kind in India… There are lot of websites dedicated to trading but those are mostly from US and western countries…. Thanks a lot for this effort … It really helps aspiring Indian traders like me…..

Dear Ananth

Thanks for sharing such motivating thoughts… Hope to continue the effort in the future. Happy to have people like you in our community. Stay Connected and let us know what else we can do to help traders like you…

Enjoy!!